Benchmark Electronics (BHE): Evaluating Valuation Following Mixed Q3 Results and Updated Guidance

Reviewed by Simply Wall St

Benchmark Electronics (BHE) just posted its third quarter results, revealing higher sales compared to last year, but a drop in profitability. The company also shared its revenue and earnings outlook for the next quarter, drawing investor focus.

See our latest analysis for Benchmark Electronics.

Shares of Benchmark Electronics have climbed in recent weeks, with a 12.7% share price return over the past month as investors weighed the mixed signals from the company’s Q3 results, new revenue guidance, and shifting earnings outlook. Despite some near-term volatility, the longer-term picture is robust, with a five-year total shareholder return of 104% reflecting the company’s ability to deliver for patient investors.

If this momentum has you thinking bigger, it could be the perfect moment to expand your radar and discover fast growing stocks with high insider ownership

So with Benchmark Electronics delivering modest growth in sales but ongoing pressure on earnings, investors must ask themselves whether there is hidden value in the current share price or if the market has already accounted for future improvements.

Most Popular Narrative: 3.7% Undervalued

Benchmark Electronics recently closed at $43.00, which sits just below the current most popular narrative’s fair value estimate of $44.67. This narrow gap reflects growing optimism in the company’s future potential, hinging on advanced technology wins and expanding integration across key sectors.

Benchmark is positioned to benefit from the surging demand for advanced computing and AI infrastructure, as evidenced by recent contract wins in water-cooling for high-performance computing and AI data centers, and ramping opportunities expected to drive a return to revenue growth in AC&C by late 2025 and into 2026. This supports both revenue acceleration and an upward mix in gross margin due to the complexity of these projects.

Want to uncover what’s powering this bullish view? There is a bold forecast buried in the numbers, one that hinges on seismic shifts in earnings, revenue, and margins. The entire case for this future value rests on a handful of eye-opening analyst bets. Can Benchmark really deliver? The next move is yours, only in the full narrative.

Result: Fair Value of $44.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, trade restrictions or a slower rebound in key sectors could quickly challenge these upbeat assumptions and cast doubt on the current growth projections.

Find out about the key risks to this Benchmark Electronics narrative.

Another View: Looking at Valuation Through Multiples

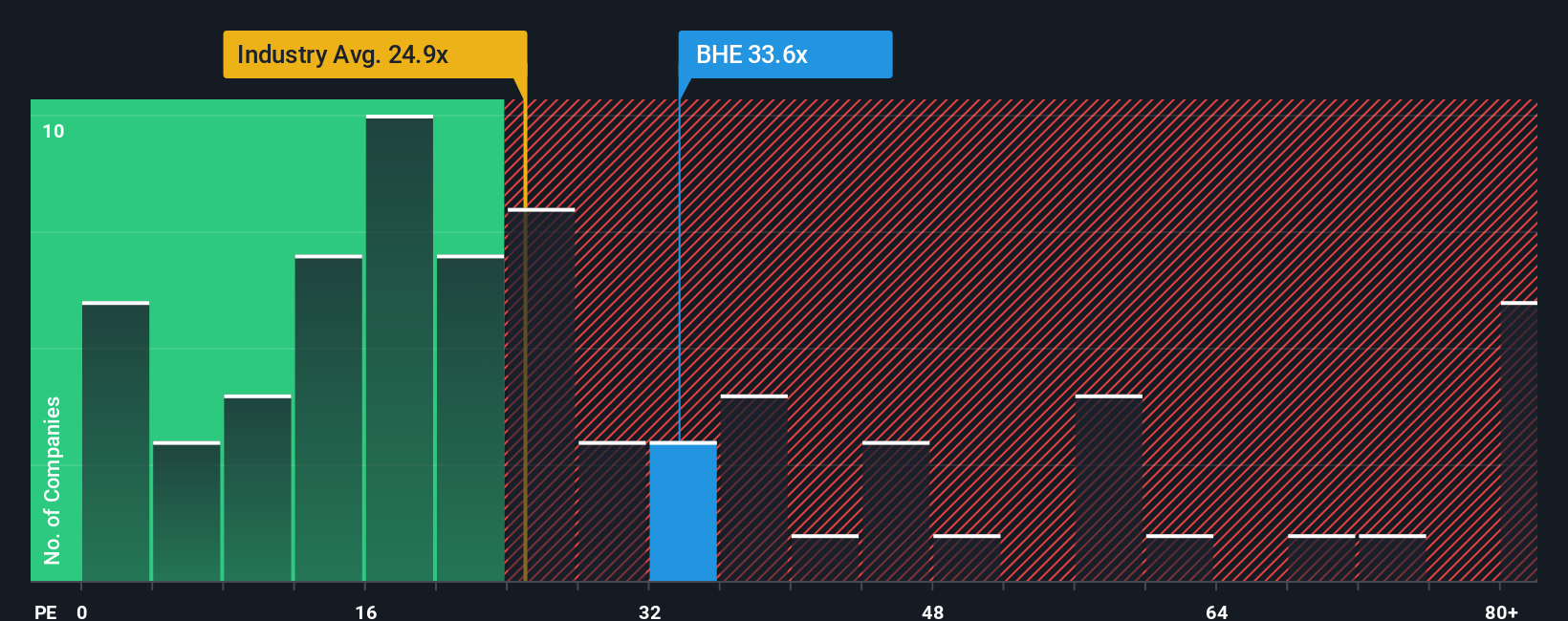

While analyst forecasts point to upside, looking at Benchmark Electronics' price-to-earnings ratio tells a different story. The current ratio sits at 40.2x, which is much higher than both the US Electronic industry average of 25x and also above what would be considered a fair ratio of 35.5x. This elevated level could signal valuation risk if growth does not accelerate as projected. So is the market betting too much on a turnaround, or is there still room for expansion?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Benchmark Electronics Narrative

If you think there’s another story hidden in the numbers, why not dive in and craft your own Benchmark Electronics outlook in just minutes. Do it your way

A great starting point for your Benchmark Electronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Moves?

Why limit your returns to just one opportunity? Smart investors keep their radar wide, targeting emerging themes. Here are three powerful ways to put your money to work right now.

- Spot high yields and supercharge your income by zeroing in on these 20 dividend stocks with yields > 3% that pay above-market returns with stable fundamentals.

- Unlock future growth by targeting these 26 AI penny stocks pushing the boundaries in artificial intelligence across healthcare, industry, and beyond.

- Catch undervalued potential before the crowd by browsing these 840 undervalued stocks based on cash flows quietly primed for recovery and long-term upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Benchmark Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHE

Benchmark Electronics

Offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives