- United States

- /

- Pharma

- /

- NasdaqGS:AMRX

3 Growth Companies With High Insider Ownership And 101% Earnings Growth

Reviewed by Simply Wall St

As the U.S. stock market faces volatility with major indexes closing sharply lower and tech stocks experiencing significant fluctuations, investors are increasingly focused on companies that demonstrate resilience and potential for growth. In this environment, growth companies with high insider ownership can be appealing as they often align management interests with shareholder value, potentially driving strong earnings performance even amid broader market challenges.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 21.9% | 73.4% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 63% |

| FTC Solar (FTCI) | 23% | 74% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Better Home & Finance Holding (BETR) | 19.4% | 90.3% |

| Atour Lifestyle Holdings (ATAT) | 18.1% | 24.2% |

| Astera Labs (ALAB) | 12.5% | 27.1% |

| AppLovin (APP) | 27.5% | 26.6% |

Let's dive into some prime choices out of the screener.

Harrow (HROW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Harrow, Inc. is an eyecare pharmaceutical company focused on the discovery, development, and commercialization of ophthalmic products with a market cap of approximately $1.51 billion.

Operations: Harrow's revenue is derived from its Branded segment, contributing $167.97 million, and its Compounding segment, which adds $82.07 million.

Insider Ownership: 15.8%

Earnings Growth Forecast: 55.9% p.a.

Harrow's recent financial performance highlights its growth trajectory, with Q3 2025 revenue reaching US$71.64 million, up from US$49.26 million a year ago, and a net income turnaround to US$1.02 million from a loss of US$4.22 million previously. The company is forecasted to grow earnings by 55.86% annually and revenue by 28.4%, outpacing the broader market's growth expectations significantly while trading below estimated fair value, indicating potential upside in valuation amidst high insider ownership dynamics.

- Get an in-depth perspective on Harrow's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Harrow's shares may be trading at a discount.

Amneal Pharmaceuticals (AMRX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amneal Pharmaceuticals, Inc. is a global biopharmaceutical company that develops, manufactures, markets, and distributes generics, injectables, biosimilars, and specialty branded pharmaceutical products worldwide with a market cap of approximately $3.66 billion.

Operations: The company's revenue is primarily derived from three segments: Avkare with $704.37 million, Specialty contributing $482.42 million, and Affordable Medicines generating $1.75 billion.

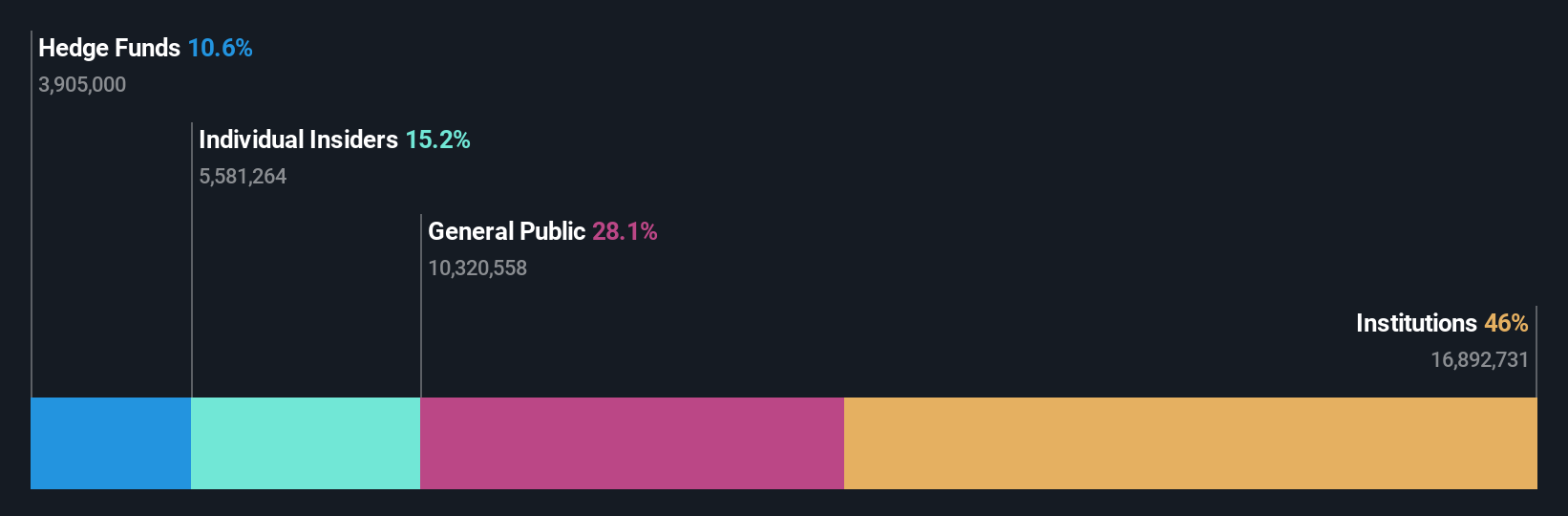

Insider Ownership: 39.2%

Earnings Growth Forecast: 80.1% p.a.

Amneal Pharmaceuticals' financial performance indicates a shift to profitability, with Q3 2025 sales at US$784.51 million and net income of US$2.37 million. Despite slower revenue growth forecasts compared to the market, earnings are expected to grow significantly at 80.1% annually, surpassing broader market expectations. Recent FDA approvals for key products like iohexol injection and Brekiya autoinjector highlight strategic expansion into new therapeutic areas, although insider selling has been noted recently amidst high insider ownership levels.

- Click to explore a detailed breakdown of our findings in Amneal Pharmaceuticals' earnings growth report.

- The analysis detailed in our Amneal Pharmaceuticals valuation report hints at an deflated share price compared to its estimated value.

SmartRent (SMRT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SmartRent, Inc. is an enterprise real estate technology company offering management software and applications to various stakeholders in the rental property sector both in the United States and internationally, with a market cap of $274.34 million.

Operations: The company's revenue primarily comes from its Electronic Security Devices segment, which generated $151.22 million.

Insider Ownership: 10%

Earnings Growth Forecast: 101.8% p.a.

SmartRent's insider ownership aligns with its growth trajectory, as insiders have increased their holdings recently. The company is expected to transition to profitability within three years, with earnings projected to grow significantly above market averages. Despite a revenue decline in the latest quarter (US$36.2 million), SmartRent's strategic focus on transformation and operational excellence under new leadership supports future scalability. Trading substantially below estimated fair value suggests potential for long-term growth despite current challenges.

- Take a closer look at SmartRent's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, SmartRent's share price might be too pessimistic.

Summing It All Up

- Investigate our full lineup of 195 Fast Growing US Companies With High Insider Ownership right here.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMRX

Amneal Pharmaceuticals

A global biopharmaceutical company, develops, manufactures, markets, and distributes generics, injectables, biosimilars, and specialty branded pharmaceutical products worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives