- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

How Investors Are Reacting To IonQ (IONQ) Record Revenue, Major Acquisitions and Quantum Fidelity Breakthrough

Reviewed by Sasha Jovanovic

- IonQ reported record third-quarter revenue, surpassing expectations and raising its 2025 outlook, while also achieving world-record 99.99% two-qubit gate fidelity, completing the acquisitions of Oxford Ionics and Vector Atomic, and launching Switzerland’s first citywide quantum network.

- These developments underscore IonQ’s rapid expansion in both technical capability and geographic presence, solidifying its role as a global quantum technology leader.

- With these new technical and commercial milestones, we'll explore how IonQ's breakthrough in two-qubit gate fidelity shapes its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is IonQ's Investment Narrative?

To be comfortable as an IonQ shareholder, you need to believe that quantum computing is on track to become a transformational technology, and that IonQ’s global reach and technical milestones can help it convert early leadership into durable commercial gains. The recent record quarterly revenue and world-best two-qubit gate fidelity, combined with the launch of the Geneva Quantum Network and advancement to DARPA’s Quantum Benchmarking Initiative Stage B, accelerate IonQ’s credibility and pipeline for real-world applications. These wins help reinforce some of the short-term growth catalysts, such as contract opportunities, increased revenue visibility, and technical progress that previously shaped analyst optimism. However, IonQ’s net losses have widened substantially, management remains relatively new, and the company has seen insider selling and share dilution. While recent technical and business accomplishments support the near-term bullish case, the risks around long-term profitability, market adoption, and stock volatility remain unchanged, or could become more scrutinized as competition and valuation concerns persist.

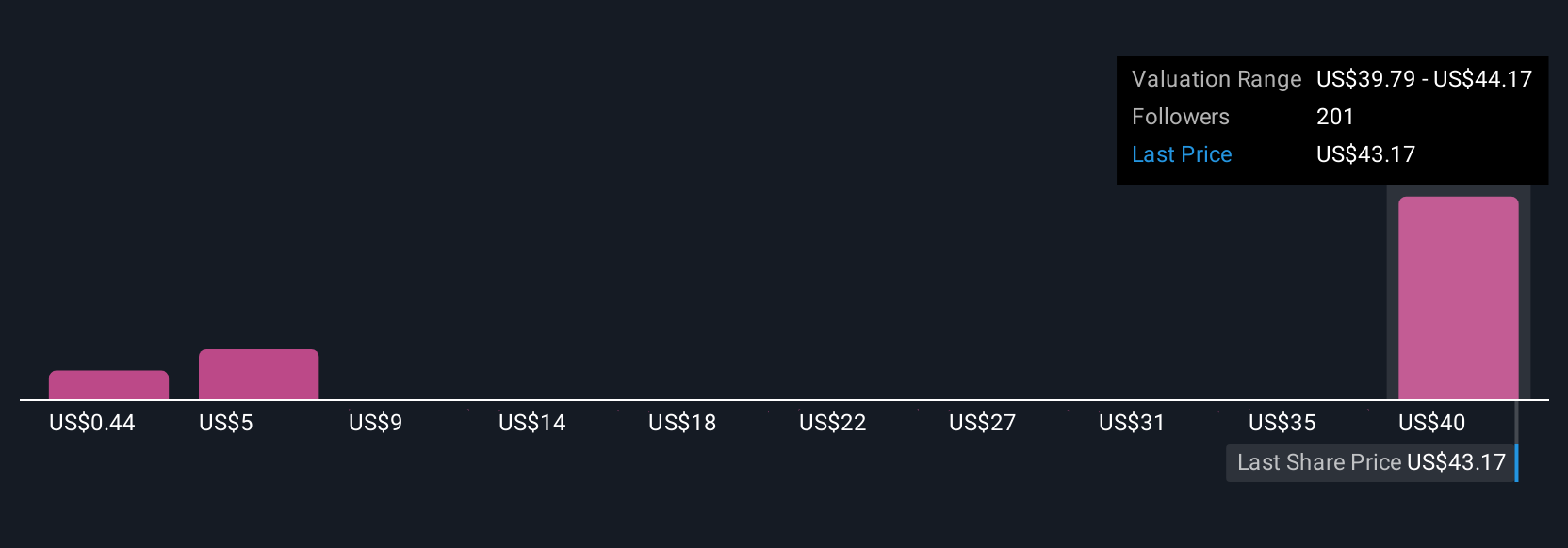

But, despite the excitement, future profitability is still a key uncertainty investors should watch. The analysis detailed in our IonQ valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 66 other fair value estimates on IonQ - why the stock might be worth less than half the current price!

Build Your Own IonQ Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IonQ research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free IonQ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IonQ's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives