- United States

- /

- Communications

- /

- NYSE:CIEN

Ciena's (NYSE:CIEN) investors will be pleased with their respectable 42% return over the last five years

It hasn't been the best quarter for Ciena Corporation (NYSE:CIEN) shareholders, since the share price has fallen 10% in that time. But at least the stock is up over the last five years. Unfortunately its return of 42% is below the market return of 96%.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Ciena

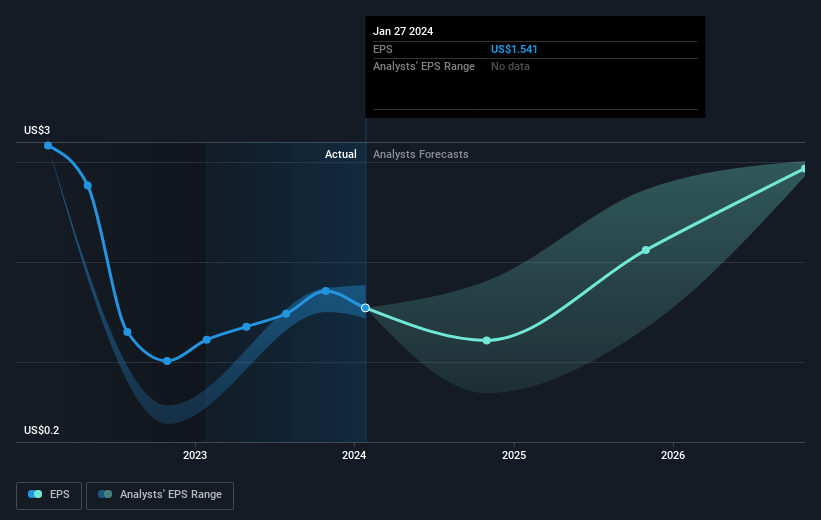

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Ciena managed to grow its earnings per share at 7.4% a year. This EPS growth is remarkably close to the 7% average annual increase in the share price. This indicates that investor sentiment towards the company has not changed a great deal. In fact, the share price seems to largely reflect the EPS growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Ciena has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

Ciena shareholders are up 11% for the year. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 7% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Ciena better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CIEN

Ciena

Provides hardware and software services for delivery of video, data, and voice traffic metro, aggregation, and access communications network worldwide.

Excellent balance sheet with moderate growth potential.