How Record Q3 Results and New AI Partnerships Could Influence Belden's (BDC) Investment Profile

Reviewed by Sasha Jovanovic

- In the past week, Belden Inc. reported record third-quarter results with US$698.22 million in sales, US$56.69 million in net income, and announced the completion of a major share repurchase program totaling US$109.91 million under its 2024 buyback plan.

- Belden also revealed a collaboration with Accenture and NVIDIA to commercially deploy advanced physical AI systems enhancing worker safety in industrial settings, highlighting its focus on intelligent automation and solutions innovation.

- We'll examine how early commercial progress in AI-powered industry solutions could reshape Belden's investment outlook and margin profile.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Belden Investment Narrative Recap

Being a Belden shareholder means believing in the company’s ability to capture rising demand for advanced industrial automation and intelligent connectivity solutions, driven by global digital transformation projects. Recent record earnings and completion of its US$109.91 million share buyback reinforce confidence in its operational execution, but near-term visibility may still hinge on customer investment cycles and ongoing price competition, which could affect revenue momentum and margins. The latest news does not materially change the most important near-term catalyst, order growth from industrial digitalization, or the primary risk, which remains margin pressure from input cost volatility.

Among recent announcements, Belden’s partnership with Accenture and NVIDIA to roll out AI-enabled worker safety systems is especially relevant, as it highlights the company’s focus on high-value, differentiated solutions and its broader transition toward recurring, solutions-driven revenue. This initiative supports Belden’s catalyst of expanding into higher-margin, software-integrated offerings, potentially strengthening its position in the fast-evolving automation sector.

However, despite solid results, investors should be aware that ongoing price competition and weakness in commoditized cabling may still challenge near-term margin improvement, especially if...

Read the full narrative on Belden (it's free!)

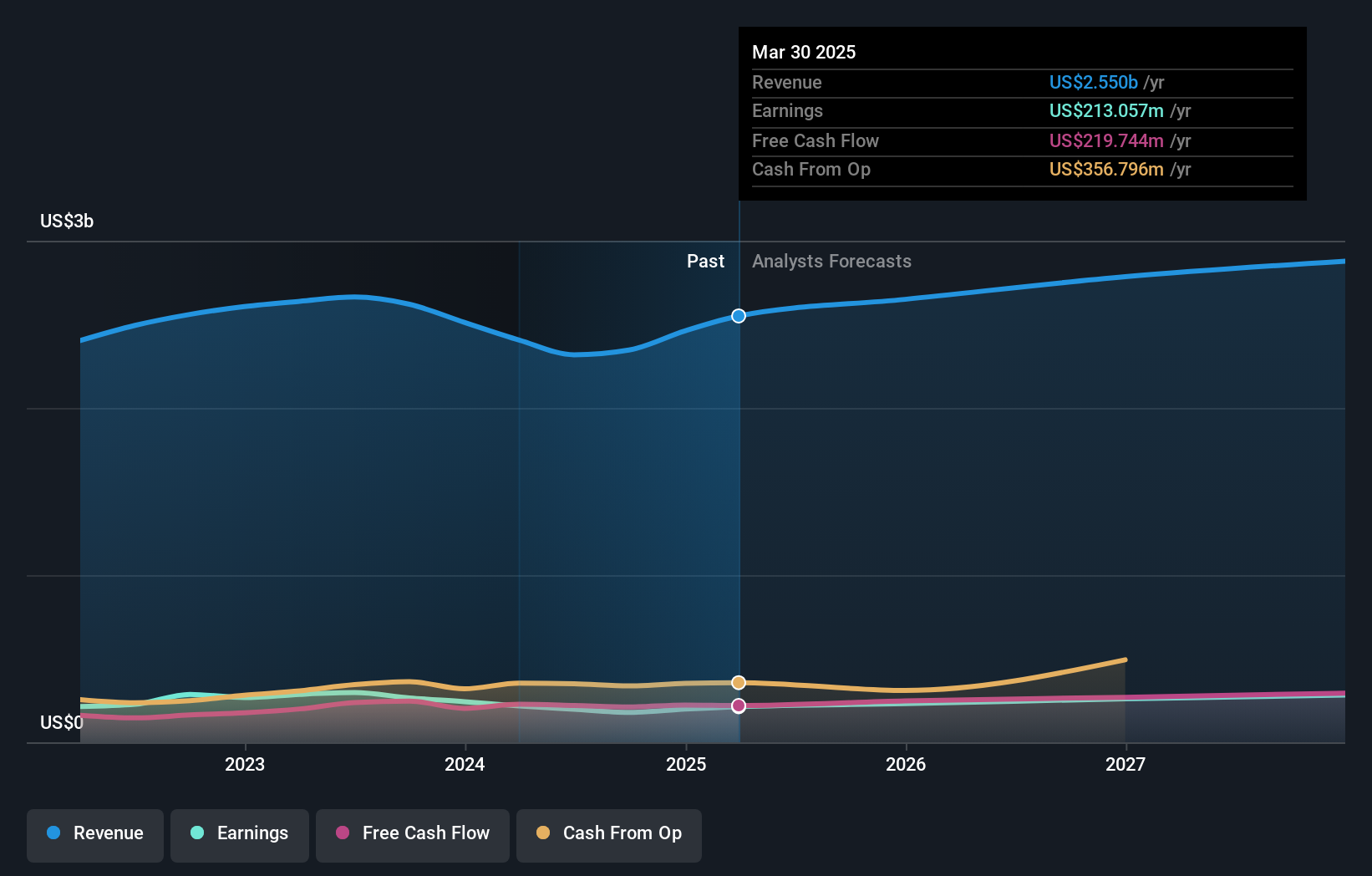

Belden's outlook anticipates $3.0 billion in revenue and $277.7 million in earnings by 2028. This scenario assumes a 4.4% annual revenue growth and a $52.7 million increase in earnings from the current level of $225.0 million.

Uncover how Belden's forecasts yield a $142.60 fair value, a 17% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s three fair value estimates for Belden range from US$80.69 to US$142.60, showing wide differences in outlook. While some expect margin expansion driven by automation, price competition in legacy segments still weighs on the company’s longer-term story, explore multiple viewpoints to inform your understanding.

Explore 3 other fair value estimates on Belden - why the stock might be worth 34% less than the current price!

Build Your Own Belden Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Belden research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Belden research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Belden's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Belden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDC

Belden

Provides connection solutions to bring data infrastructure into alignment to unlock new possibilities for its customers.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives