- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Exploring High Growth Tech Stocks In The United States October 2024

Reviewed by Simply Wall St

The United States market has shown a robust performance, climbing 1.1% in the last seven days and 36% over the past year, with earnings forecasted to grow by 15% annually. In this dynamic environment, high growth tech stocks that demonstrate strong innovation and adaptability are particularly noteworthy for their potential to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.67% | 43.83% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| AsiaFIN Holdings | 60.53% | 81.55% | ★★★★★★ |

| Amicus Therapeutics | 20.33% | 62.45% | ★★★★★★ |

| Travere Therapeutics | 27.74% | 70.00% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 253 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

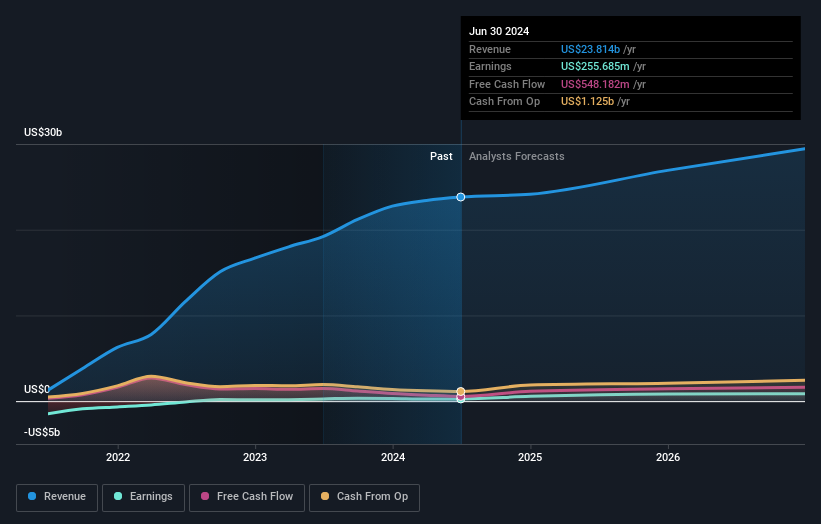

Take-Two Interactive Software (NasdaqGS:TTWO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Take-Two Interactive Software, Inc. is a global developer, publisher, and marketer of interactive entertainment solutions with a market cap of $27.15 billion.

Operations: Take-Two generates revenue primarily from its publishing segment, which accounts for $5.40 billion.

Take-Two Interactive Software, despite recent challenges, shows promising growth prospects with a forecasted revenue increase of 13.9% annually, outpacing the U.S. market's 8.8%. In their latest quarterly report, they posted sales of $1.22 billion and revised fiscal year revenue expectations to between $5.57 billion and $5.67 billion, reflecting resilience and adaptability in a competitive landscape. The company's commitment to innovation is evident in its R&D investments aimed at enriching its gaming portfolio and enhancing user engagement across various platforms. While currently unprofitable with a net loss widening from the previous year to $262 million in Q1 2024, Take-Two is expected to pivot into profitability within three years due to strategic expansions and an effective monetization model highlighted at recent industry conferences. This transition is underpinned by substantial R&D spending which bolsters its capabilities in developing cutting-edge gaming technologies that are critical for long-term success in the dynamic tech sector.

Coherent (NYSE:COHR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Coherent Corp. specializes in the development, manufacturing, and marketing of engineered materials and optoelectronic components for various global markets including industrial and communications, with a market cap of approximately $15.61 billion.

Operations: Coherent Corp. generates revenue primarily through its Networking, Materials, and Lasers segments, with Networking contributing the highest at $2.34 billion. The company's focus on engineered materials and optoelectronic components supports diverse applications across industrial, communications, electronics, and instrumentation markets globally.

Coherent Corp. is navigating a transformative phase with significant R&D investments, marking an 85.3% forecasted annual earnings growth, which underscores its aggressive innovation strategy. Despite current unprofitability, these efforts are projected to steer the company towards profitability within three years, outpacing the broader U.S. market's growth rate of 8.8% with an expected revenue increase of 11.7% per year. Recent executive changes, including appointing Sherri R. Luther as CFO, align with Coherent's strategic vision to bolster financial leadership amidst this pivotal period. Moreover, the launch of advanced silicon carbide (SiC) epitaxial wafers and pioneering L-band coherent pluggable transceivers illustrates Coherent's commitment to setting new industry standards in semiconductor and optical communication technologies.

- Take a closer look at Coherent's potential here in our health report.

Examine Coherent's past performance report to understand how it has performed in the past.

Live Nation Entertainment (NYSE:LYV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Live Nation Entertainment, Inc. is a global live entertainment company with a market capitalization of approximately $26.35 billion.

Operations: The company generates revenue primarily from its Concerts segment, which accounts for $19.72 billion, and Ticketing, contributing $3.03 billion. Sponsorship & Advertising adds another $1.15 billion to the revenue mix.

Live Nation Entertainment, despite a challenging past year with a slight earnings decline of 1.2%, is poised for robust future growth with earnings expected to surge by 28.8% annually. This forecast outpaces the broader U.S. market's anticipated growth rate of 15.2%. The company has also been proactive in its financial strategies, evidenced by a recent shelf registration to raise $479.8 million through common stock offerings, aligning with strategic expansions and potentially bolstering its market position amidst evolving entertainment dynamics. Furthermore, Live Nation's consistent R&D investment enhances its service offerings, maintaining relevance and competitive edge in the rapidly shifting landscape of live events and digital entertainment platforms.

- Click here and access our complete health analysis report to understand the dynamics of Live Nation Entertainment.

Learn about Live Nation Entertainment's historical performance.

Where To Now?

- Gain an insight into the universe of 253 US High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential and fair value.