How Investors May Respond To Rogers (ROG) Q3 Revenue Growth and Efficiency-Focused Outlook

Reviewed by Sasha Jovanovic

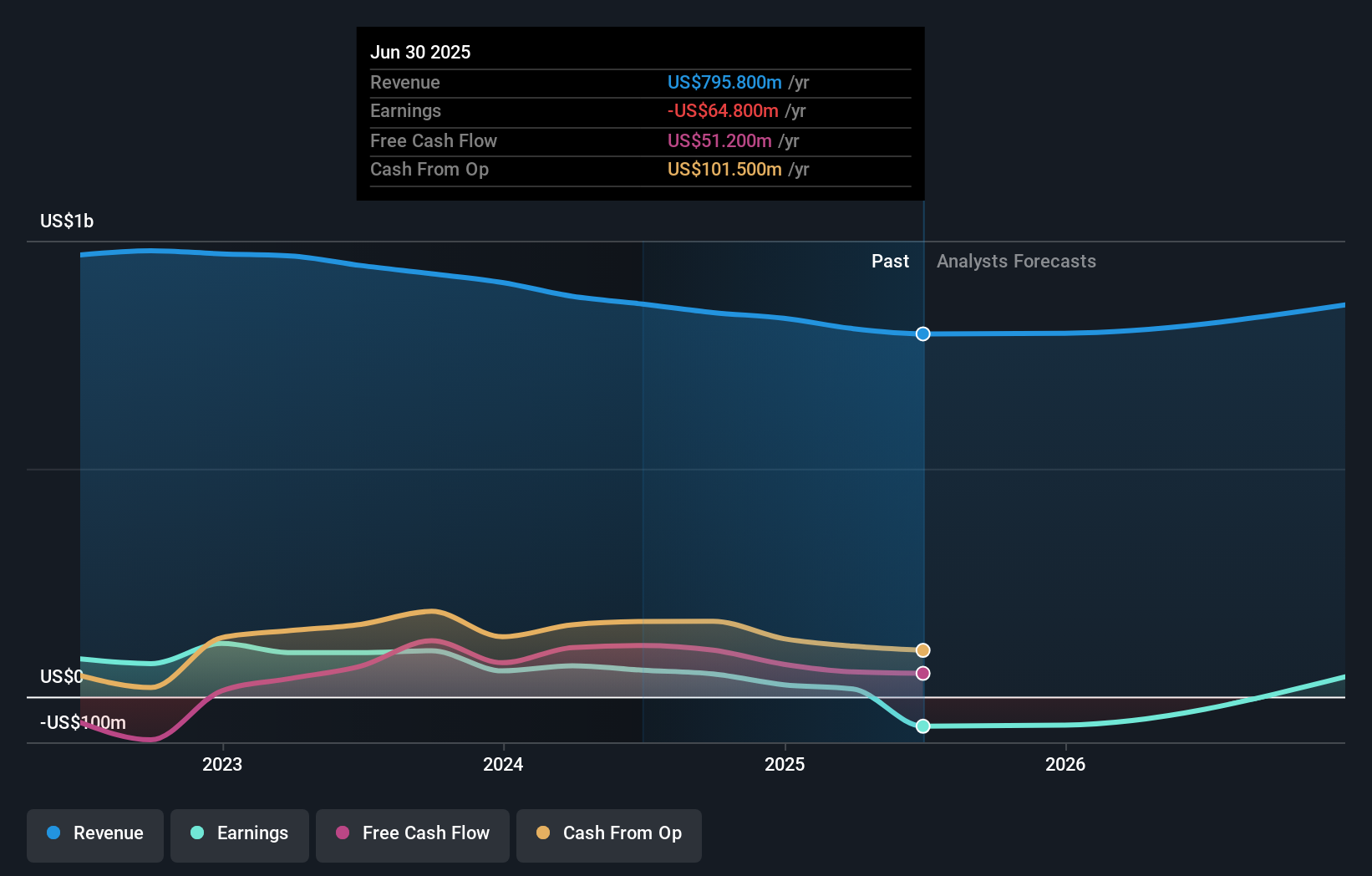

- In late October 2025, Rogers Corporation reported third quarter revenues of US$216 million, a year-over-year increase, and announced fourth quarter 2025 guidance targeting revenues between US$190 million and US$205 million with projected earnings per share ranging from breakeven to US$0.40.

- An interesting aspect of this update is the company's continued focus on cost reduction and operational efficiency, highlighted by expense reduction actions and the completion of a share buyback representing over 10% of shares since 2015.

- We’ll explore how Rogers’ confident sales outlook and margin improvement measures could influence its investment narrative moving forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Rogers Investment Narrative Recap

To be a shareholder in Rogers, you need to believe in its ability to capture long-term growth from global electrification trends, especially in EV and advanced materials. The recent Q3 results and Q4 guidance reflect incremental sales improvement and continued margin focus, but do not significantly change the key short-term catalyst, which remains delivery of cost savings from Asian manufacturing shifts. However, the biggest risk, delayed recovery in the company’s curamik business amid sluggish European and North American EV markets, remains firmly in place.

Among recent announcements, the completion of the multi-year share buyback stands out. While this action has reduced share count and returned capital to investors, its relevance now is mainly symbolic, as immediate investor attention has shifted toward operational execution and booking sustainable gains from the company’s Asian capacity moves.

But while catalysts offer optimism on cost efficiency, investors should also be aware of the risk that...

Read the full narrative on Rogers (it's free!)

Rogers' outlook anticipates $921.6 million in revenue and $83.3 million in earnings by 2028. This scenario is based on an assumed 5.0% annual revenue growth and a $148.1 million increase in earnings from the current $-64.8 million.

Uncover how Rogers' forecasts yield a $95.67 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 2 fair value estimates for Rogers ranging from US$16.20 to US$95.67. While these views vary widely, ongoing margin improvements remain top of mind for many, highlighting the value of weighing multiple perspectives.

Explore 2 other fair value estimates on Rogers - why the stock might be worth as much as 14% more than the current price!

Build Your Own Rogers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rogers research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Rogers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rogers' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROG

Rogers

Designs, develops, manufactures, and sells engineered materials and components in the United States, other Americas, China, other Asia Pacific countries, Germany, Europe, the Middle East, and Africa.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives