Will Teledyne’s (TDY) New Space-Grade Image Sensors Strengthen Its Aerospace and Defense Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Teledyne Technologies announced that engineering models and integration tools for its newly launched industrial CMOS image sensors qualified for space applications will be available by the end of 2025, offering 1.3MP and 12MP variants tailored for the New Space market.

- This initiative showcases Teledyne’s increasing focus on advanced imaging technology and radiation-hardened sensors to meet the rigorous demands of modern space exploration and satellite systems.

- We’ll explore how Teledyne’s commitment to advanced space-grade imaging could reinforce its long-term positioning in aerospace and defense markets.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Teledyne Technologies Investment Narrative Recap

Teledyne’s mission to drive growth through advanced sensing and imaging technology is central for those considering the stock. The latest launch of space-grade CMOS sensors shines a light on its commitment to aerospace and defense innovation, but by itself is unlikely to shift the most significant short-term catalyst: robust defense demand and long-cycle order growth. Likewise, the primary risk, margin pressure tied to integration of acquired businesses, remains unchanged following this announcement.

Of the company’s recent initiatives, Teledyne’s expansion in Saudi Arabia stands out as especially relevant. The new regional headquarters is set to enhance market access and foster closer collaboration with government and defense agencies in the Middle East, tying directly to the company’s efforts to capitalize on surging international defense demand and high-value order trends.

However, in contrast, investors should be aware of the ongoing risk if margins in acquired segments continue to trail expectations or integration lags behind...

Read the full narrative on Teledyne Technologies (it's free!)

Teledyne Technologies' narrative projects $6.9 billion revenue and $1.1 billion earnings by 2028. This requires 5.2% yearly revenue growth and a $241 million earnings increase from $859 million.

Uncover how Teledyne Technologies' forecasts yield a $621.73 fair value, a 24% upside to its current price.

Exploring Other Perspectives

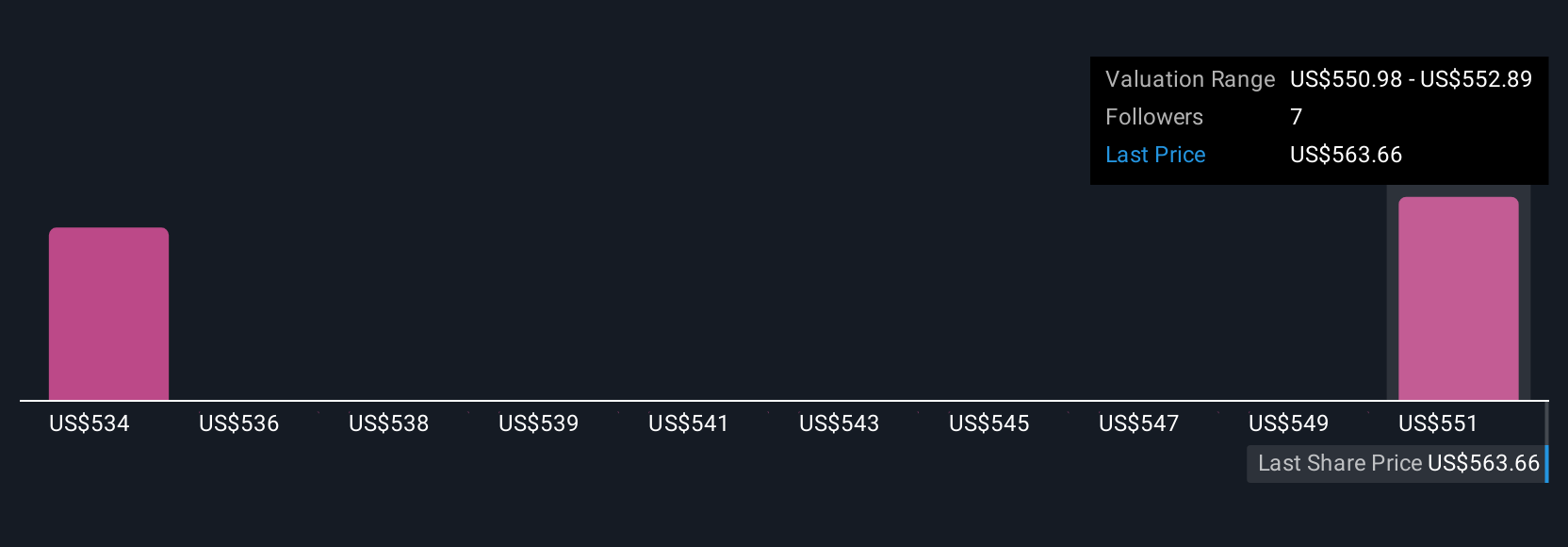

Simply Wall St Community members have provided two fair value estimates for Teledyne, spanning US$585.83 to US$621.73. With broad agreement on strong defense and aerospace catalysts, you can explore where your outlook falls among the range of community viewpoints.

Explore 2 other fair value estimates on Teledyne Technologies - why the stock might be worth as much as 24% more than the current price!

Build Your Own Teledyne Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teledyne Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Teledyne Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teledyne Technologies' overall financial health at a glance.

No Opportunity In Teledyne Technologies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teledyne Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDY

Teledyne Technologies

Provides enabling technologies for industrial growth markets in the United States, Europe, Asia, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives