Knowles Corporation (NYSE:KN) Might Not Be As Mispriced As It Looks

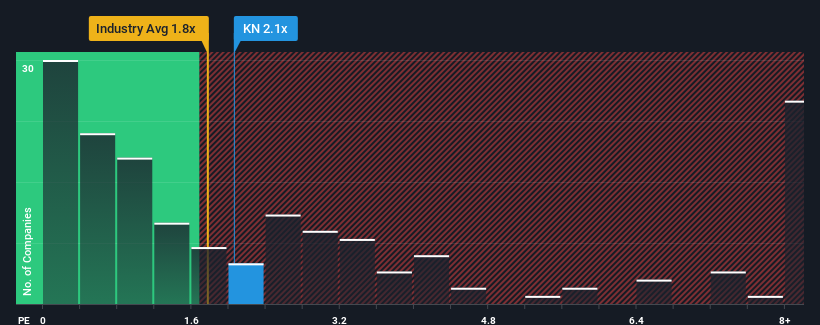

With a median price-to-sales (or "P/S") ratio of close to 1.8x in the Electronic industry in the United States, you could be forgiven for feeling indifferent about Knowles Corporation's (NYSE:KN) P/S ratio of 2.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Knowles

What Does Knowles' Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Knowles has been doing quite well of late. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Knowles will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Knowles' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 7.4% gain to the company's revenues. Still, lamentably revenue has fallen 5.3% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 10% during the coming year according to the four analysts following the company. That's shaping up to be materially higher than the 6.4% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Knowles' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Knowles' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Knowles with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Knowles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KN

Knowles

Offers capacitors, radio frequency (RF) and microwave filters, balanced armature speakers, and medtech microphones in Asia, the United States, Europe, rest of Americas, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives