- United States

- /

- Communications

- /

- NYSE:MSI

Will AI-Driven Drones and Assist Upgrades Redefine Motorola Solutions' (MSI) Public Safety Ambitions?

Reviewed by Sasha Jovanovic

- In October 2025, Motorola Solutions announced major enhancements to its public safety AI assistant, Assist, and new capabilities for Drone as First Responder programs, including AI-powered report writing and automated drone dispatch through partnerships with BRINC and SkySafe.

- These innovations empower law enforcement with advanced AI-driven tools for real-time information access, improved report accuracy, and faster emergency response, underscoring Motorola Solutions’ expanding leadership in public safety technology integration.

- We'll explore how Motorola Solutions’ integration of AI-assisted reporting and drone response could reshape its long-term investment outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Motorola Solutions Investment Narrative Recap

To hold Motorola Solutions stock, an investor typically needs to believe that long-term demand for integrated public safety technology will continue to grow, offsetting any exposure to budget cycles or competition. The latest AI-powered enhancements to the Assist platform and emergency drone programs reinforce Motorola’s leadership in smart public safety, but have minimal near-term impact on the upcoming quarterly earnings catalyst, which remains the most watched short-term driver. The risks tied to reliance on government funding and rapid technology shifts remain material and unchanged.

Among recent developments, the integration of AI-assisted reporting and voice-driven policy search inside Assist is most relevant, offering greater operational efficiency and accuracy for law enforcement agencies. These AI tools could increase retention and growth in software and services, which is vital as Motorola seeks an expanding share of the recurring revenue market, addressing concerns around future earnings predictability and margin expansion.

However, even with these advances, investors should be aware of the ongoing risk that government contract cycles and fiscal priorities...

Read the full narrative on Motorola Solutions (it's free!)

Motorola Solutions' outlook anticipates $13.8 billion in revenue and $2.8 billion in earnings by 2028. This assumes a 7.5% annual revenue growth rate and a $0.7 billion increase in earnings from the current $2.1 billion.

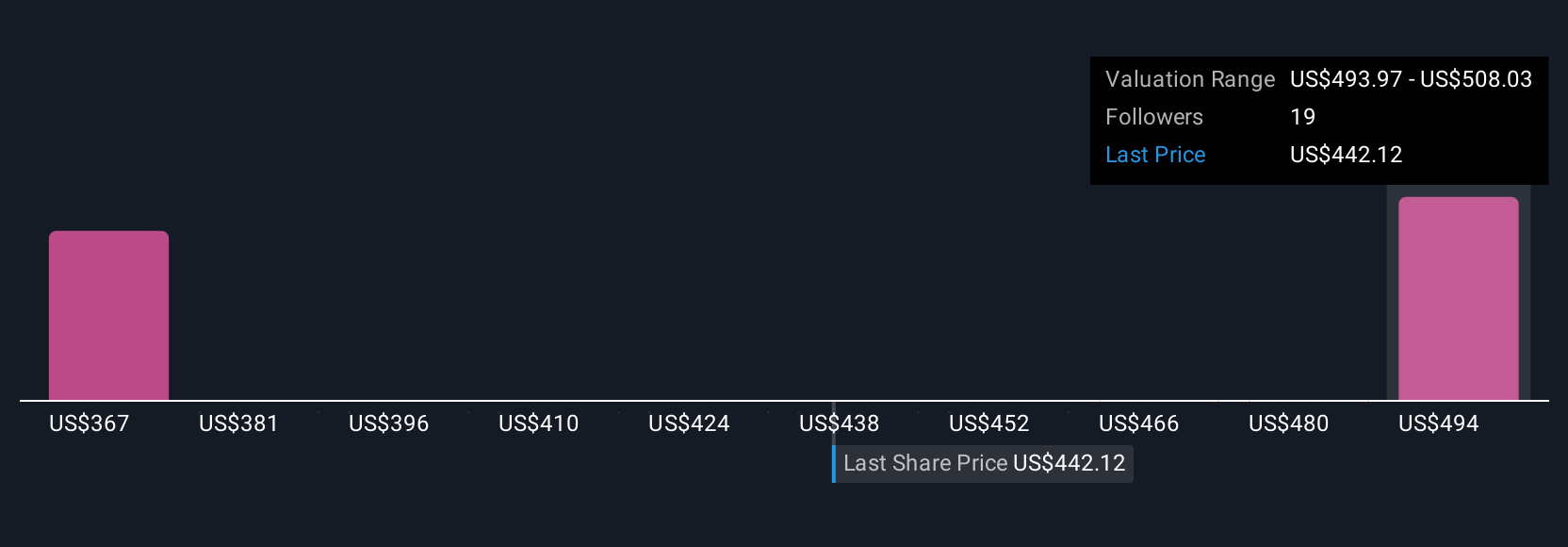

Uncover how Motorola Solutions' forecasts yield a $503.75 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members value Motorola Solutions between US$342.91 and US$503.75, across four distinct estimates. While forecasts diverge, the company’s dependence on multi-year government contracts shapes how participants weigh future revenue stability and growth potential.

Explore 4 other fair value estimates on Motorola Solutions - why the stock might be worth 23% less than the current price!

Build Your Own Motorola Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Motorola Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Motorola Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Motorola Solutions' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives