Should You Rethink Amphenol After Its 101.9% Surge and Strong Demand in 2025?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Amphenol stock is really worth its price tag right now, you are not alone. You are in the right place to find out.

- Shares have been on a tear, jumping 4.1% in the past week, up 14.0% over the last month, and rising an impressive 101.9% year-to-date.

- Recent news has highlighted robust demand across Amphenol’s core markets and ongoing sector-wide investment in connectivity. This has contributed to optimism behind the surge in share price. Market analysts are also discussing the company’s aggressive expansion initiatives, which could be encouraging investors to look past short-term market noise.

- Despite all the excitement, Amphenol comes in with a valuation score of 1 out of 6, suggesting the market may see limited value on standard checks. In this article, we will explore several valuation approaches, break down what that score means, and at the end, share a smarter way to understand if the stock is a true bargain.

Amphenol scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Amphenol Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the fair value of a stock by projecting the company’s future cash flows and then discounting these numbers back to today's dollars. This approach is widely used to determine what a company’s shares should be worth based on expected performance, rather than daily market swings.

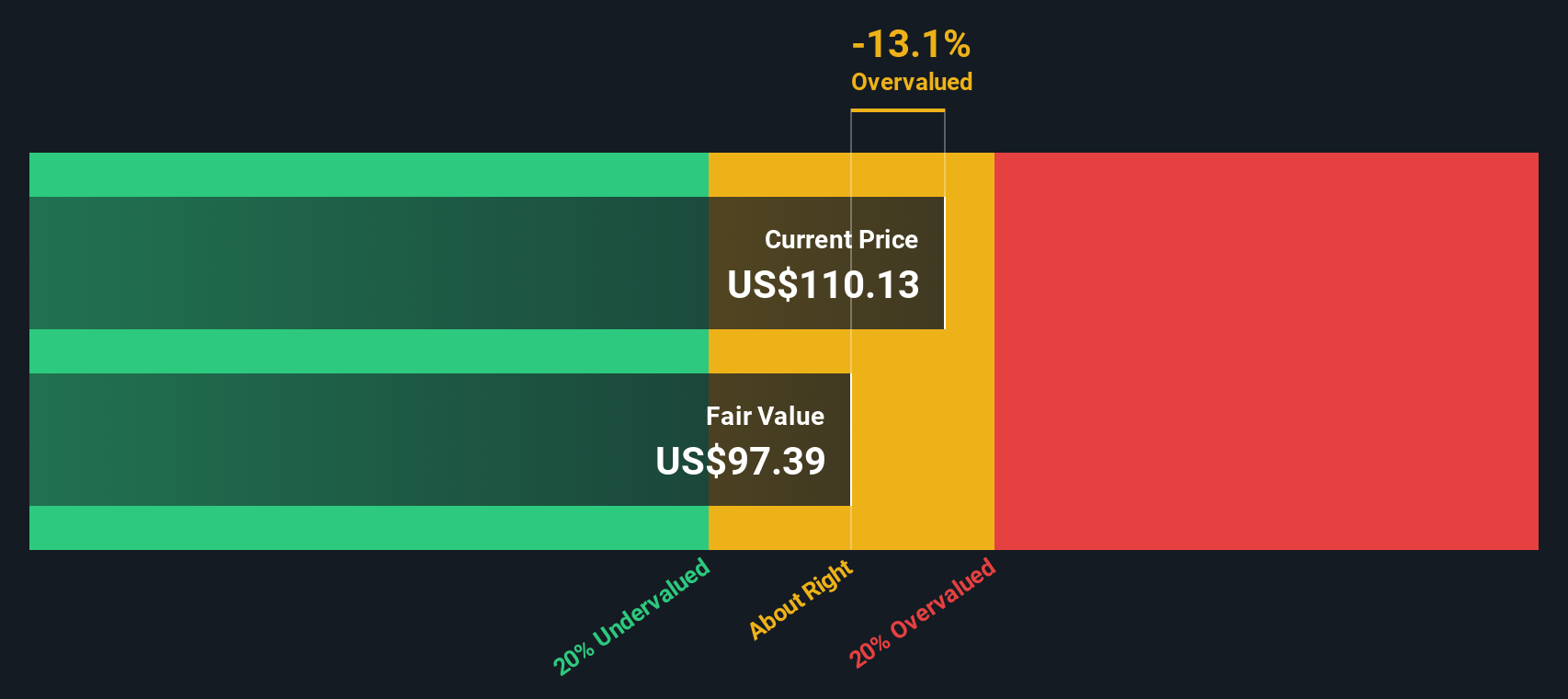

For Amphenol, the latest reported Free Cash Flow sits at $3.67 Billion. According to analyst forecasts and model estimates, this is projected to rise to about $5.45 Billion in 2027, with incremental growth continuing each year. While analysts typically provide forecasts for up to five years out, additional cash flow figures beyond that period are extrapolated to cover a full decade. This suggests continued but slowing growth over time.

Based on these projections, the DCF model estimates Amphenol’s intrinsic value at $96.65 per share. Compared to Amphenol’s current market price, this implies the shares are trading at a 44.2% premium. This means they appear significantly overvalued according to this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amphenol may be overvalued by 44.2%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Amphenol Price vs Earnings (PE)

For companies with consistent profitability like Amphenol, the Price-to-Earnings (PE) ratio is often the most telling valuation metric. The PE ratio tells us how much investors are willing to pay for each dollar of the company’s earnings, offering a simple way to compare firms of different sizes and business models.

What constitutes a “normal” or “fair” PE depends largely on expectations for future growth and perceived risks. Fast-growing or lower-risk companies typically command higher PE ratios. In contrast, slower-growing or more volatile businesses tend to have lower PE ratios.

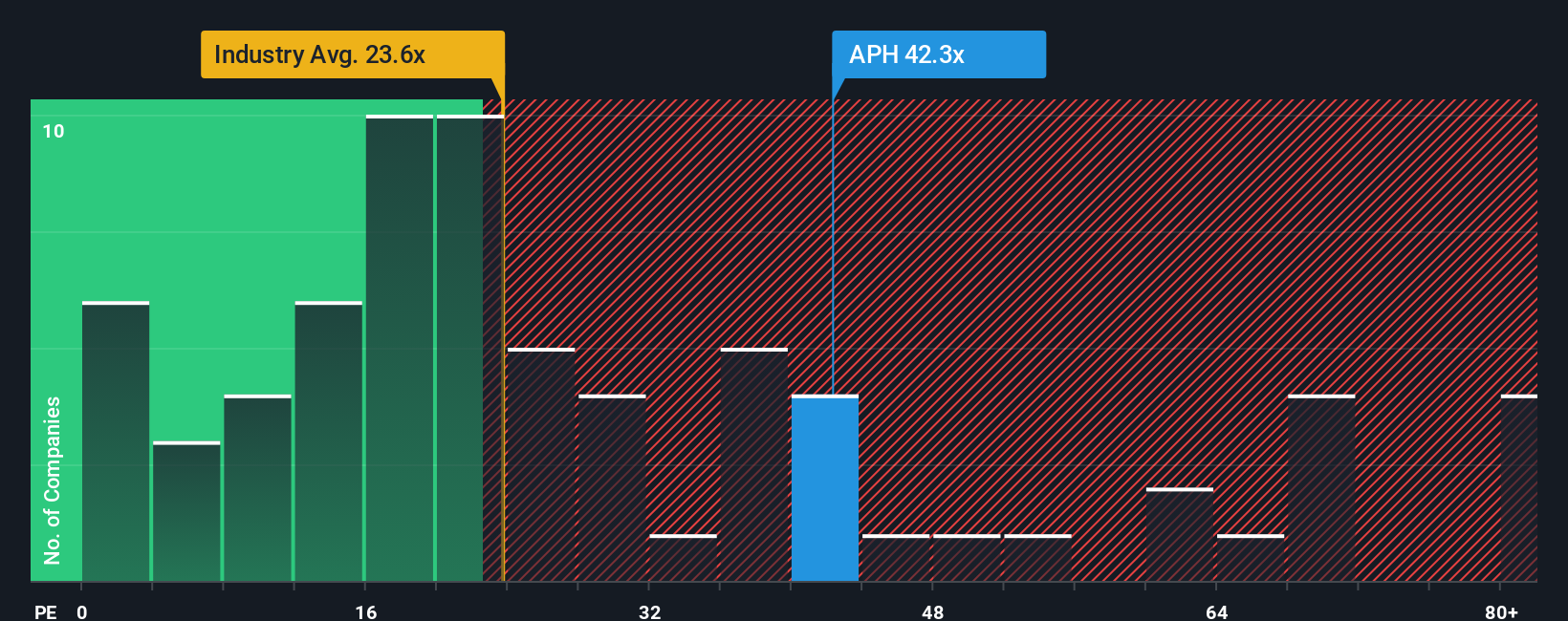

Currently, Amphenol trades at a PE of 44.6x. That is a bit below the peer group average of 47.2x, but well above the broader electronic industry average of 24.3x. On the surface, Amphenol looks expensive compared to most of the industry, but less so within its closest competitive set.

To move beyond simple side-by-side comparisons, Simply Wall St calculates a proprietary Fair Ratio for each stock. For Amphenol, the Fair Ratio is 38.5x. This number factors in expected earnings growth, profit margins, business risks, industry group, and company size. It is a more complete measure than a plain comparison with sector averages or other firms since it is tailored for Amphenol’s unique profile.

Comparing the Fair Ratio (38.5x) to Amphenol’s current PE (44.6x), the shares look somewhat overvalued by PE standards, given this difference is noticeable and above the 0.10 threshold for being “about right.”

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amphenol Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own investment story—a clear, personal perspective that ties together your outlook for Amphenol's future growth, margins, and risks with a fair value estimate based on your assumptions. Rather than reducing analysis to just static ratios or market prices, Narratives bridge your view of a company's business prospects directly to a dynamic financial forecast and then all the way to what you believe the shares are really worth.

Narratives are easy to create and use, and they are available right on Simply Wall St's Community page, trusted by millions of investors globally. Narratives help you make your own buy or sell decisions by letting you measure your Fair Value against the current stock price, which gives you confidence in your convictions, not just consensus. Best of all, your Narrative updates in real-time as new news, earnings, or market data arrives so your viewpoint stays relevant and actionable.

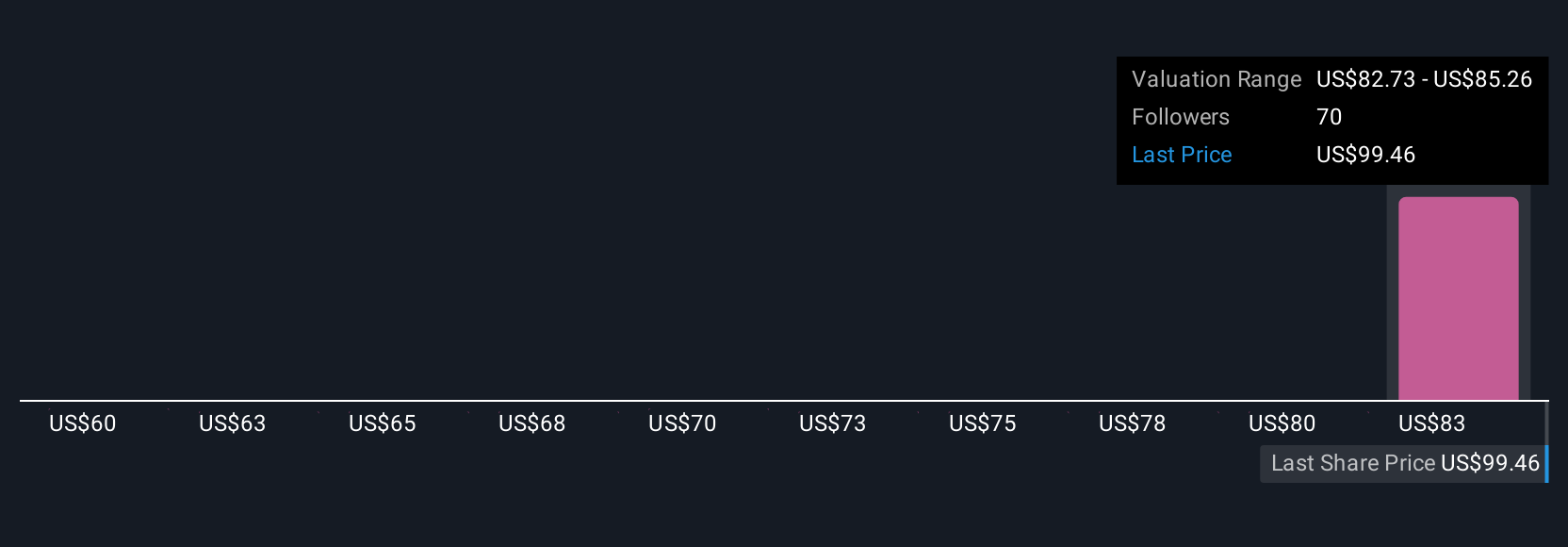

For example, some investors believe Amphenol’s continued innovation, acquisitions, and booming demand for high-speed connectors will justify a price as high as $134 per share. Others, concerned about tech market volatility and execution risk, put fair value at just $85. Narratives empower you to see both sides and decide for yourself where you think fair value lies for Amphenol.

Do you think there's more to the story for Amphenol? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives