- United States

- /

- Communications

- /

- NYSE:MSI

Motorola Solutions (MSI): Evaluating Valuation After New Public Safety Wins and AI Security Innovations

Reviewed by Kshitija Bhandaru

Motorola Solutions (MSI) is making waves in the public safety technology arena with new AI-assisted security offerings and recent deployments in high-profile environments such as the University of Palermo and the Sao Paolo subway. These moves underscore a growing focus on integrated, intelligent safety solutions that could shape long-term investor sentiment.

See our latest analysis for Motorola Solutions.

Amid this push into cutting-edge AI-powered security, Motorola Solutions’ long-term story remains compelling, with a five-year total shareholder return near 193% thanks to consistent growth and recurring revenue streams. While momentum has cooled recently, with the latest share price at $448.03 and one-year total shareholder return essentially flat, the recent wins and product launches suggest tech-driven innovation could still power future gains or rebalance risk perception.

If these moves in public safety tech got you thinking, it might be the right moment to broaden your search and discover fast growing stocks with high insider ownership

Given the company’s strong long-term performance and ambitious AI rollouts, is Motorola Solutions now undervalued after a pause in share price gains, or is the market already pricing in its next phase of growth?

Most Popular Narrative: 11% Undervalued

The most widely followed narrative pegs Motorola Solutions’ fair value at $503.75, well above the recent close of $448.03. This sets the stage for a debate over whether recent growth investments and strong recurring revenues justify further upside in the near term.

The rapid adoption of integrated smart technologies, including AI-enhanced video security, spectrum monitoring, and advanced mesh networking through offerings like SVX and Silvus Mobile Ad Hoc Networks, is positioning Motorola to capitalize on the proliferation of smart cities and next-gen public safety applications. This is enabling high double-digit growth in software and services and supports higher-margin, recurring revenue streams.

Want to know the math behind this bullish price? The narrative is powered by aggressive forecasts for top-line expansion and higher profit margins. Curious how these assumptions deliver a premium valuation? The full narrative reveals all the critical numbers that move the price.

Result: Fair Value of $503.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and Motorola's reliance on government contracts could still create earnings volatility or unsettle the company's current growth projections.

Find out about the key risks to this Motorola Solutions narrative.

Another View: What Do Valuation Ratios Suggest?

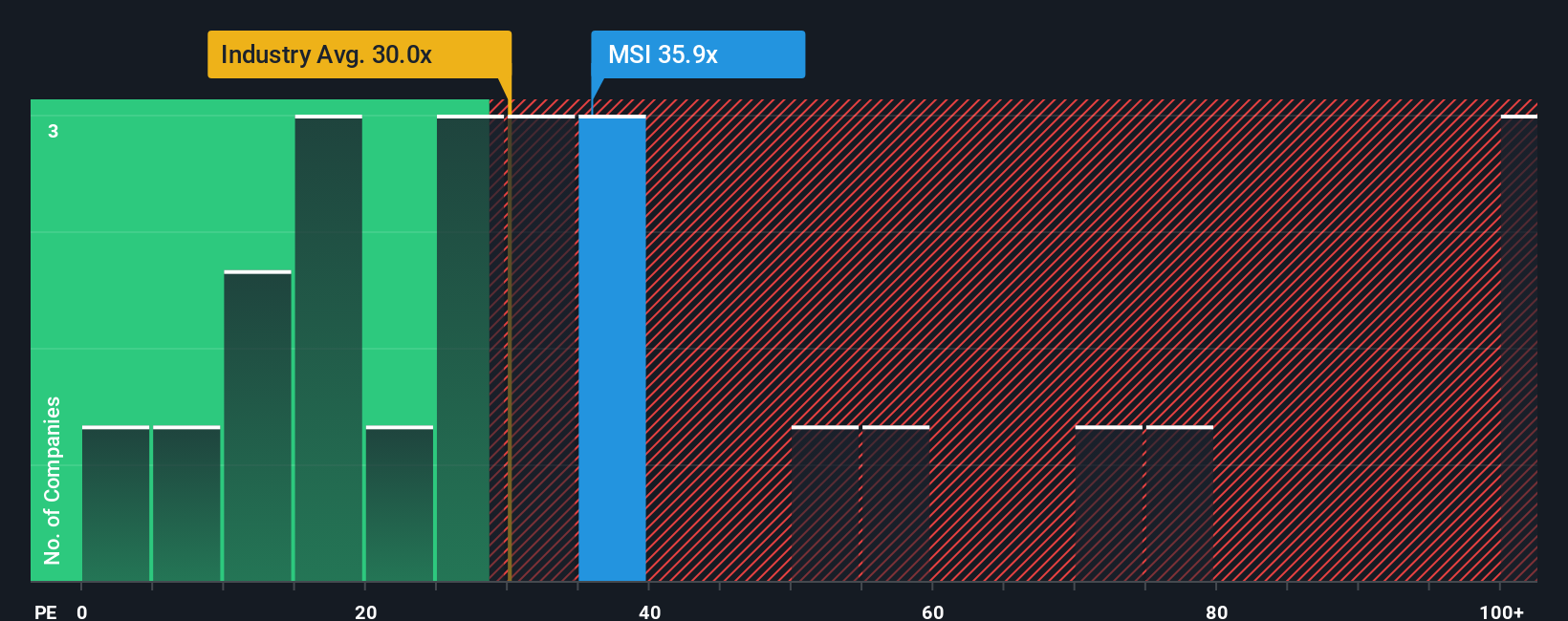

Looking at the numbers through the lens of the price-to-earnings ratio, Motorola Solutions trades at 35.3x, higher than both the US Communications industry average of 29.9x and its own fair ratio of 29.4x. This gap suggests the stock might carry some valuation risk if the market starts prioritizing fundamentals over momentum. Could sentiment shift, or does this premium reflect real staying power?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Motorola Solutions Narrative

If you're looking to form your own perspective or dig deeper into the data, it's quick and easy to craft your own story for Motorola Solutions. See just how fast you can get started: Do it your way

A great starting point for your Motorola Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t limit your portfolio possibilities. Tap into powerful themes that could define tomorrow’s biggest stock market winners using Simply Wall Street’s screeners.

- Accelerate your search for steady passive income by checking out these 19 dividend stocks with yields > 3% yielding more than 3% from established, resilient companies.

- Seize the momentum in advanced tech by investigating these 24 AI penny stocks that are pushing boundaries with artificial intelligence breakthroughs and market leadership.

- Stay ahead of the crowd with these 910 undervalued stocks based on cash flows revealing stocks overlooked by the market but loaded with value based on core fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives