Vishay Precision Group (VPG) Margin Decline Challenges Bullish Growth Narrative Despite Upbeat Forecasts

Reviewed by Simply Wall St

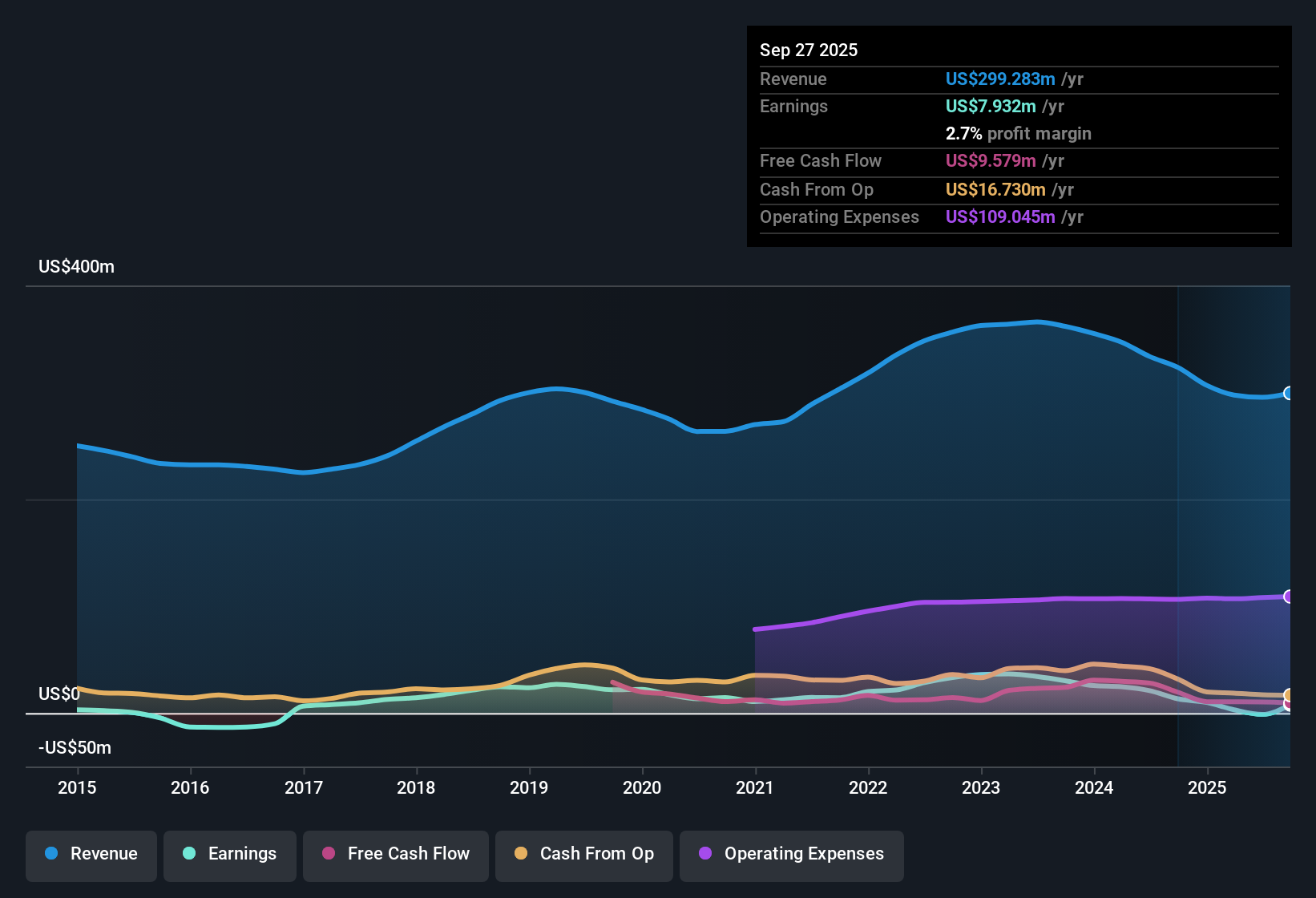

Vishay Precision Group (VPG) reported a net profit margin of 2.7%, dropping from last year’s 4.2%. Over the past five years, the company’s earnings have declined by 7.6% each year, with the latest period benefiting from a one-off $4.4 million gain as of September 27, 2025. However, with earnings expected to rise 54.7% per year going forward, investors are weighing persistent pressure on margins against forecasts that point to a significant rebound.

See our full analysis for Vishay Precision Group.Next, we’ll see how these earnings numbers compare with the most widely discussed narratives, highlighting where the facts reinforce consensus and where expectations may need to adjust.

See what the community is saying about Vishay Precision Group

Margin Expansion Projected After Recent Cost Cuts

- Analysts estimate profit margins will jump from -0.4% currently to 19.7% within three years, a turnaround that relies on operational efficiencies including a $5 million fixed cost reduction program and production consolidation.

- According to the analysts' consensus view, the company is expected to benefit as new orders gain pace in robotics, aerospace, and precision agriculture. These are key areas where VPG’s book-to-bill ratio shows underlying demand momentum.

- The consensus narrative notes that entry into higher-margin markets, such as humanoid robotics and high-performance testing systems, puts gross margins on a potential upswing even as the company faces cyclical headwinds in traditional end-markets.

- Stable long-term earnings are expected as a combination of cost reduction, pricing power, and exposure to growth sectors offset current margin pressures from tariffs and subdued market demand.

Sharp Premium to Peers Despite Discount to Fair Value

- VPG trades at a price-to-earnings ratio of 59.7x, which far exceeds both its peer average (13.5x) and the broader US electronic industry (25x). Yet the $35.69 share price currently sits below its estimated DCF fair value of $41.40.

- Analysts' consensus view points out this tension: while valuation metrics flag the stock as expensive compared to competitors, some investors justify paying a premium given the forecasted 54.7% annual earnings growth that outpaces the market.

- Premium multiples may only be sustainable if the company can deliver the sharp improvement in margins and earnings that consensus forecasts require.

- The apparent discount to intrinsic value gives bulls a narrative for upside, but persistent margin pressure and non-recurring gains keep skeptics cautious.

Lumpy Gains Skewed by One-Off Items

- Recent results were boosted by a one-time $4.4 million gain, and average earnings have declined 7.6% per year over five years. This raises questions about the durability of future profit growth claims.

- Analysts' consensus view highlights that while forecasts hinge on a rapid earnings rebound, past volatility caused by non-recurring items and subdued demand in key markets introduces execution risk.

- The consensus narrative underscores that success in new tech markets will be key to offsetting the long streak of declining underlying earnings.

- Margin forecasts assume operational changes deliver sustainable benefits, but any misstep in cost controls or demand ramp-up could quickly reverse momentum.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vishay Precision Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these results? Share your perspective and craft your own narrative in just minutes. Do it your way

A great starting point for your Vishay Precision Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite forecasts for recovery, Vishay Precision Group’s inconsistent earnings track record and reliance on one-off gains raise concerns about the sustainability of future growth.

If you want to sidestep this volatility, look for steadier options among companies showing consistent expansion with reliable results by using our stable growth stocks screener (2077 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VPG

Vishay Precision Group

Engages in the precision measurement and sensing technologies business in the United States, Europe, Israel, Asia, and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives