Arlo Technologies (ARLO): Assessing Valuation Following Profit Turnaround and Insider Selling

Reviewed by Simply Wall St

Arlo Technologies (ARLO) has swung back to profitability, posting a quarterly net profit after reporting losses for the same period last year. This turnaround is sparking optimism among analysts, while investor sentiment remains divided due to insider selling activity.

See our latest analysis for Arlo Technologies.

After a turbulent run over the past years, Arlo Technologies’ 76.3% share price return year-to-date and an impressive 1-year total shareholder return of 88.1% are catching investors’ attention. The strong momentum, amid the profit turnaround and despite insider selling, shows renewed growth potential. Multi-year total returns have outpaced the broader tech sector.

If you’re curious about other stocks with compelling growth and evolving leadership stories, now’s a perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading below analyst targets and a renewed streak of profitability, investors are left wondering whether Arlo Technologies is currently undervalued or if the market has already priced in all future growth.

Most Popular Narrative: 16.6% Undervalued

Arlo Technologies’ narrative fair value stands at $23.20, representing significant upside from the recent share price of $19.34. The valuation optimism is rooted in expectations of continued growth, enhanced profitability, and upcoming catalysts that could reshape the company’s future earnings profile.

The recently signed strategic partnership with ADT, North America's largest security company, with anticipated impact beginning in 2026, represents a major new channel for unlocking additional services revenue and ARR. This is expected to contribute to future revenue growth and margin expansion.

Want to understand what’s fueling this bullish projection? The narrative hinges on a blockbuster new partnership, service revenue expansion, and some unusually ambitious profit targets. But what assumptions are hiding beneath the surface? Find out how bold analyst expectations are powering this eye-catching fair value.

Result: Fair Value of $23.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts toward lower hardware prices or weaker adoption of recurring subscriptions could challenge Arlo’s growth outlook and cast doubt on bullish forecasts.

Find out about the key risks to this Arlo Technologies narrative.

Another View: Multiple-Based Valuation Raises Questions

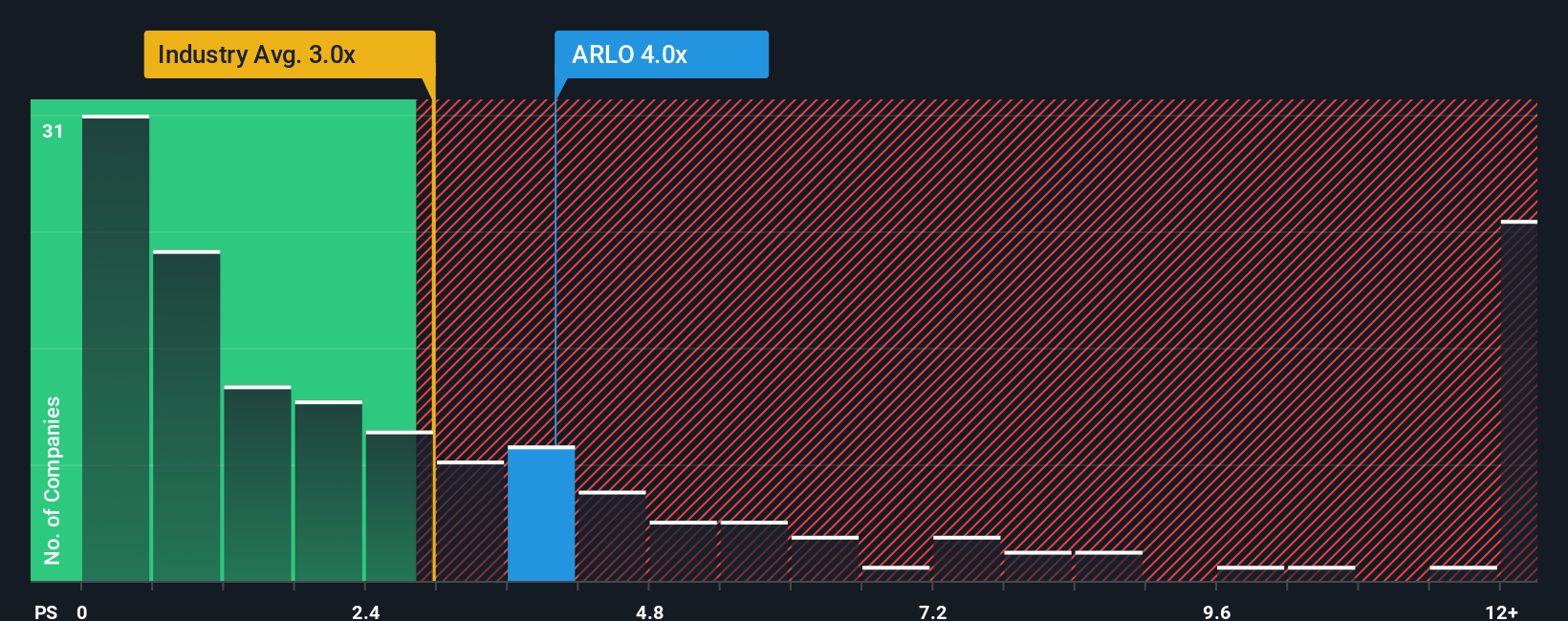

While narrative-driven optimism sees Arlo Technologies as undervalued, a closer look at its price-to-sales ratio tells a different story. The company trades at 4x sales, well above the sector average of 2.6x and the fair ratio of 2.1x. This premium suggests the market may already be factoring in significant future growth. Are investors taking on more valuation risk than they realize?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arlo Technologies Narrative

If you’re thinking differently or prefer hands-on research, you can craft your own perspective on Arlo Technologies in just a few minutes. Do it your way

A great starting point for your Arlo Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors know that staying ahead means spotting the next breakout theme before the crowd does. Don’t settle for just one idea; expand your toolkit and target tomorrow’s winners today.

- Boost your portfolio’s income by checking out these 22 dividend stocks with yields > 3% that consistently deliver strong yields and reliable cash flow.

- Capitalize on the rise of artificial intelligence by considering these 27 AI penny stocks propelling innovations across multiple industries.

- Catch emerging trends early with these 3588 penny stocks with strong financials offering high growth potential and unique market opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARLO

Arlo Technologies

Provides cloud-based platform services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives