Vishay Intertechnology Q4 Profitability Return Challenges Persistent Bearish Narratives On Earnings

Vishay Intertechnology FY 2025 earnings snapshot

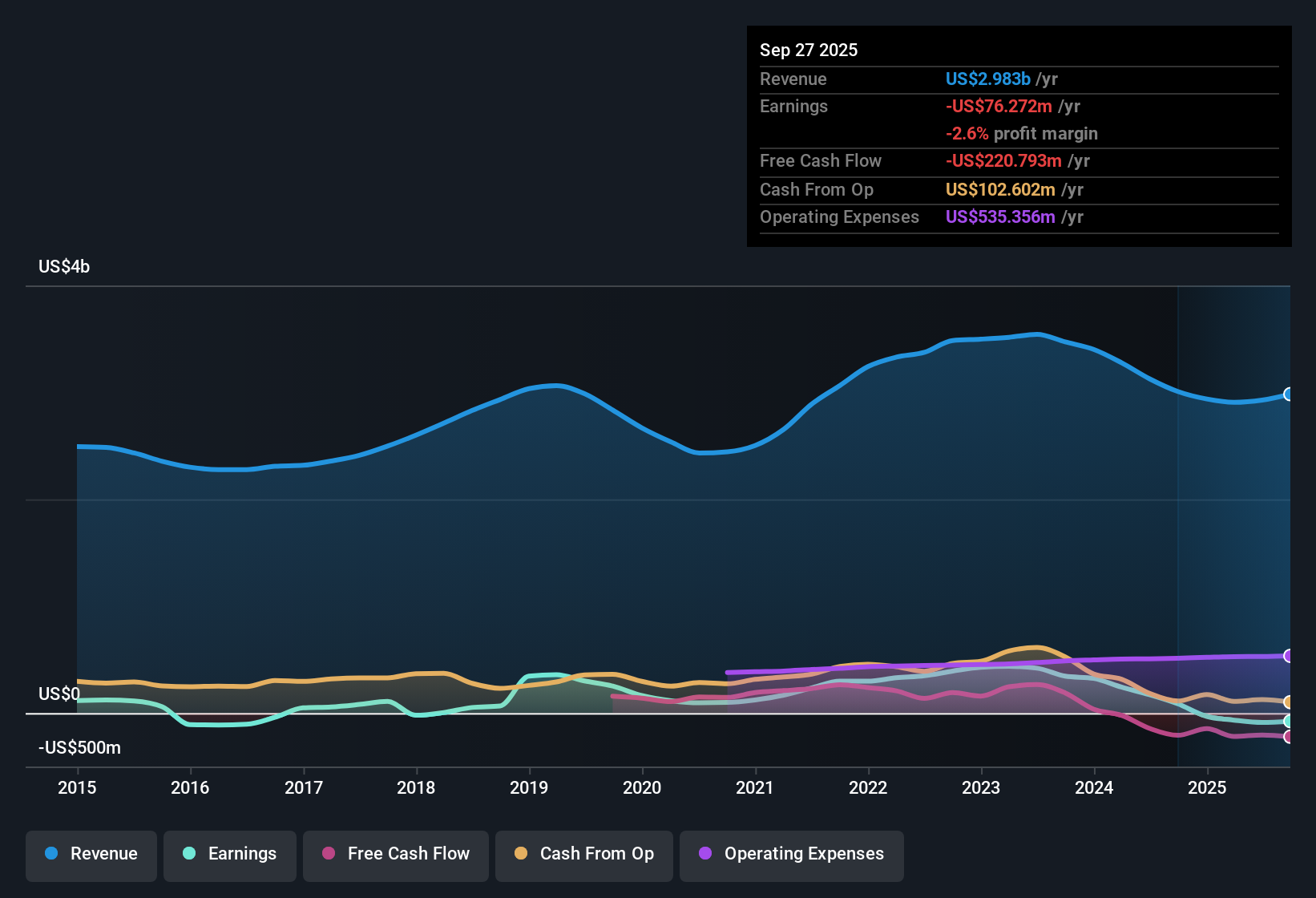

Vishay Intertechnology (VSH) closed FY 2025 with Q4 revenue of US$800.9 million and basic EPS of US$0.01. The trailing twelve months show total revenue of about US$3.1 billion and a small net loss of US$9.0 million. The company reported quarterly revenue ranging from US$715.2 million in Q1 2025 to US$800.9 million in Q4 2025, with EPS moving between a loss of US$0.06 in Q3 2025 and a profit of US$0.01 in Q4 2025 as margins shifted through the year. With the stock trading at US$19.86, these results highlight how efficiently Vishay is converting its multi billion dollar revenue base into sustainable profitability.

See our full analysis for Vishay Intertechnology.With the latest numbers available, the next step is to see how Vishay’s revenue and EPS trends compare with widely followed narratives about its growth prospects, margin pressure, and long term earning power.

Curious how numbers become stories that shape markets? Explore Community Narratives

US$3.1b in sales, still a small annual loss

- Over the last 12 months, Vishay generated about US$3.1b in revenue but recorded a net loss of US$9.0 million, so the business was slightly unprofitable on a trailing basis despite a large sales base.

- What stands out for a more cautious, bearish view is that losses have grown at about 29.6% per year over the past five years, which lines up with the latest trailing loss of US$9.0 million and keeps the focus firmly on whether earnings can move away from this pattern.

- Bears highlight that even with quarterly net income swinging from a loss of US$66.3 million in Q4 2024 to a small profit of US$1.0 million in Q4 2025, the trailing 12 month line is still in the red at US$9.0 million.

- They also point to trailing basic EPS of US$0.01 in Q4 2025 and US$0.63 in Q3 2024 turning into a trailing 12 month basic EPS loss of about US$0.07 by Q4 2025, which they see as evidence that earnings pressure has not yet cleared.

Quarterly swing from US$66.3m loss to break even

- On a quarterly basis, net income moved from a loss of US$66.3 million in Q4 2024 to a profit of US$1.0 million in Q4 2025, with interim quarters showing smaller losses of US$4.1 million in Q1 2025 and US$7.9 million in Q3 2025 and small profits of US$2.0 million in Q2 2025.

- General market opinion that views Vishay as a diversified, cyclical supplier gets some support here, because this pattern of a very large loss in Q4 2024 followed by modest profits and losses around break even through FY 2025 fits the idea that component makers can see earnings move around as end demand and pricing shift.

- Supporters of this view tend to point out that quarterly revenue stayed in a relatively tight band between US$714.7 million and US$800.9 million across the six quarters shown, while net income and EPS moved much more sharply, which is typical of a business where margins, rather than volumes, do a lot of the work.

- At the same time, they acknowledge that the trailing 12 month figures of US$3.1b in revenue and a US$9.0 million loss show that, even with the improvement from Q4 2024 to Q4 2025, the income statement has not yet settled into a consistently profitable pattern.

Cheap 0.9x P/S, yet above DCF fair value

- Vishay trades on a P/S of about 0.9x based on the US$19.86 share price and roughly US$3.1b of trailing revenue, versus peer and US electronic industry averages of about 2.9x to 3.0x, while the provided DCF fair value of US$6.88 is well below the current share price.

- Supporters of a more optimistic, bullish angle often lean on the low 0.9x P/S multiple as a sign the stock is priced cheaply on sales, but that view sits in tension with a DCF fair value of US$6.88 and the fact that the company is still unprofitable over the last 12 months.

- On one side, the roughly 0.9x P/S versus about 3x for peers makes it easy to argue the market is giving limited credit for Vishay's US$3.1b revenue base, especially when recent quarters like Q4 2025 showed a small profit of US$1.0 million instead of the much larger losses seen in Q4 2024.

- On the other side, the same data set flags that the US$19.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Vishay Intertechnology's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Vishay's combination of a small annual loss on roughly US$3.1b in revenue and a share price well above the cited DCF fair value highlights valuation pressure.

If you want ideas where pricing appears more aligned with underlying cash flows, check out these 868 undervalued stocks based on cash flows today and compare alternatives side by side.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSH

Vishay Intertechnology

Manufactures and sells discrete semiconductors and passive electronic components in the United States, Germany, rest of Europe, Israel, and Asia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Investment Thesis: Olvi Oyj (OLVAS)

UnitedHealth Group's Future Revenue Grows by 3.59%: What Will It Mean?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.