- United States

- /

- Tech Hardware

- /

- NYSE:DBD

Diebold Nixdorf (DBD): Deep Discount to Fair Value Reinforces Optimistic Turnaround Narrative

Reviewed by Simply Wall St

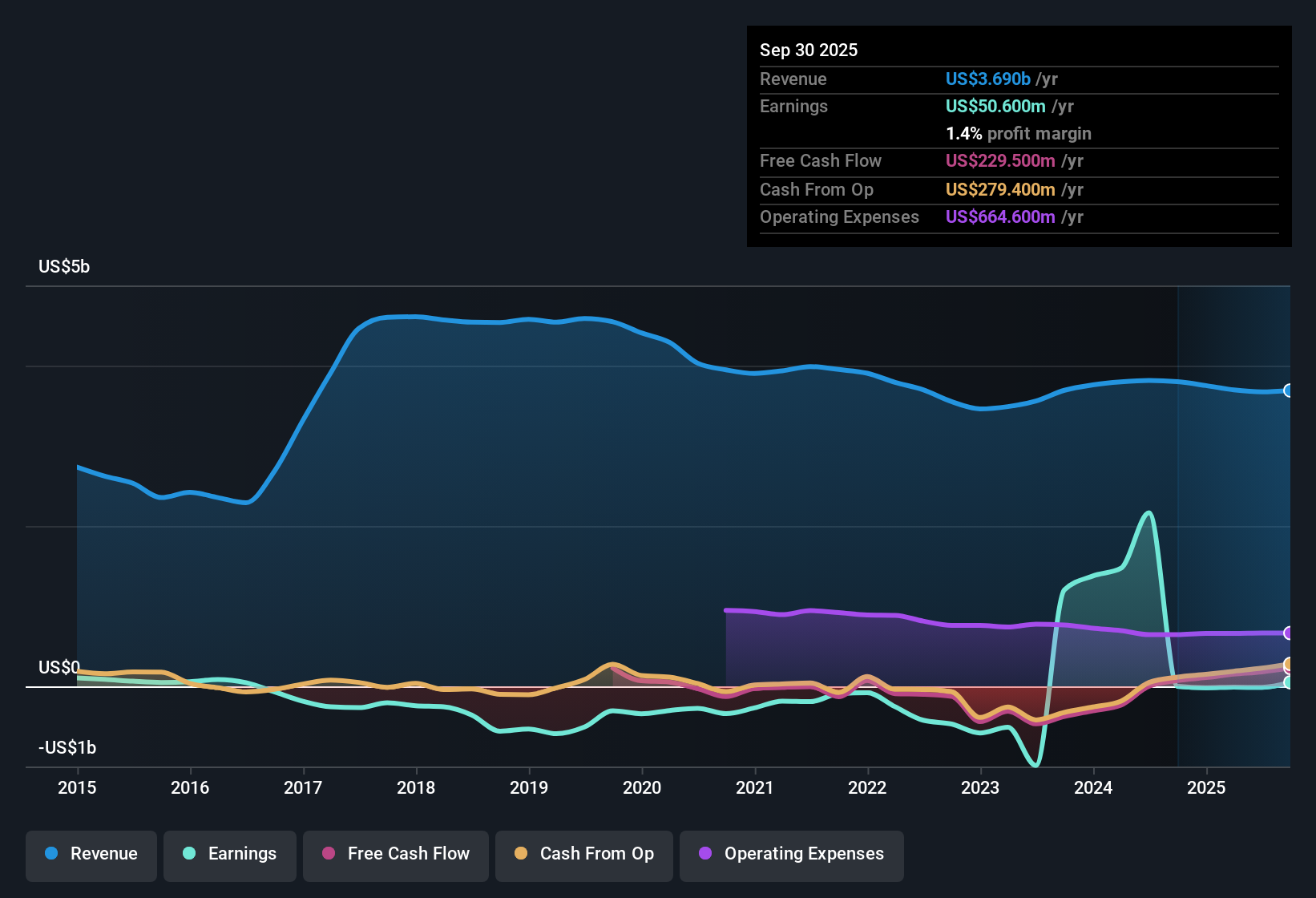

Diebold Nixdorf (DBD) remains unprofitable, but losses have narrowed significantly over the last five years at an annual rate of 41%. The company is expected to grow earnings at 36.43% per year, with a return to profit forecast within three years. This pace is well above the broader market. Revenue growth is projected at a slower 3% per year, which may not excite those hunting for top-line acceleration. However, current valuation metrics like a 0.6x price-to-sales ratio and trading well below fair value at $63.24 per share are drawing investor attention.

See our full analysis for Diebold Nixdorf.Next, we’ll see how these headline results compare with the major narratives shaping investor expectations, highlighting where the numbers confirm the story and where they call it into question.

See what the community is saying about Diebold Nixdorf

Margins Set to Expand Sharply

- Analysts expect Diebold Nixdorf's profit margin to rise from -0.4% today to 7.5% in three years, a turnaround that could see earnings reach $312.7 million by September 2028.

- According to the analysts' consensus view, margin expansion is anchored in recurring high-margin service revenues and operational cost cuts.

- Supply chain improvements, such as localized manufacturing in key markets and company-wide streamlining, as detailed in the consensus narrative, are expected to lower costs and drive more sustainable margin growth.

- Efforts to shift the business from a hardware focus toward services and software could support higher and more predictable profit margins compared to traditionally lower-margin hardware contracts.

Consensus sees Diebold Nixdorf’s progress on services and margin expansion as a crucial piece of the company’s turnaround. See how market perspectives are shifting in the full story. 📊 Read the full Diebold Nixdorf Consensus Narrative.

Revenue Growth Beats Company History but Lags Market

- Diebold Nixdorf’s revenue is projected to grow at 4.3% per year over the next three years, which is above its recent 3% pace but still trails the US market’s 10.5% average.

- Analysts' consensus view highlights that, while automation and digital upgrades are unlocking attractive new contracts, the pace of growth may limit Diebold's appeal to aggressive growth-seekers.

- Strong demand for advanced ATMs and retail tech, especially in North America, anchors future growth but does not close the gap to higher-growth industry peers.

- Slower top-line expansion means successful cost management and improved margins will matter most for shareholder returns, according to consensus.

Valuation Signals Deep Discount to Peers

- At a 0.6x price-to-sales ratio and $63.24 share price, Diebold Nixdorf trades well below both its peer average (4.6x P/S) and DCF fair value of $116.71, underscoring its value appeal.

- The consensus narrative points out that analysts see 19.7% upside to their $75.67 target, with the current multiple lower than the US tech industry average of 1.8x.

- For this upside to be realized, investors must believe in sustained margin gains and long-term growth, rather than simply betting on a return to previous highs.

- The discounted valuation buffers some risk but also reflects questions about whether revenue and margin forecasts will play out as planned, according to consensus.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Diebold Nixdorf on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own view on these figures? Share your perspective in just a few minutes and shape your own company story. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Diebold Nixdorf.

See What Else Is Out There

While Diebold Nixdorf’s turnaround story features improving margins, its revenue growth still lags behind market leaders and may not satisfy aggressive growth investors.

If steady and dependable top-line expansion matters most to you, look for businesses with consistent revenue and earnings progress by starting your search with stable growth stocks screener (2074 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DBD

Diebold Nixdorf

Engages in the automating, digitizing, and transforming the way people bank and shop worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives