- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Pure Storage (NYSE:PSTG) Expands Next-Gen Storage Products For High-Performance Workloads

Reviewed by Simply Wall St

Pure Storage (NYSE:PSTG) recently announced an expansion of its enterprise data cloud offerings, aiming to address rising data volumes and shifting business demands. This announcement, along with other updates such as the introduction of the FlashArray//XL R5, coincided with a 1.65% price increase over the last quarter. The market also reflected broader conditions with tech stocks generally rising amid geopolitical tensions and market volatility. While Pure Storage's innovative announcements could have added momentum to its stock, they were in line with the overall sector trends, rather than standing out distinctly in influence.

Buy, Hold or Sell Pure Storage? View our complete analysis and fair value estimate and you decide.

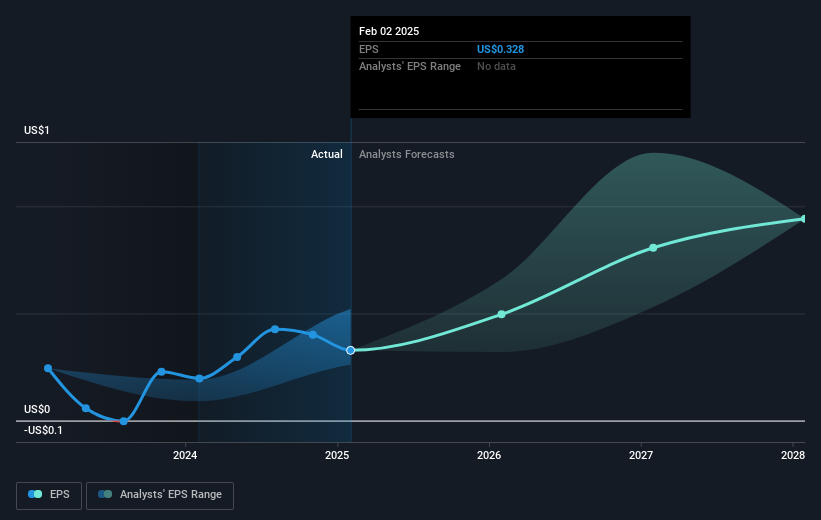

The recent expansion of Pure Storage’s enterprise data cloud offerings and new product introductions could potentially amplify its revenue and earnings forecasts. By achieving a design win with a major hyperscaler, Pure Storage might see increased market penetration and operational scale, which aligns with the forecasted revenue growth due to AI-driven demand. However, challenges such as increased costs and geopolitical risks could impact Pure Storage's projected profit margins. The stock's current price movement, with a 1.65% increase last quarter, remains in line with the company's innovation efforts and the broader tech sector trends, rather than significantly outperforming.

Over the longer term, Pure Storage's shares have appreciated by nearly 204.12% over five years, reflecting solid performance amidst rapidly evolving market conditions. Despite this growth, the company has underperformed both the US market, which returned 9.8%, and the US Tech industry, which saw a 9.5% decline over the past year. With the share price currently at US$47.58, there remains considerable upside potential relative to the consensus analyst price target of US$67.06, suggesting a 29% increase is possible assuming current forecasts hold.

Understand Pure Storage's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Engages in the provision of data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives