- United States

- /

- Tech Hardware

- /

- NYSE:HPE

How Major AI Collaborations and Government Deals Could Shape HPE’s (HPE) Sector Leadership and Investor Outlook

Reviewed by Sasha Jovanovic

- In late October 2025, Hewlett Packard Enterprise announced a series of major collaborations and product launches, including contracts to deliver advanced AI and supercomputing systems for the U.S. Department of Energy, Oak Ridge and Los Alamos National Laboratories, the University of Utah, and the Town of Vail, as well as an expanded NVIDIA-powered AI infrastructure portfolio targeting governments, enterprises, and regulated industries.

- These developments underscore HPE’s expanding leadership in next-generation AI infrastructure, marking its growing presence across government, academic, and smart city sectors with full-stack, scalable solutions.

- We'll examine how HPE's expanded NVIDIA AI partnerships and government contracts shape the company's investment narrative and sector positioning.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Hewlett Packard Enterprise Investment Narrative Recap

To be a shareholder in Hewlett Packard Enterprise today, you need to believe the company can convert its major wins in AI infrastructure into lasting revenue and margin growth, especially as enterprise tech shifts toward hybrid cloud and as-a-service models. The latest headline AI and supercomputing contracts will likely bolster HPE’s positioning in next-generation workloads, but the company’s biggest near-term catalyst, accelerating adoption of its AI platforms, still faces the risk of competitive pressures and potential earnings drag if its hardware-centric legacy slows cloud transition or service integration.

Among the recent announcements, HPE’s expanded NVIDIA AI Computing portfolio is one of the most relevant. This suite aims to make AI deployment more efficient and secure for enterprise and public sector clients, tying directly into HPE’s opportunity to increase higher-margin recurring revenues, but also highlighting the challenge of differentiating their offering amid rapid AI adoption across the industry.

In contrast, investors should be aware that as HPE pushes deeper into AI and software, the risk of margin compression from intense competition in the sector could...

Read the full narrative on Hewlett Packard Enterprise (it's free!)

Hewlett Packard Enterprise's outlook anticipates $44.4 billion in revenue and $2.7 billion in earnings by 2028. This requires annual revenue growth of 10.3% and an earnings increase of $1.6 billion from the current $1.1 billion.

Uncover how Hewlett Packard Enterprise's forecasts yield a $26.51 fair value, a 12% upside to its current price.

Exploring Other Perspectives

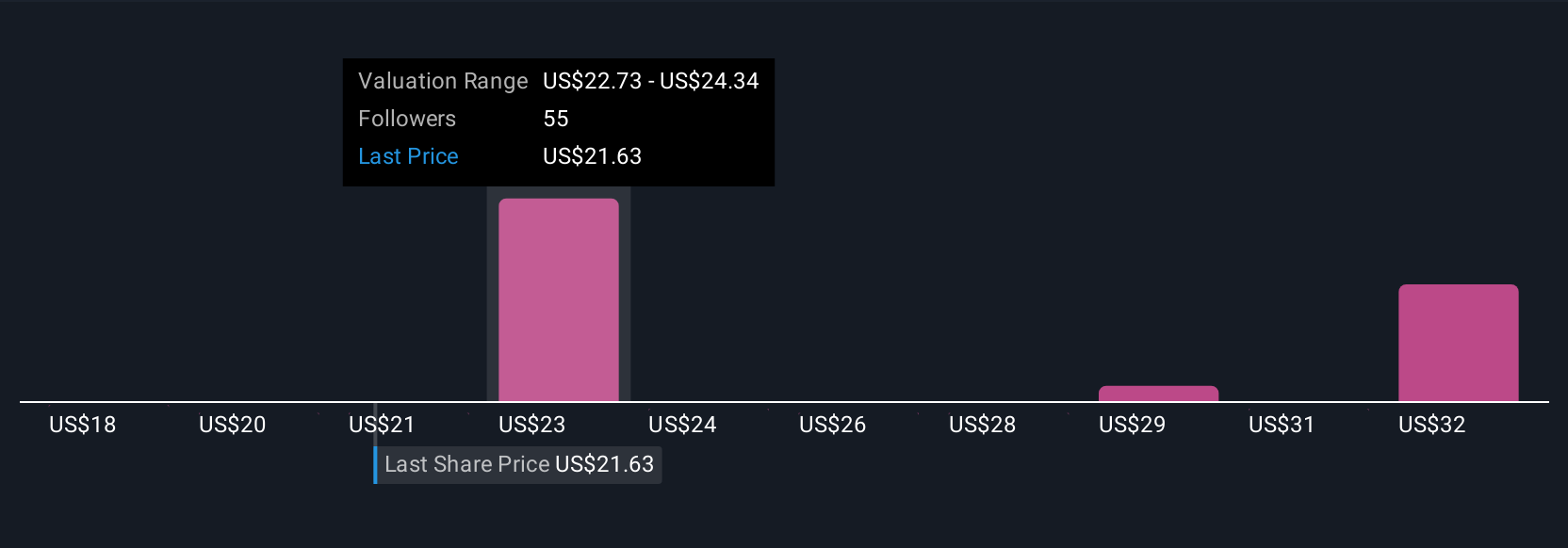

Six members of the Simply Wall St Community estimate HPE’s fair value anywhere between US$17.90 and US$34.97 per share, showing a broad range of outlooks. While consensus sees AI as a major growth catalyst, opinions vary and suggest it’s worth considering multiple viewpoints on future performance.

Explore 6 other fair value estimates on Hewlett Packard Enterprise - why the stock might be worth 25% less than the current price!

Build Your Own Hewlett Packard Enterprise Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hewlett Packard Enterprise research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Hewlett Packard Enterprise research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hewlett Packard Enterprise's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives