Stock Analysis

- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Pure Storage (NYSE:PSTG) delivers shareholders impressive 31% CAGR over 5 years, surging 3.2% in the last week alone

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. Long term Pure Storage, Inc. (NYSE:PSTG) shareholders would be well aware of this, since the stock is up 285% in five years. Also pleasing for shareholders was the 47% gain in the last three months.

Since it's been a strong week for Pure Storage shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Pure Storage

We don't think that Pure Storage's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Pure Storage can boast revenue growth at a rate of 16% per year. That's well above most pre-profit companies. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 31% per year, in that time. This suggests the market has well and truly recognized the progress the business has made. Pure Storage seems like a high growth stock - so growth investors might want to add it to their watchlist.

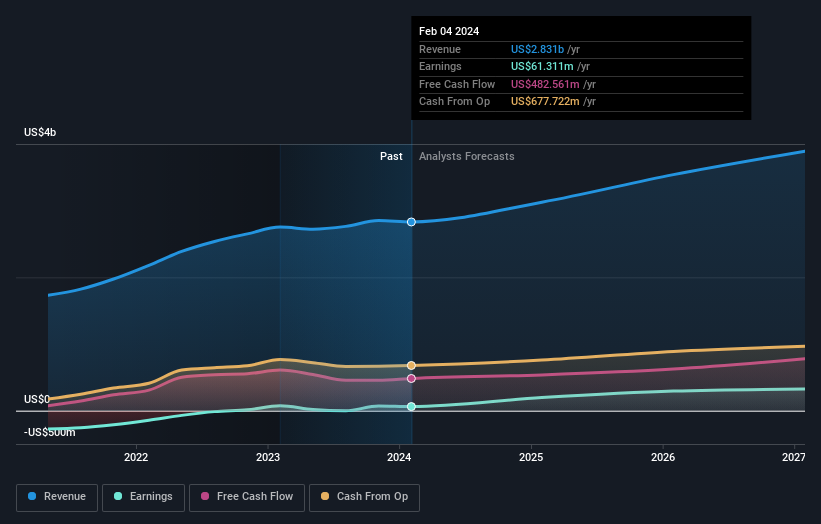

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Pure Storage is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's nice to see that Pure Storage shareholders have received a total shareholder return of 122% over the last year. That gain is better than the annual TSR over five years, which is 31%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Pure Storage you should know about.

Of course Pure Storage may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Pure Storage is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PSTG

Pure Storage

Engages in the provision of data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.