- United States

- /

- Communications

- /

- NYSE:CALX

Calix (CALX) Profitability Forecast Challenges Valuation Premium as Losses Deepen and Revenue Growth Leads Peers

Reviewed by Simply Wall St

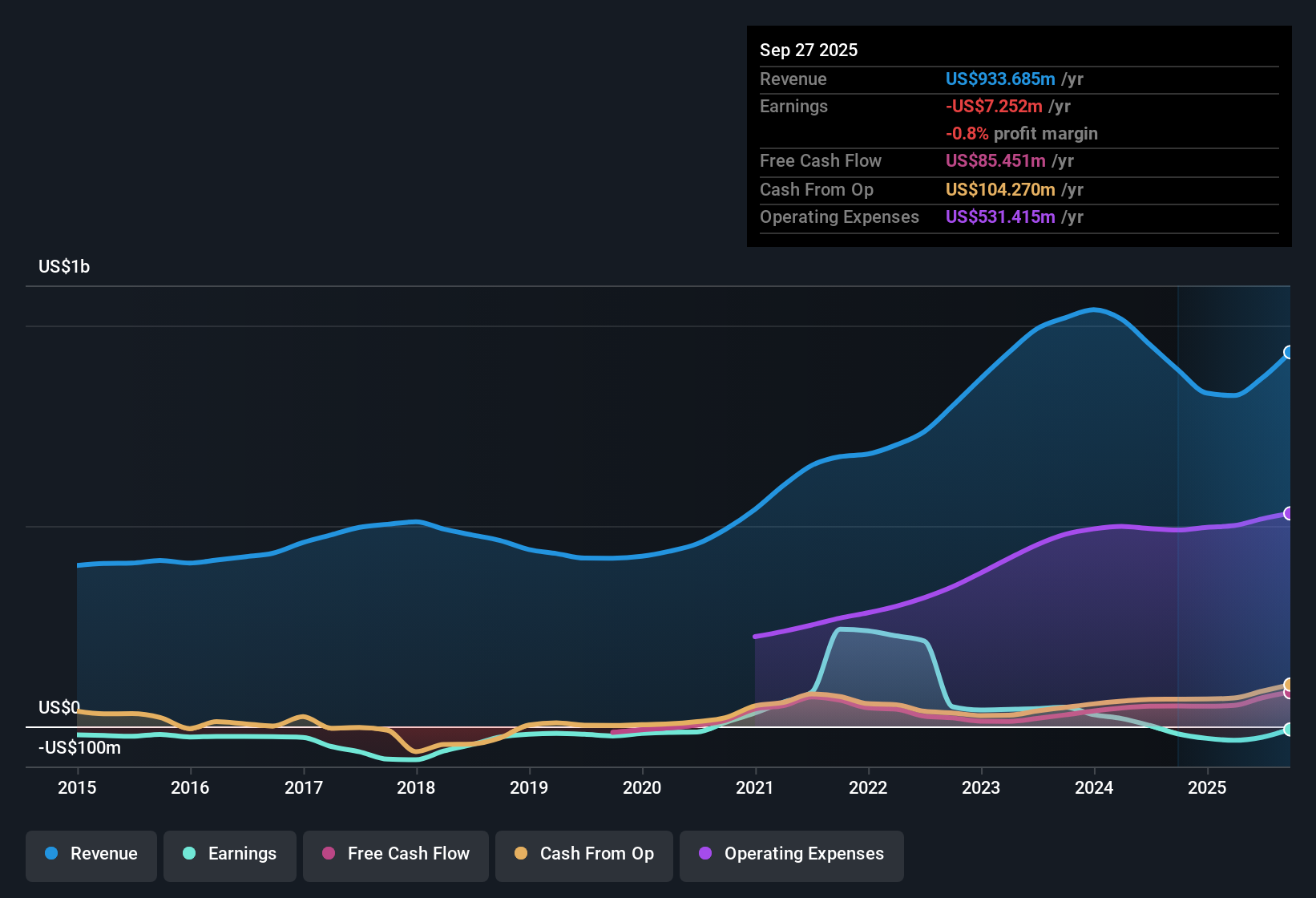

Calix (CALX) remains unprofitable, with earnings growth unable to be compared to its five-year average and losses worsening at a 46.5% annual rate over the past five years. Despite a flat net profit margin and profits that have failed to grow, the company is forecast to achieve 11% annual revenue growth and a sharp 91.94% increase in earnings per year, with profitability expected within three years. Investors are weighing strong future growth prospects against the company’s current high price-to-sales ratio of 4.8x and a share price of $68.04, which sits above the estimated fair value of $56.39.

See our full analysis for Calix.The next section sets these headline numbers against the market’s main narratives for Calix, highlighting where consensus is supported and where the new results challenge traditional views.

See what the community is saying about Calix

Recurring Revenue Set to Accelerate From Next-Gen Platform

- The third-generation platform's rollout is aimed at boosting recurring revenue and expanding margins, with analysts projecting margin improvement from negative 3.1% today to 15.4% in three years.

- According to the consensus narrative, the integrated agentic AI features are expected to speed up service providers’ ability to upsell and reduce churn. This could open the door for stronger revenue expansion and improved earnings quality.

- Analysts forecast Calix’s revenue will grow at 13.4% annually for the next three years, outpacing US market averages.

- The platform’s architecture is designed to unlock new international markets and additional recurring revenue streams, supporting claims for accelerating subscriber growth.

See how analysts weigh Calix's growth moves in the full Consensus Narrative. 📊 Read the full Calix Consensus Narrative.

Profit Margins Projected to Reverse Course

- Analysts expect profit margins to move from negative 3.1% currently to 15.4% by 2028, with earnings forecast to rise from a loss of $26.9 million to $195.4 million over that period.

- The consensus view expects recurring revenue and managed services to drive this sharp improvement, but highlights the risk that success depends on rapid adoption of new AI features and the ability to manage higher compliance costs.

- If customer adoption lags or competitive pressures increase, recurring revenue could grow more slowly than targets suggest, which could challenge the pace of profitability gains.

- Expanding into new geographies may be slowed by fragmented data privacy laws, which could impact the targeted margin uplift if compliance-related costs rise more than anticipated.

Valuation Remains at a Premium to Peers

- Calix trades at a price-to-sales multiple of 4.8x, above its US Communications industry peer average of 2.2x, and is priced at $68.04, above its DCF fair value of $56.39.

- Consensus narrative notes that to be justified at the $72.17 analyst price target, Calix needs to deliver revenue of $1.3 billion and a PE ratio of 25.9x on projected $3.13 EPS by 2028, a scenario that assumes both sustained growth and a narrowing valuation gap.

- The current premium valuation indicates investors are counting on execution of the growth forecast and rapid margin expansion.

- With the stock already trading above DCF fair value, any shortfall on revenue or margin could lead to a sharp repricing, especially if industry multiples decline.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Calix on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

View the data from another perspective. It takes just a few minutes to share your own take and add your voice to the conversation. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Calix.

See What Else Is Out There

Calix’s high price-to-sales ratio and premium valuation mean that if expected growth or margin expansion falls short, investors could face a sharp repricing risk.

If you want to focus on opportunities with more attractive entry points and less valuation downside, discover these 839 undervalued stocks based on cash flows that may offer stronger risk-reward in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CALX

Calix

Provides cloud and software platforms, and systems and services in the United States, rest of Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives