- United States

- /

- Tech Hardware

- /

- NYSE:DBD

Should Diebold Nixdorf’s (DBD) Role in ROSSMANN’s Swiss Expansion Prompt Investor Attention?

Reviewed by Sasha Jovanovic

- ROSSMANN announced that Diebold Nixdorf has supported its expansion into Switzerland by providing Managed Services through the eServices portal and deploying retail technologies such as self-checkout and point-of-sale systems, following a successful collaboration in over 2,350 German stores since 2021.

- This expansion establishes a scalable operational framework for ROSSMANN across Europe and highlights Diebold Nixdorf’s capacity to deepen large-scale client relationships with integrated hardware and software solutions.

- We'll explore how Diebold Nixdorf’s integral role in ROSSMANN’s Swiss expansion may influence the company’s growth narrative and service outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Diebold Nixdorf Investment Narrative Recap

Shareholders in Diebold Nixdorf need to believe in the company’s ability to leverage its retail technology and managed services to drive recurring revenue from both established and growing clients. The recent ROSSMANN Switzerland expansion signals ongoing progress in shifting toward a software and services-centric business model, but this development appears incremental rather than a game-changing short-term catalyst, while execution risk remains the biggest challenge as the company continues its transformation. Among recent announcements, Diebold Nixdorf’s reaffirmed 2025 earnings guidance and ongoing buyback program underscore management’s commitment to operational discipline, which has supported margin improvements and confidence in near-term cash flow, factors that underpin the company’s resilience as it secures large-scale service contracts such as the ROSSMANN rollout. However, investors should also be alert, if efficiency gains from restructuring slow or seem to reverse, the outlook for stable net earnings and positive cash flow could quickly become uncertain...

Read the full narrative on Diebold Nixdorf (it's free!)

Diebold Nixdorf's outlook anticipates $4.2 billion in revenue and $312.7 million in earnings by 2028. This scenario assumes a 4.3% annual revenue growth rate and a $325.6 million increase in earnings from the current level of -$12.9 million.

Uncover how Diebold Nixdorf's forecasts yield a $79.00 fair value, a 27% upside to its current price.

Exploring Other Perspectives

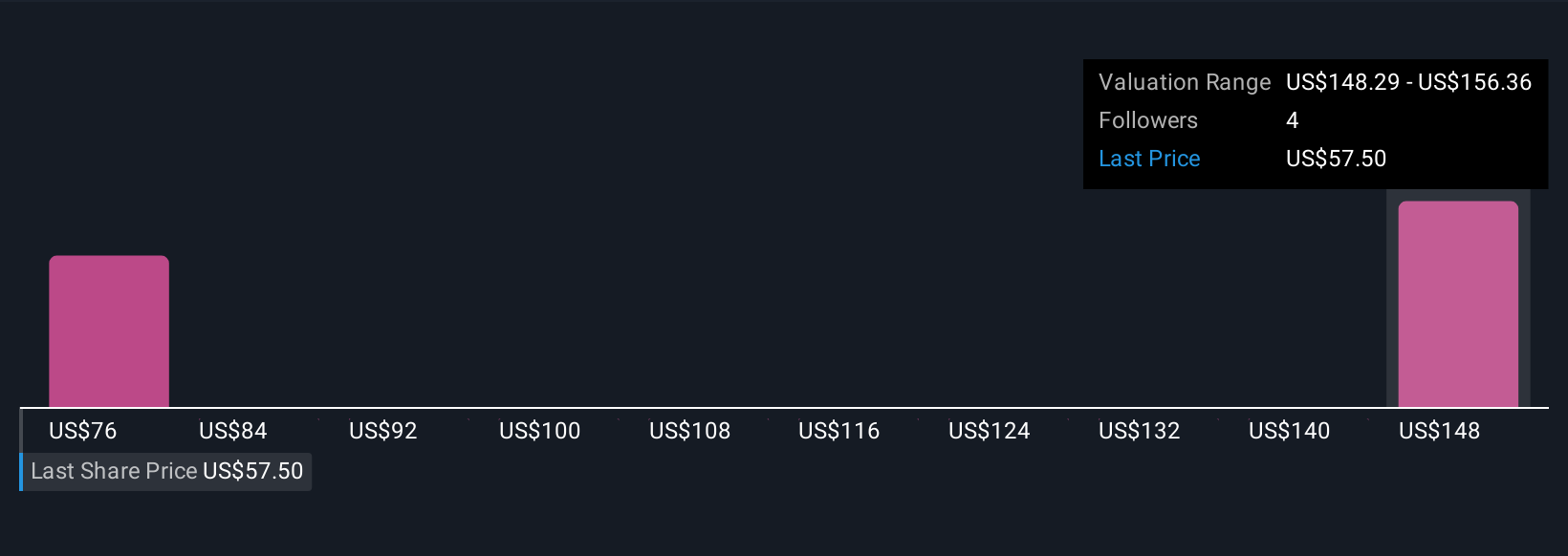

Simply Wall St Community members’ fair value targets for Diebold Nixdorf span US$79 to US$114, based on 2 independent estimates. With ongoing execution risk as the company pivots to higher-margin services, you can see just how much your outlook can differ from other investors' views.

Explore 2 other fair value estimates on Diebold Nixdorf - why the stock might be worth just $79.00!

Build Your Own Diebold Nixdorf Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diebold Nixdorf research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Diebold Nixdorf research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diebold Nixdorf's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DBD

Diebold Nixdorf

Engages in the automating, digitizing, and transforming the way people bank and shop worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives