- United States

- /

- Tech Hardware

- /

- NYSE:DELL

Is There Still Opportunity in Dell After 30.8% Rally and AI-Focused Partnerships in 2025?

Reviewed by Bailey Pemberton

- Wondering if Dell Technologies is priced for opportunity or if the ship has sailed? You are not alone. Its recent gains have caught the eye of many curious investors.

- The stock has climbed an impressive 30.8% year-to-date, despite dipping 6.8% over the last week, and has delivered an extraordinary 406.6% return over the past five years.

- Much of this movement tracks with Dell’s recent push into AI-powered enterprise solutions and its high-profile partnerships with hyperscalers. These developments have stirred buzz about the company’s evolving business mix. News outlet coverage has highlighted how Dell’s robust order book and expansion plans could play a major role in sustaining momentum.

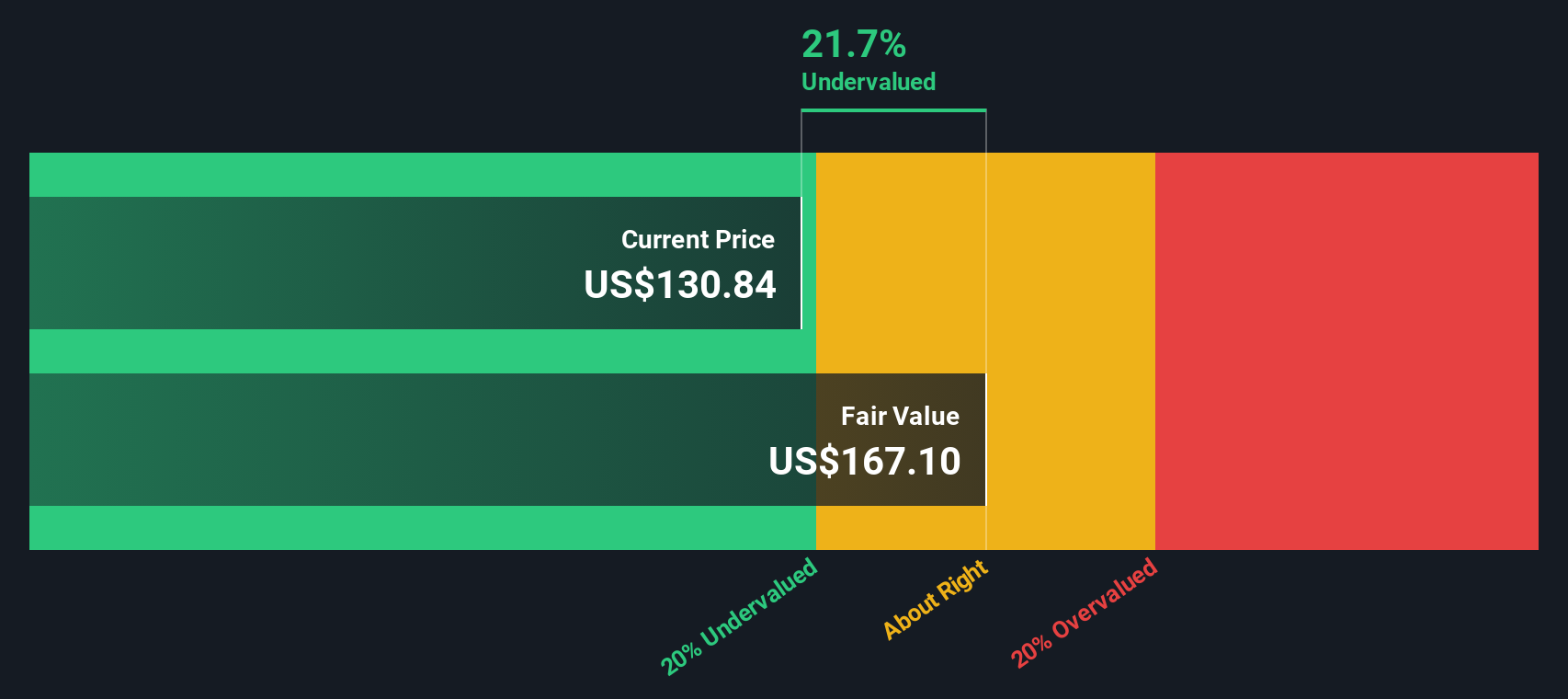

- Dell shines with a valuation score of 5 out of 6, indicating it is undervalued across most checks. Let’s dig deeper into how this score is calculated and explore other valuation methods. By the end of our analysis, there may be an even better way to judge Dell’s true worth.

Find out why Dell Technologies's 12.2% return over the last year is lagging behind its peers.

Approach 1: Dell Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting future cash flows and bringing them back to today’s value using a chosen discount rate. This process provides investors with an intrinsic value that can be compared to current market prices.

Dell Technologies currently reports trailing twelve-month Free Cash Flow of $4.59 Billion. According to analyst forecasts and further extrapolation, Dell’s Free Cash Flow is projected to grow steadily, reaching an estimated $8.52 Billion by the year 2030. It is important to note that analyst forecasts typically cover up to five years, and projections beyond that are based on estimates sourced by Simply Wall St.

Based on this DCF analysis, Dell’s estimated fair value stands at $192.46 per share. This valuation implies the stock is trading at a 20.8% discount compared to its intrinsic value, suggesting meaningful upside potential for investors who believe in the long-term story of the company.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dell Technologies is undervalued by 20.8%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

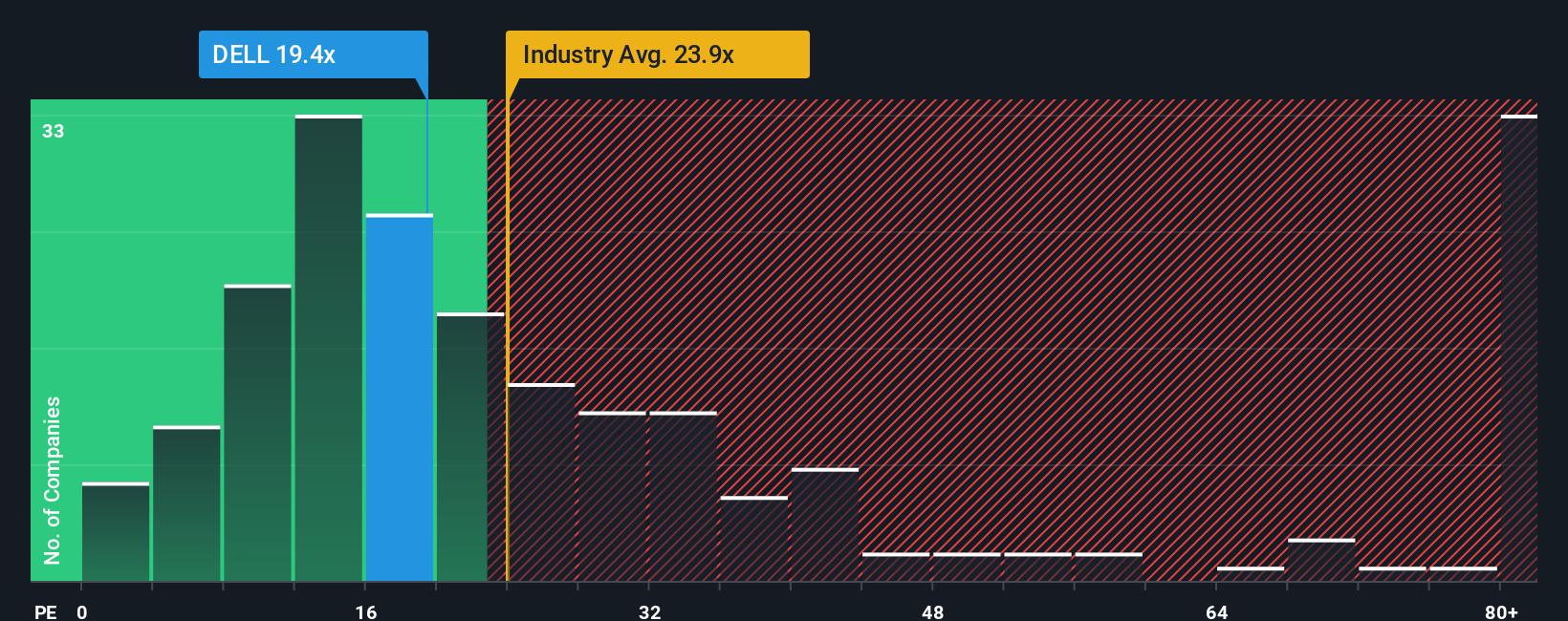

Approach 2: Dell Technologies Price vs Earnings

For profitable companies like Dell Technologies, the Price-to-Earnings (PE) ratio remains one of the most popular and effective ways to assess valuation. This metric gives a sense of how much investors are willing to pay for each dollar of current earnings, offering a snapshot of market sentiment and company prospects.

Interpreting the right PE ratio depends on expectations for future earnings growth and the perceived risks in the business. Companies with higher expected growth or lower risk profiles typically command premium PE multiples, while those with uncertain outlooks or higher risk trade at lower multiples.

Currently, Dell Technologies trades at a PE ratio of 21.12x. This sits slightly below both its peer average of 23.10x and the Tech industry average of 22.98x. This positions Dell on the lower side relative to comparable companies. However, Simply Wall St’s proprietary Fair Ratio, which incorporates factors such as earnings growth, profit margins, industry context, company size, and risk profile, suggests Dell's fair PE multiple should be 39.10x.

The Fair Ratio is a more nuanced benchmark than a simple peer or industry comparison. By factoring in growth potential, profitability, scale, and unique risks, it can highlight valuation mismatches that basic averages might overlook. In Dell’s case, the current PE ratio is well below the Fair Ratio, which indicates the stock could be meaningfully undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dell Technologies Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple way to link your view of a company's story—where you think it is headed—to a tangible forecast of future revenue, earnings, and margins, and finally to an estimate of fair value. Instead of relying solely on static models or peer comparisons, Narratives enable you to express your personal outlook, update your assumptions as new information appears, and see instantly how your scenario compares to others.

On Simply Wall St’s Community page, millions of investors already use Narratives to bring together business context and numbers. Narratives help you decide if now is the right time to buy or sell by automatically comparing your calculated fair value with the current market price, making your decision-making smarter and more transparent. As the news changes, such as Dell’s surging AI momentum or a dip in margins, Narratives are refreshed so you always have an up-to-date perspective.

For example, some investors believe Dell’s fair value should be as high as $180, forecasting rapid AI-driven growth, while others see risks and put fair value as low as $104, emphasizing challenges in PC demand and margin pressures. Your Narrative, built on your own expectations, guides the investment decision that fits your outlook best.

Do you think there's more to the story for Dell Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DELL

Dell Technologies

Designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives