- United States

- /

- Wireless Telecom

- /

- NasdaqGS:KYIV

Does Kyivstar Group’s 34% Rally Signal a Missed Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Wondering if Kyivstar Group is truly a hidden value play? You are not alone. The story behind the numbers might surprise you.

- Kyivstar Group’s stock has climbed 11.0% over the last month and is now up an impressive 34.0% year-to-date, sparking fresh questions about future upside and risk.

- Market watchers have recently highlighted sector-wide optimism in the telecom space as well as positive sentiment surrounding emerging market tech collaborations. These factors are fueling interest in Kyivstar Group and have driven both investor attention and some price volatility over recent weeks.

- The company clocks a perfect 6 out of 6 valuation score, making it one of the strongest stories in its peer group. But how does that play out using different valuation approaches? We will dive into those methods next and wrap up with an even better way to look at value that you might not have considered.

Approach 1: Kyivstar Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach gives investors a way to look past the day-to-day noise and judge the underlying worth of the business based on its long-term ability to generate cash.

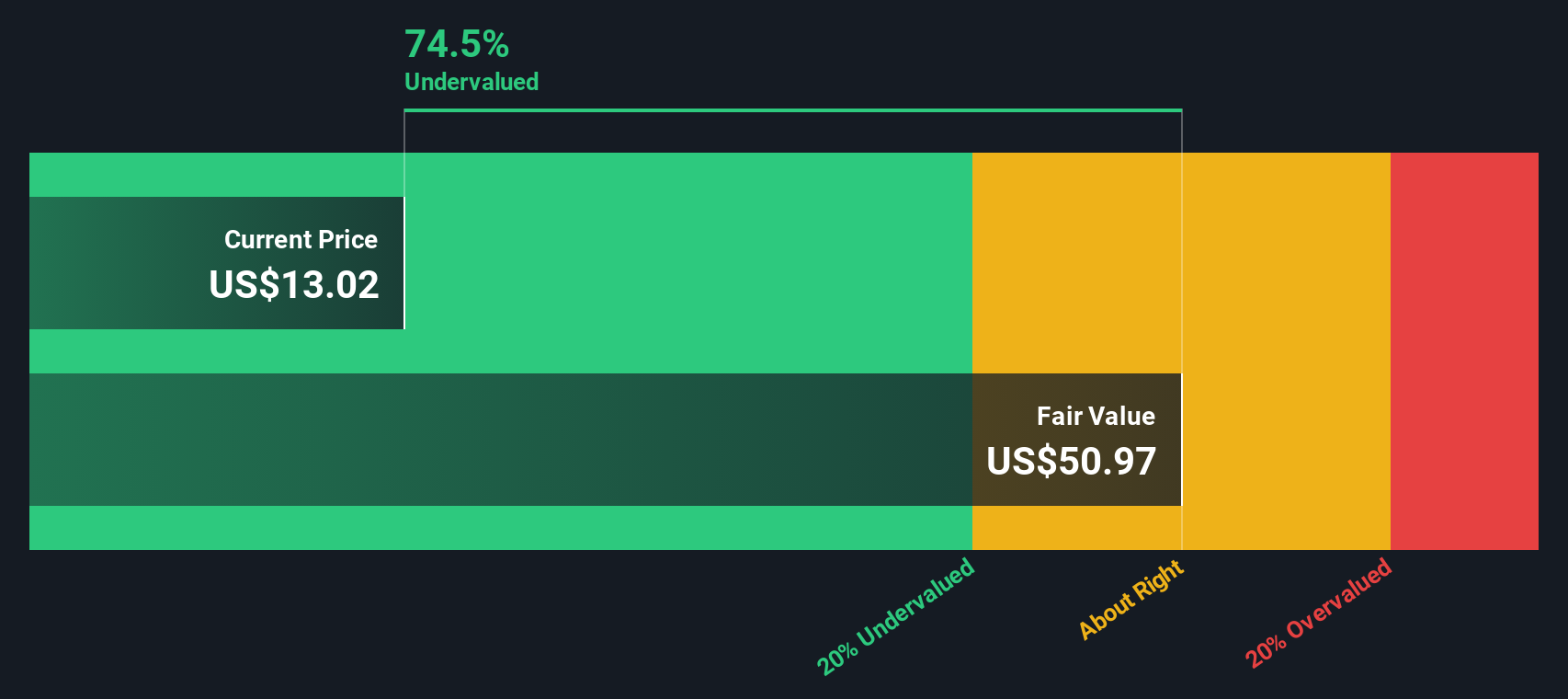

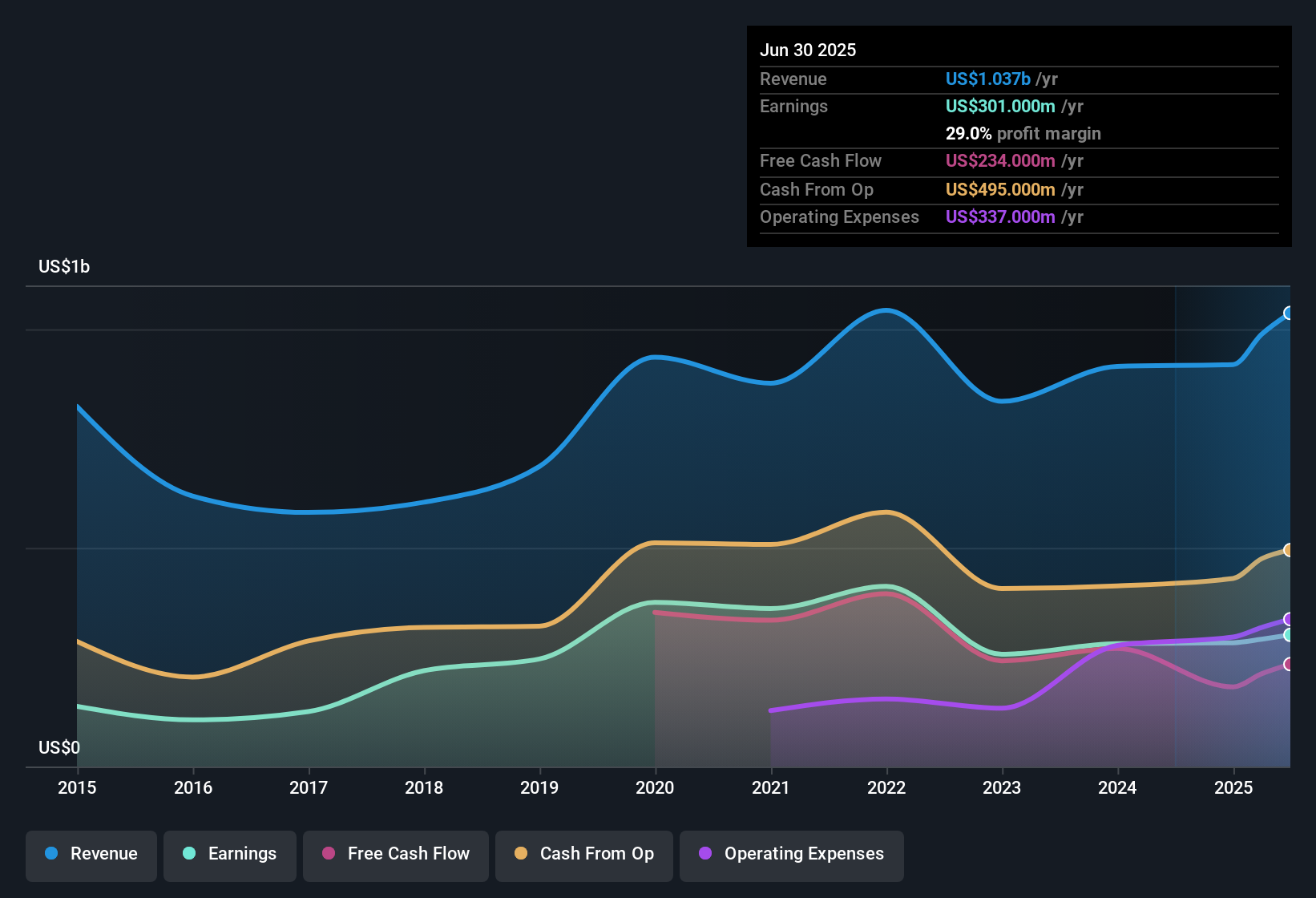

For Kyivstar Group, the current Free Cash Flow sits at $271 million. Analysts forecast continued growth, projecting Free Cash Flow to reach $464 million by 2029, with interim years also showing steady increases. Simply Wall St takes these analyst estimates and, for years beyond 2029, extrapolates using industry-based assumptions.

After running these projections through a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share comes out to $51.38. Compared to the current share price, this means the stock is trading at a 73.9% discount. In plain language, the market is valuing Kyivstar Group well below what its future cash flows suggest it is worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kyivstar Group is undervalued by 73.9%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

Approach 2: Kyivstar Group Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like Kyivstar Group. It compares a company's share price to its earnings per share, giving investors a quick sense of how much they are paying for each dollar of earnings. A "fair" PE ratio depends on growth expectations. Faster-growing, less risky businesses often justify higher multiples, while slower or riskier companies warrant lower ones.

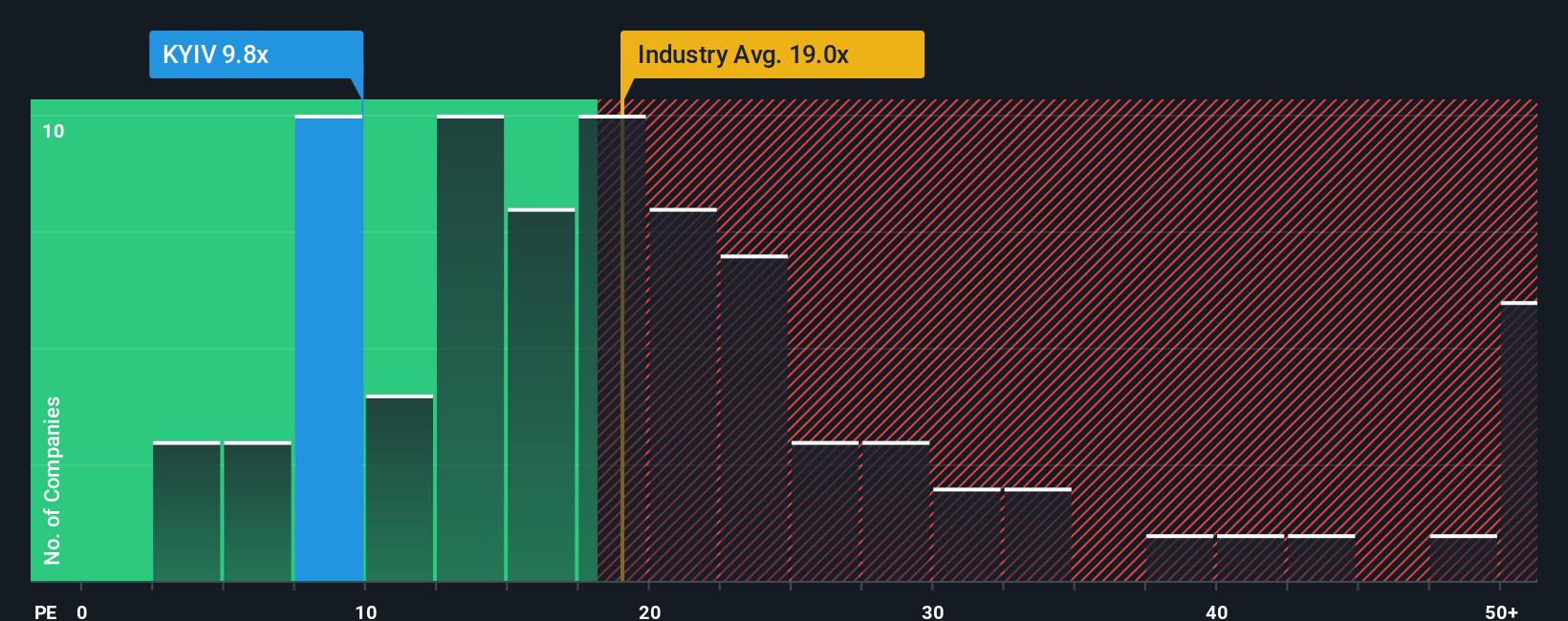

Kyivstar Group currently trades on a PE multiple of 10.1x. For context, the average for the wireless telecom industry is 18.4x, while the company’s peer group averages a much higher 47.3x. This presents Kyivstar as significantly cheaper than both its direct competitors and the broader industry.

However, instead of comparing only with averages, Simply Wall St calculates a “Fair Ratio” for each stock, tailored to its earnings growth prospects, profit margins, risk profile, industry, and market capitalization. For Kyivstar Group, this Fair Ratio is calculated at 16.7x. This approach offers a more nuanced take, factoring in real-world elements driving long-term value rather than relying on broad industry numbers.

Comparing the actual PE ratio of 10.1x to the Fair Ratio of 16.7x, Kyivstar Group appears clearly undervalued on this measure as well. This further supports the case that its current share price may not fully reflect its underlying strengths and growth outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kyivstar Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a personalized story you create for a company, connecting your view of its future to the numbers behind its value, such as your assumptions for fair value, future revenue, earnings, and margins.

Narratives go beyond traditional ratios by helping you tie Kyivstar Group’s real-world story directly to a financial forecast and then to a practical fair value estimate. They are simple, accessible, and available for every stock on Simply Wall St’s Community page, where millions of investors share their perspectives.

By creating a Narrative, you can quickly see when the Fair Value, based on your own assumptions, indicates an opportunity to buy or sell compared to the current price. Narratives update dynamically whenever Kyivstar Group releases news or earnings, keeping you up to date with the latest information.

For example, one investor might build a Narrative with an optimistic forecast and higher fair value, while another might use more conservative assumptions and arrive at a lower figure, showing how different viewpoints can shape investment decisions.

Do you think there's more to the story for Kyivstar Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyivstar Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KYIV

Kyivstar Group

Provides a range of mobile communication and home Internet services in Ukraine.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives