- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (NYSE:HPE) Will Pay A Dividend Of $0.13

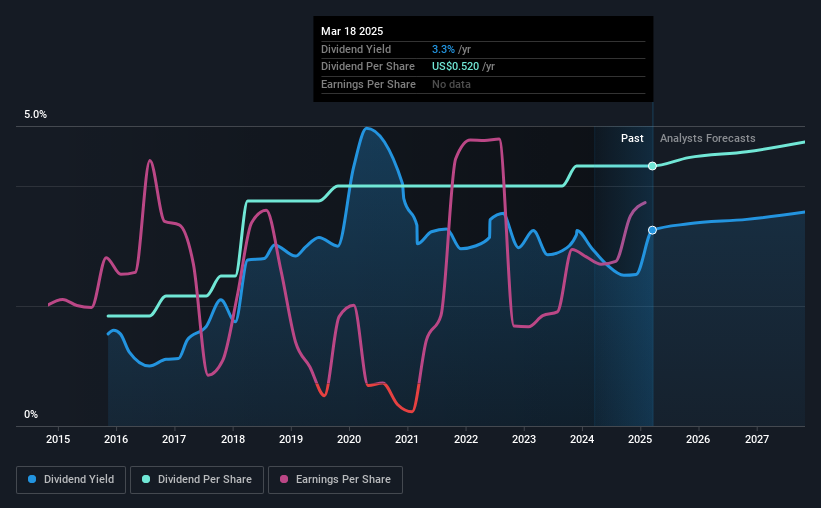

The board of Hewlett Packard Enterprise Company (NYSE:HPE) has announced that it will pay a dividend of $0.13 per share on the 18th of April. This means the annual payment is 3.3% of the current stock price, which is above the average for the industry.

See our latest analysis for Hewlett Packard Enterprise

Hewlett Packard Enterprise's Projected Earnings Seem Likely To Cover Future Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. However, Hewlett Packard Enterprise's earnings easily cover the dividend. This means that most of what the business earns is being used to help it grow.

Looking forward, earnings per share is forecast to fall by 6.1% over the next year. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 29%, which is comfortable for the company to continue in the future.

Hewlett Packard Enterprise Doesn't Have A Long Payment History

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. The dividend has gone from an annual total of $0.22 in 2016 to the most recent total annual payment of $0.52. This implies that the company grew its distributions at a yearly rate of about 10% over that duration. Hewlett Packard Enterprise has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. It's encouraging to see that Hewlett Packard Enterprise has been growing its earnings per share at 18% a year over the past five years. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

We Really Like Hewlett Packard Enterprise's Dividend

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. The company is generating plenty of cash, and the earnings also quite easily cover the distributions. If earnings do fall over the next 12 months, the dividend could be buffeted a little bit, but we don't think it should cause too much of a problem in the long term. All of these factors considered, we think this has solid potential as a dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for Hewlett Packard Enterprise that investors need to be conscious of moving forward. Is Hewlett Packard Enterprise not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Undervalued with moderate risk and pays a dividend.

Similar Companies

Market Insights

Community Narratives