Keysight Technologies (KEYS): Evaluating Valuation After Major Advances in Test and Wireless Innovation

Reviewed by Simply Wall St

Keysight Technologies (KEYS) has rolled out several major initiatives this week, including a new GNSS simulation platform, the industry’s first PTCRB-approved 5G NTN test cases, and expanded power supply solutions. These developments highlight its focus on accelerating innovation in wireless and test technologies.

See our latest analysis for Keysight Technologies.

This surge of new products and strategic collaborations has come amid a notable upswing in Keysight Technologies’ shares, with the stock posting an 8.6% one-month share price return and a robust 19.9% total shareholder return over the past year. Momentum appears to be building as investors take notice of both recent wins in wireless innovation and the company’s expanding footprint in next generation test solutions.

If Keysight’s momentum in high-tech testing has you curious for more, it’s a great moment to explore See the full list for free.

But with shares already rebounding strongly, is Wall Street underestimating Keysight’s long-term value, or has all the upside from these breakthroughs already been factored in, leaving little room for further gains?

Most Popular Narrative: 6% Undervalued

According to the most widely followed narrative, Keysight’s fair value sits at $190, a meaningful premium to its last close price of $179. This situation creates an environment for bold growth assumptions that drive the narrative's optimism.

Early engagement and leadership in next-generation wireless technologies, such as ongoing 5G-Advanced deployments, direct-to-cell, non-terrestrial networks, and active participation in 6G research, position Keysight to capture significant share as new wireless standards roll out globally, supporting future revenue growth and a stable order outlook.

Curious what ambitious financial leaps underpin this outlook? The core narrative centers on future earnings growth and margin strength typically reserved for standout tech players. Find out which impressive long-term projections are used to justify this valuation increase.

Result: Fair Value of $190 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, new tariffs and a possible slowdown in AI infrastructure spending could quickly dampen Keysight’s strong outlook if these challenges are not effectively managed.

Find out about the key risks to this Keysight Technologies narrative.

Another View: Looking at Earnings Multiples

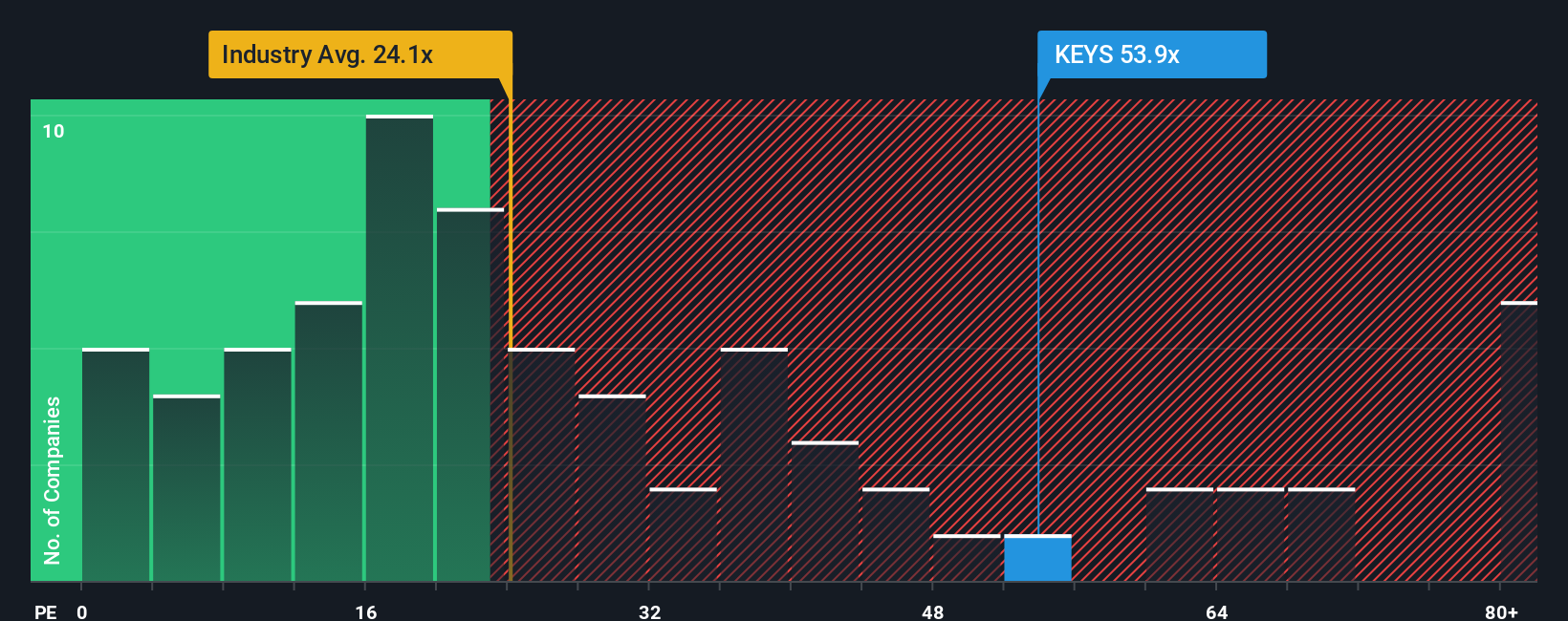

While the narrative approach suggests Keysight shares are undervalued, a closer look at its price-to-earnings ratio paints a different picture. Currently, the company trades at 56.6x earnings, far above the industry average of 23.9x and the fair ratio of 32.1x. This significant gap implies investors are paying a premium for future growth. However, could the market be overestimating its prospects?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Keysight Technologies Narrative

If you want to dig deeper, challenge the consensus, or follow your own convictions, you can craft your own take on Keysight in just a couple of minutes. Do it your way

A great starting point for your Keysight Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More High-Potential Investment Ideas?

Expand your portfolio by taking action right now. Savvy investors know the best opportunities never wait around, and missing out could mean passing up the next breakout stock.

- Unlock juicy yields and shield your wealth from market volatility by considering these 16 dividend stocks with yields > 3% with proven payout power and strong fundamentals.

- Tap into the AI revolution and fuel your returns by accessing these 25 AI penny stocks taking machine learning and automation to new heights.

- Supercharge your potential gains by scanning these 879 undervalued stocks based on cash flows that are trading well below intrinsic value and may be poised for a comeback.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keysight Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEYS

Keysight Technologies

Provides electronic design and test solutions worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion