- United States

- /

- Communications

- /

- NYSE:MSI

Motorola Solutions (MSI): Assessing Current Valuation as Shares Slide Further This Month

Reviewed by Simply Wall St

Motorola Solutions (MSI) shares slipped nearly 2% in the past day, extending a steady decline that has continued over the past month. With returns also lagging over the past quarter, investors are watching for fresh catalysts or signs of stabilization.

See our latest analysis for Motorola Solutions.

Shares have struggled this year, with the 1-year total shareholder return down 22.85% and momentum fading recently. This comes despite Motorola Solutions delivering solid multi-year gains of 45% over three years and 130% over five years. The recent declines suggest investors are recalibrating expectations after a strong run, perhaps weighing growth prospects against market uncertainties.

If this shift in sentiment has you exploring broader opportunities, now’s the perfect time to discover fast growing stocks with high insider ownership.

With shares now trading at a notable discount to analyst targets and recent gains giving way to caution, the key question is whether Motorola Solutions is undervalued at today’s levels or if the market is already taking future growth into account.

Most Popular Narrative: 25.3% Undervalued

Compared to the last close at $372.36, the most widely followed narrative estimates Motorola Solutions’ fair value at $498.44. The narrative projects room for meaningful upside based on ongoing business transformation and long-term growth drivers.

The accelerating focus on public safety and security, fueled by heightened geopolitical instability, border security needs, and new government funding programs like the "One Big Beautiful Bill", is driving strong, sustained customer demand for advanced, integrated communication solutions. This expanding long-term tailwind is visible in Motorola’s record Q2 orders, growing backlog, and consistent multi-year contract wins, supporting above-trend revenue growth and durability.

Ever wondered what ambitious growth targets and margin improvement justify such a bullish outlook? The fair value is powered by analyst forecasts that look beyond short-term headwinds and connect recurring revenue growth, margin expansion, and a rising profit multiple. Find out what future assumptions are fueling this price.

Result: Fair Value of $498.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on government contracts and the rapid pace of new technology adoption could present headwinds that disrupt the current growth trajectory of Motorola Solutions.

Find out about the key risks to this Motorola Solutions narrative.

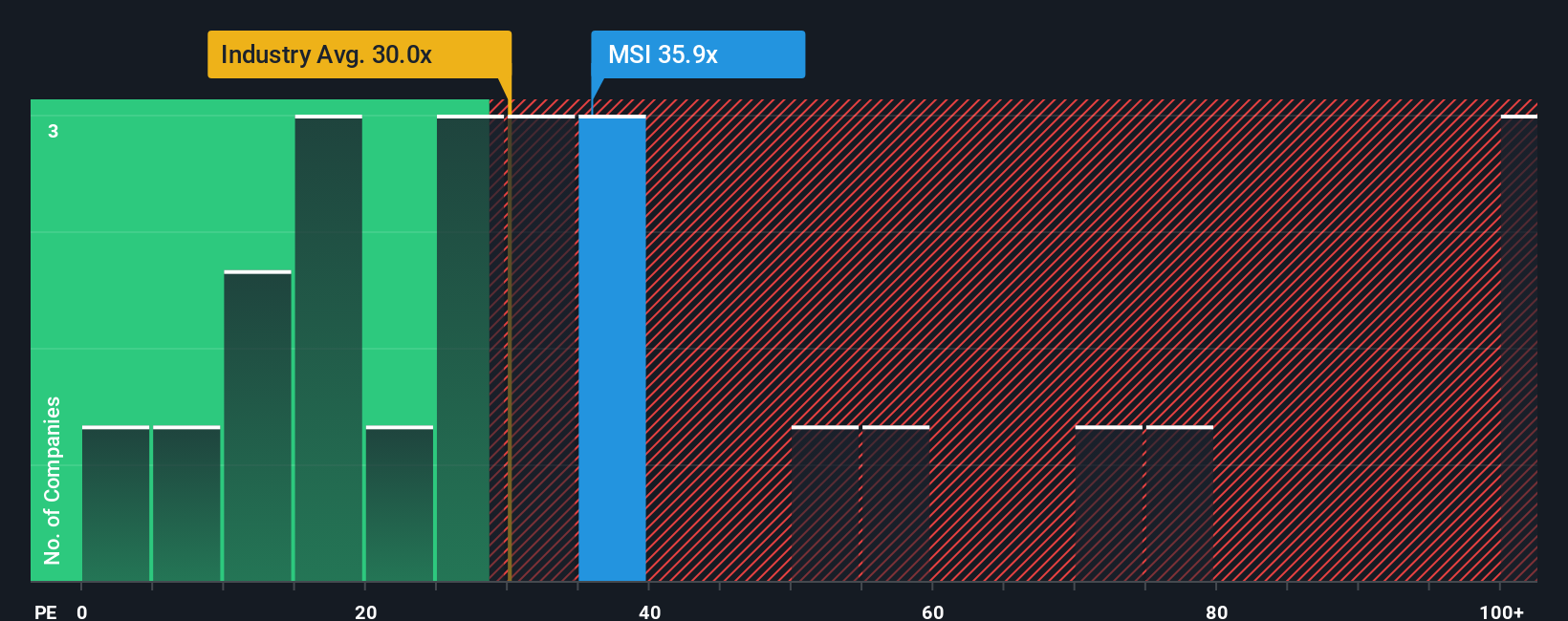

Another View: What Do Price Ratios Suggest?

Looking from a different angle, Motorola Solutions is valued at 29.3 times earnings, which is lower than the US Communications industry average of 31.6 times but higher than its fair ratio of 27.7 times. This puts the stock in a tricky spot: good value versus peers, but a touch pricey relative to its own fundamentals. Will the market shift toward the fair ratio, or sustain the current premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Motorola Solutions Narrative

If the current analysis doesn't quite fit your outlook, you can dig into the details yourself and shape your own narrative in just a few minutes, Do it your way.

A great starting point for your Motorola Solutions research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your investing to the next level by checking out stocks built for high growth, future tech, and solid returns using expert-curated tools from Simply Wall Street.

- Accelerate your portfolio’s growth and jump on momentum with these 906 undervalued stocks based on cash flows, which offers potential bargains based on strong cash flows.

- Capitalize on the AI boom and ride the next wave of innovation by targeting opportunities among these 27 AI penny stocks, making headlines for their advancements.

- Tap into reliable income and let your money work for you with these 18 dividend stocks with yields > 3%, featuring businesses delivering consistent yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives