- United States

- /

- Communications

- /

- NYSE:CIEN

Why Ciena (CIEN) Is Up 6.6% After Launching Terabit Network With Colt for Hyperscalers

Reviewed by Sasha Jovanovic

- Colt Technology Services and Ciena recently announced the successful deployment of a new transatlantic and terrestrial terabit network, using Ciena's advanced WaveLogic 6 Extreme transponder, to support two major global content providers with increased capacity and reduced power consumption.

- This rollout marks a significant step in addressing soaring demand for bandwidth driven by AI, gaming, and streaming applications, while dramatically improving network efficiency and sustainability for hyperscalers.

- We’ll examine how Ciena’s breakthrough with Colt, enabling higher capacity for hyperscalers, could influence its long-term investment outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Ciena Investment Narrative Recap

To be a shareholder in Ciena, you need to believe that hyperscalers’ ongoing demand for next-generation optical networks, driven by AI, connectivity, and increasing data traffic, will support long-term growth, despite concentrated customer exposure. The recent Colt rollout highlights Ciena’s capacity to meet hyperscaler needs, reinforcing the main growth catalyst, though it doesn’t materially change the near-term risk of heavy revenue reliance on a few large clients.

The announcement with Colt is directly tied to Ciena’s WaveLogic 6 Extreme, a technology already central in the company’s recent successes, such as winning contracts for the new TAM-1 submarine cable system. By securing major partnerships around its latest optical platform, Ciena is aligning with the key catalyst of deepening relationships with large cloud and content providers.

However, while Ciena’s market position looks strengthened, investors should also consider how concentrated revenue streams can become a concern if one large customer decides to…

Read the full narrative on Ciena (it's free!)

Ciena's outlook anticipates $6.5 billion in revenue and $590.5 million in earnings by 2028. This scenario assumes 12.5% annual revenue growth and a $449.6 million increase in earnings from the current $140.9 million.

Uncover how Ciena's forecasts yield a $142.06 fair value, a 29% downside to its current price.

Exploring Other Perspectives

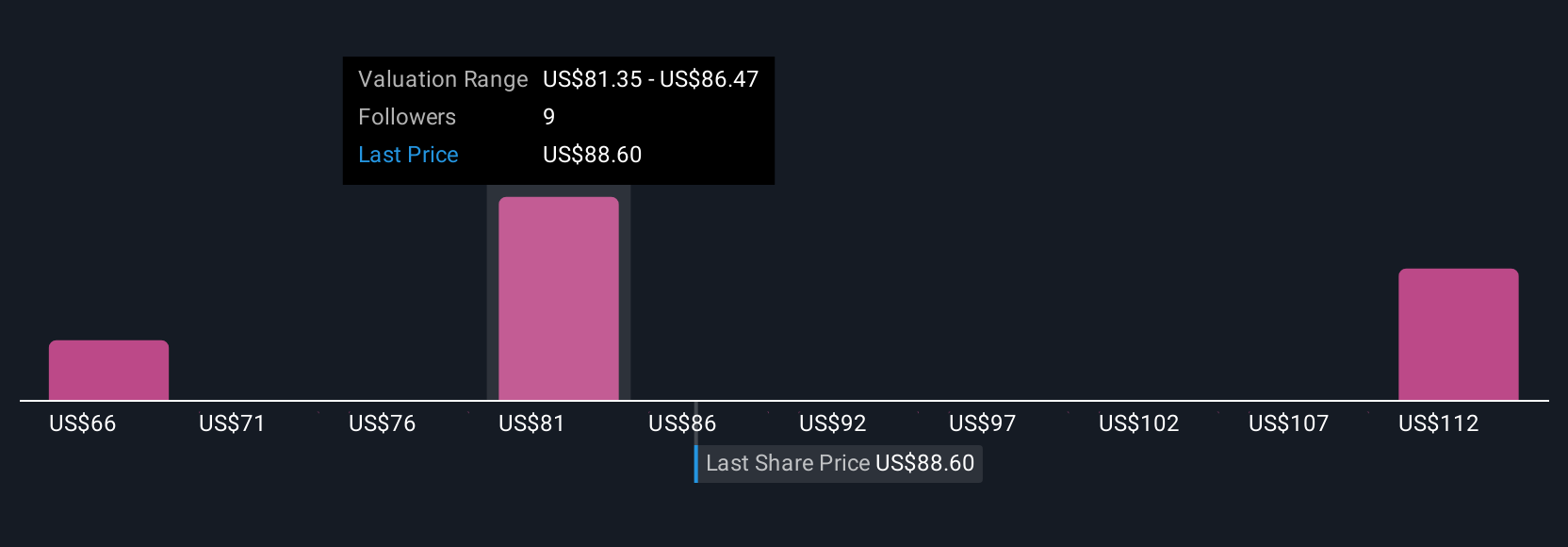

Five fair value estimates from the Simply Wall St Community span from US$67.93 to US$142.06 per share. Many see growth potential, yet reliance on a few big customers raises questions about resilience, explore diverse viewpoints before making decisions.

Explore 5 other fair value estimates on Ciena - why the stock might be worth as much as $142.06!

Build Your Own Ciena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ciena research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Ciena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ciena's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives