Vishay Intertechnology (VSH): Losses Worsen 16.6% Annually, Profitability Concerns Challenge Bullish Narratives

Reviewed by Simply Wall St

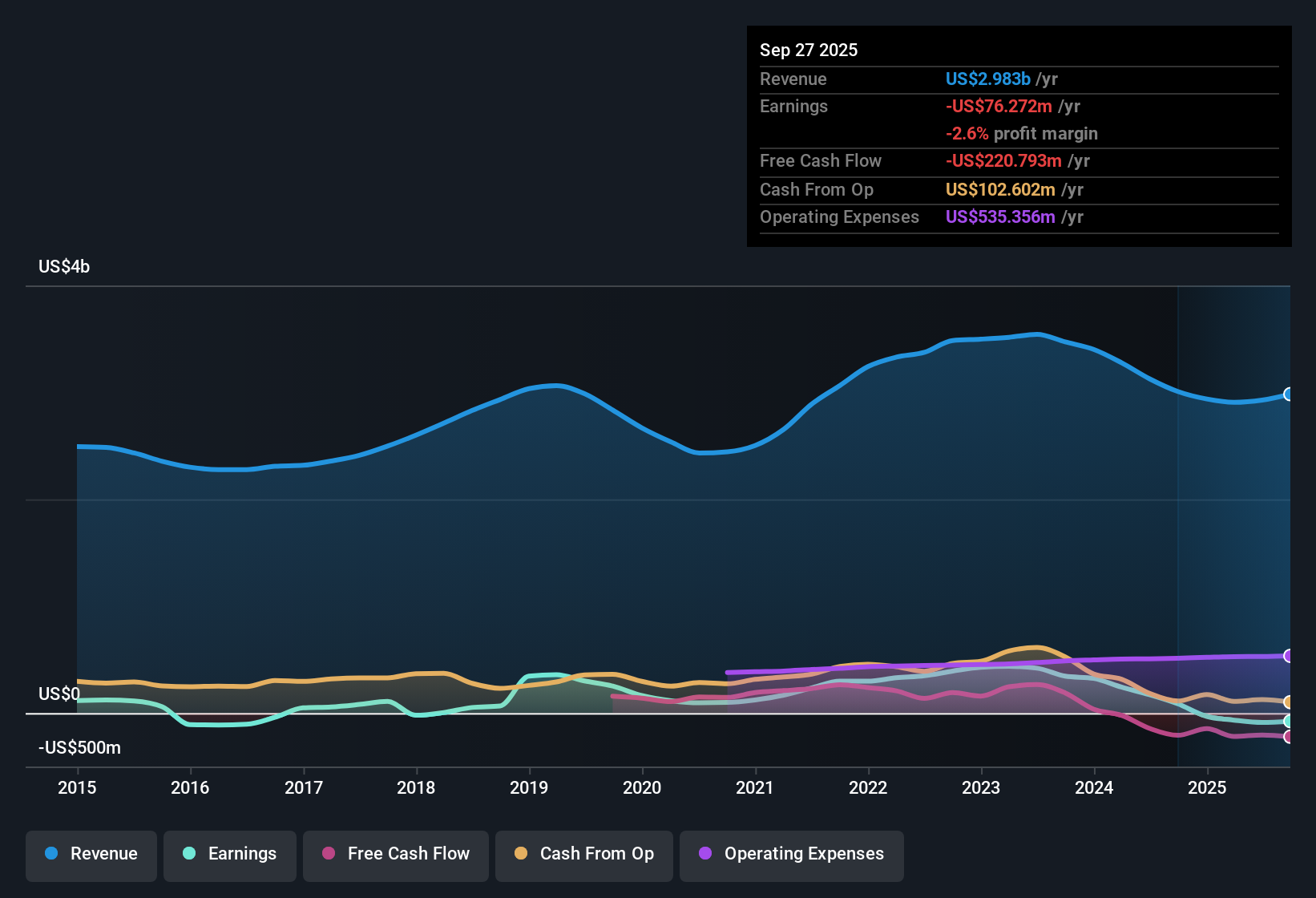

Vishay Intertechnology (VSH) has remained unprofitable, with net losses worsening at a rate of 16.6% per year over the past five years. The company’s net profit margin has shown no improvement, and investors have been unable to assess any quality or positive acceleration in underlying earnings. At the same time, Vishay’s Price-To-Sales ratio sits at 0.7x, notably lower than both the US Electronic industry average of 2.6x and the peer average of 2.4x. However, its share price of $15.32 continues to trade well above an estimated fair value of $5.91.

See our full analysis for Vishay Intertechnology.Next, we will see how these headline numbers stack up against the key narratives shaping investor sentiment, highlighting where the data supports the market story and where it raises new questions.

See what the community is saying about Vishay Intertechnology

Margin Turnaround Hinges on Recovery

- Analysts forecast profit margins to climb dramatically from -3.0% today to 16.5% within three years, suggesting a major shift in core profitability if materialized.

- The analysts' consensus view highlights a few structural strengths but remains cautious about durability:

- Nearing completion of capacity investments and product innovation in high-growth niches positions Vishay well for margin expansion if accelerating demand from sectors like automotive and AI is sustained.

- However, aggressive capital spending and persistently low GAAP operating margins, such as 2.9% in Q2 2025, underscore ongoing challenges, with concerns that operational inefficiencies and delayed gross margin recovery could dampen long-term earnings resilience despite these tailwinds.

- For a deeper dive into how analysts see the company's turnaround prospects, read the full consensus narrative. 📊 Read the full Vishay Intertechnology Consensus Narrative.

Heavy Cash Outflows Weigh On Flexibility

- Vishay has committed $775 million to capacity expansion over 2.5 years, with another $300 to $350 million planned for 2025, leading management to guide for ongoing negative free cash flow and possible increased debt reliance.

- The analysts' consensus view spotlights the cash flow strain as a key risk to the investment case:

- Bears argue that ongoing negative free cash flow could trigger incremental debt financing and, without strong demand materializing, could mean future dilution or pressure on margins rather than the hoped-for growth benefits.

- Additionally, reliance on revenue gains from legacy products leaves Vishay vulnerable to customer shifts toward more integrated solutions, risking not only delayed returns on heavy capital investments but also technology-related obsolescence.

Price-To-Sales Discount Masks Valuation Risks

- Vishay trades at a Price-To-Sales ratio of just 0.7x, making it notably cheaper than both the US Electronic industry average of 2.6x and peer average of 2.4x. Yet, the share price of $15.32 remains meaningfully above the DCF fair value of $5.91 and exceeds the analyst target of $14.00.

- The analysts' consensus view argues that, while Vishay looks optically cheap on sales multiples, the persistent lack of earnings quality and unproven margin recovery path leave the stock vulnerable to de-rating if high-growth scenarios do not materialize.

- Consensus points out that for the $14.00 analyst target to be justified by 2028, revenue would need to hit $3.5 billion with $587.0 million in earnings and a PE of 4.2x. These are aggressive targets that require buy-in to bullish long-term assumptions.

- This tension explains why the seemingly attractive valuation may not be the safety net investors hope for, especially if future growth disappoints or investments fail to yield the expected step-change in profitability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vishay Intertechnology on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Share your unique perspective and shape the conversation in just a few minutes. Do it your way

A great starting point for your Vishay Intertechnology research is our analysis highlighting 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Vishay faces ongoing negative free cash flow, persistent margin pressures, and relies on aggressive capital spending to stay competitive in the face of uncertain growth.

If you want companies with less debt risk and stronger financial footing, focus your search on solid balance sheet and fundamentals stocks screener (1979 results) so you can invest with greater confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSH

Vishay Intertechnology

Manufactures and sells discrete semiconductors and passive electronic components in the United States, Germany, rest of Europe, Israel, and Asia.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives