Benchmark Electronics (BHE): Margin Decline Challenges Bullish Narratives Despite Premium Valuation

Reviewed by Simply Wall St

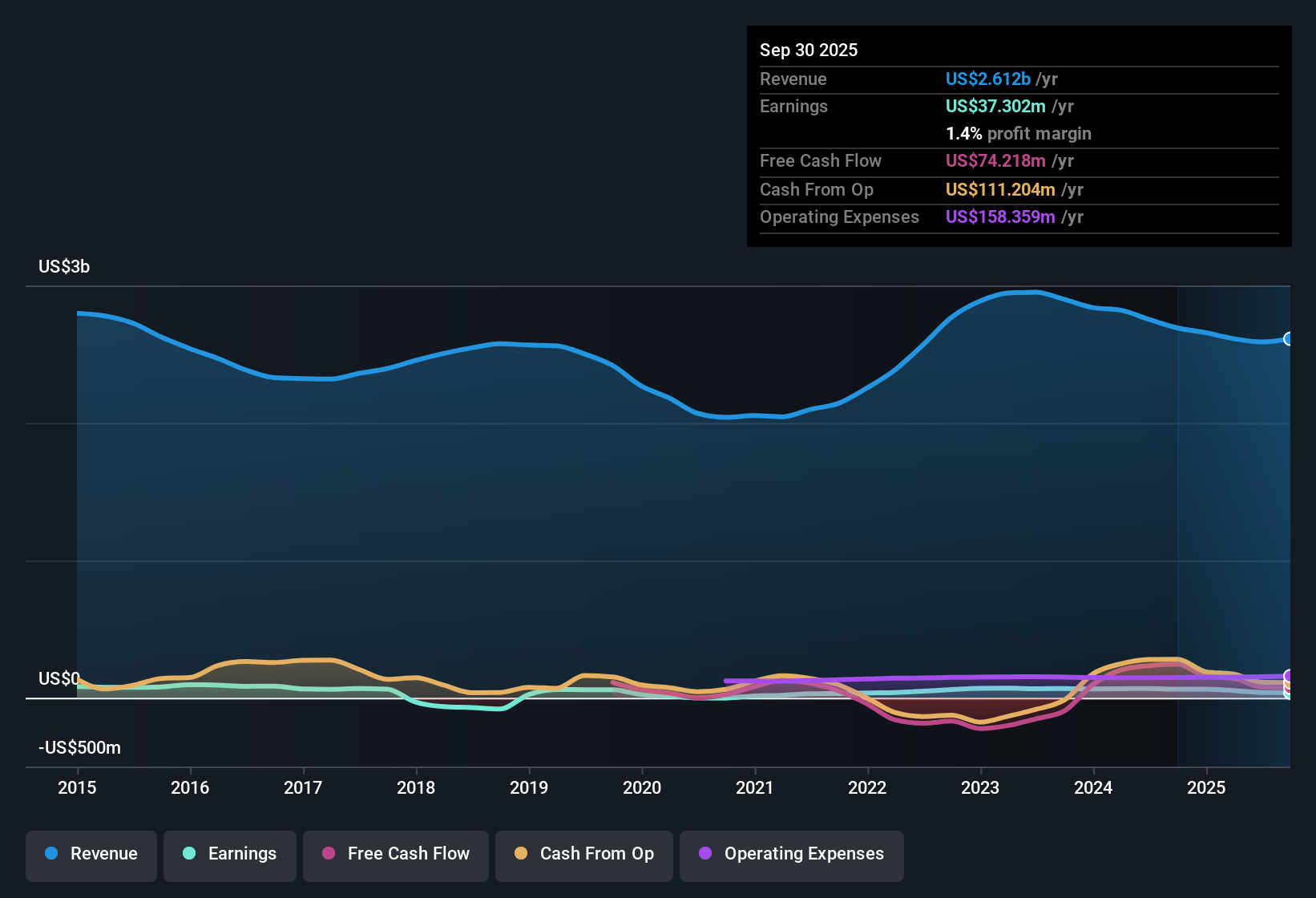

Benchmark Electronics (BHE) reported a net profit margin of 1.5%, marking a decline from 2.5% last year, and posted negative earnings growth for the latest period despite a five-year average annual earnings growth of 21.8%. Revenue growth is forecast at 4.9% annually, lagging the broader US market’s expected 10.5%. The company’s Price-To-Earnings ratio of 43.7x and share price of $46.70 both signal a hefty premium over peers. With margins coming under pressure and current growth trends weaker than the market, investors are likely weighing these numbers against Benchmark’s previously robust track record.

See our full analysis for Benchmark Electronics.Next up, we’ll see how these latest numbers stack up against the community and analyst narratives. Watch for points of alignment and where surprises might emerge.

See what the community is saying about Benchmark Electronics

Analyst Price Target Sits Above Current Valuation

- The current share price for Benchmark Electronics stands at $46.70, while analysts' latest consensus price target is $45.67. This puts the stock slightly above what the market expects in the medium term.

- According to the analysts' consensus narrative:

- They estimate revenue will reach $3.0 billion and earnings $95.5 million by 2028, with profit margins rising to 3.2%. This supports a fair price multiple of 21.1x, which is roughly half the stock's current 43.7x PE. This indicates investors are already paying for considerable improvement.

- The forecast implies a 12.6% upside from the target, but this is predicated on Benchmark delivering on margin gains and revenue growth that, so far, lag the broader US market pace.

For the full narrative breakdown, including why analysts remain constructive despite weak margins, see the consensus narrative in detail. 📊 Read the full Benchmark Electronics Consensus Narrative.

Premium Valuation Versus Peers and DCF Fair Value

- BHE trades at a 43.7x Price-to-Earnings ratio, a notable premium over both the US Electronics industry average of 25.2x and its peer average of 31.5x. The share price of $46.70 sits more than double its DCF fair value of $22.52.

- The consensus narrative contends this premium reflects investor faith in margin recovery and new business wins, but

- Actual profit margin is currently 1.5%, down from last year's 2.5%. Meanwhile, revenue growth forecasts at 4.9% remain below the market’s projected 10.5%, raising the bar for management’s execution and elevating risk if improvement does not materialize.

- Although bulls point to sizable contract wins in AI and medical segments and a ramp-up in vertical integration, those gains are not yet visible in current margins or revenue numbers. This could explain investor skepticism about the high valuation multiple.

Insider Selling and Margin Pressure Dominate Risks

- Recent reports highlight not just continued net margin pressure but also some insider selling during the past quarter. Both of these may weigh on near-term sentiment regardless of the company’s longer-term contract pipeline.

- The consensus narrative flags several ongoing risk factors:

- Softness in the semi-cap sector and uncertain timelines for recovery, along with broader industry margin pressures, mean that even with operational improvements and customer wins, near-term results are likely to remain volatile.

- Analysts note that medical and industrial momentum is still driven by inventory normalization rather than robust new program ramp-ups. As a result, margin and revenue recovery could be slower than optimistic scenarios project.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Benchmark Electronics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Does your take on the figures stand out? It only takes a few minutes to craft your own narrative and add your unique angle. Do it your way

A great starting point for your Benchmark Electronics research is our analysis highlighting 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Benchmark Electronics’ premium valuation, margin pressures, and earnings forecasts trailing the broader market expose vulnerabilities for investors seeking stronger growth at a fairer price.

Looking for more value and less risk of overpaying? Check out these 849 undervalued stocks based on cash flows to spot companies whose fundamentals reflect genuine upside, not just lofty multiples.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Benchmark Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHE

Benchmark Electronics

Offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives