- United States

- /

- Communications

- /

- NYSE:ANET

Is Now the Right Time to Consider Arista Networks After a 56% Price Surge?

Reviewed by Bailey Pemberton

If you have Arista Networks in your portfolio, or you’re considering buying in, you’re not alone in wondering what’s next after this remarkable run. The company’s stock has been anything but quiet lately: up 7.5% in the last week, landing a 56.1% gain over the past year, and an eye-popping 1078.1% over five years. With numbers like these, it’s only natural to ask if the growth can really continue, or if the stock is finally ready for a pause.

Some recent industry buzz has definitely added fuel to Arista Networks’ momentum. As tech giants ramp up investment in cloud data centers and AI infrastructure, network hardware demand has been rising. Analysts and investors have taken notice, pushing up Arista’s share price as optimism spreads about the company’s potential to capture a bigger piece of these fast-moving trends. However, with all this excitement, risk perceptions around the stock are also shifting. Not everyone agrees that current valuations are justified.

That brings us to the heart of the matter: how undervalued (or overvalued) is Arista Networks right now? According to our multi-point valuation check, the company scores a 1 out of a possible 6 for undervaluation, suggesting there’s more to dig into. In the next section, we’ll break down each method we use to value Arista Networks. Before we wrap up, I’ll share what I believe is the most insightful way to approach its valuation today.

Arista Networks scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Arista Networks Discounted Cash Flow (DCF) Analysis

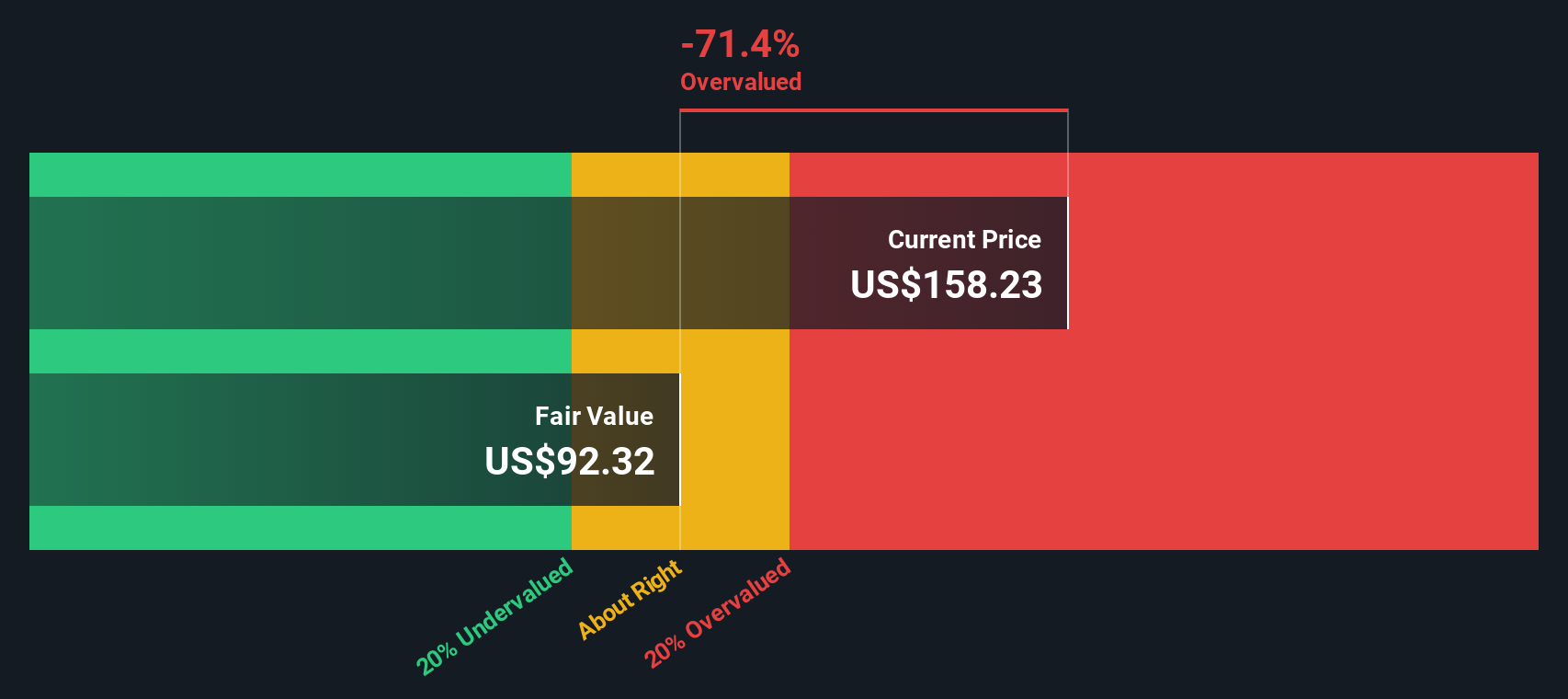

The Discounted Cash Flow (DCF) model is a valuation method that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. For Arista Networks, the model relies on recent cash flow data and forecasted growth trends to determine what the stock should be worth currently.

Currently, Arista Networks generates Free Cash Flow (FCF) of $3.99 billion. Analyst estimates reflect rapid expansion, with FCF projected to reach $4.54 billion by 2026 and $6.12 billion by 2028. Beyond this five-year window, further annual increases are extrapolated but become less certain. Simply Wall St projects cash flows to rise to roughly $7.75 billion by 2035.

According to the DCF analysis, Arista’s estimated intrinsic value comes to $92.50 per share. However, with the current share price well above this level, the stock is trading at a 66.3% premium to its calculated fair value. This significant disconnect indicates that Arista Networks is priced noticeably above what its expected future cash generation would suggest.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arista Networks may be overvalued by 66.3%. Find undervalued stocks or create your own screener to find better value opportunities.

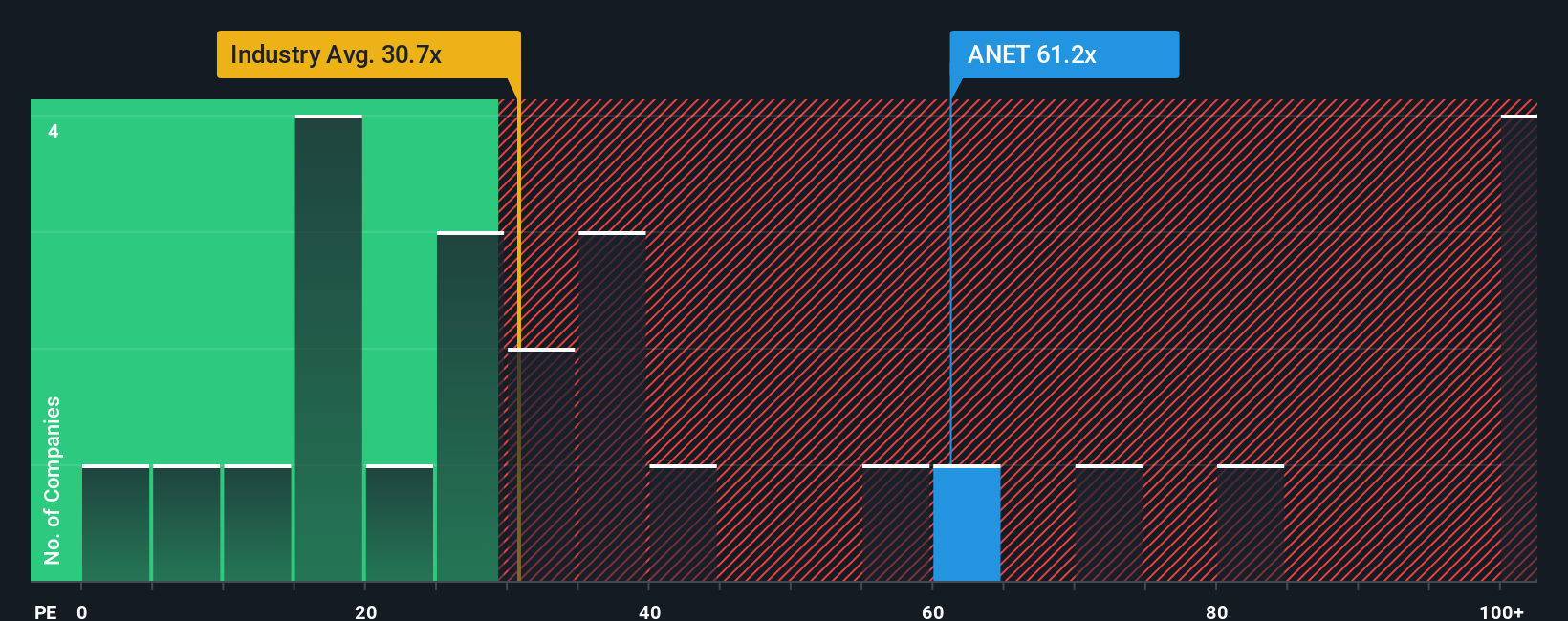

Approach 2: Arista Networks Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely-used measure for valuing profitable companies because it connects the company's share price directly to its current or expected earnings. It offers investors a quick way to gauge how much the market is paying for a dollar of the company's annual profit. Higher ratios often signal higher growth expectations, while lower ratios can reflect either risk or slower expected growth.

Arista Networks currently trades at a PE ratio of 59.46x, which stands well above the Communications industry average of 30.59x and also exceeds the peer average of 75.95x. This premium signals that investors are pricing in strong growth and perhaps a resilient business model, but it also points to higher expectations. It's important to recognize that what counts as a "fair" multiple depends on more than just industry averages. Mature, stable businesses should have lower multiples, while fast-growing, high-margin companies can often justify higher ones due to their earnings potential.

This is where Simply Wall St's proprietary "Fair Ratio" comes in. The Fair Ratio for Arista Networks is calculated as 43.58x, reflecting factors such as earnings growth, profit margins, industry positioning, market cap, and unique business risks. Unlike a raw peer or industry comparison, the Fair Ratio offers a more nuanced benchmark tailored to the company's actual fundamentals, providing a much clearer sense of whether a stock is trading in line with its true prospects.

Comparing Arista's current PE ratio (59.46x) to its Fair Ratio of 43.58x, the stock appears to be valued noticeably above what would be typical for its risk and growth profile, suggesting the market is already pricing in a lot of optimism.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arista Networks Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives—a smarter, more dynamic approach to investing that puts your perspective at the center.

A Narrative is simply your story about a company: it's how you connect what you believe about Arista Networks’ business, its industry, and its future with practical, forward-looking estimates like revenue growth, profit margins, and fair value. In other words, Narratives tie together the company’s story and numbers, helping you build your own financial forecast and see a fair value that matches your outlook.

On Simply Wall St’s Community page, Narratives are easy to use and available to everyone. Millions of investors already use them to make more informed buy and sell decisions by comparing their own Fair Value to the current market price.

The best part is that Narratives are kept fresh and relevant. Whenever major news breaks or earnings reports are published, the data and key insights in Narratives update dynamically, reflecting the latest market reality.

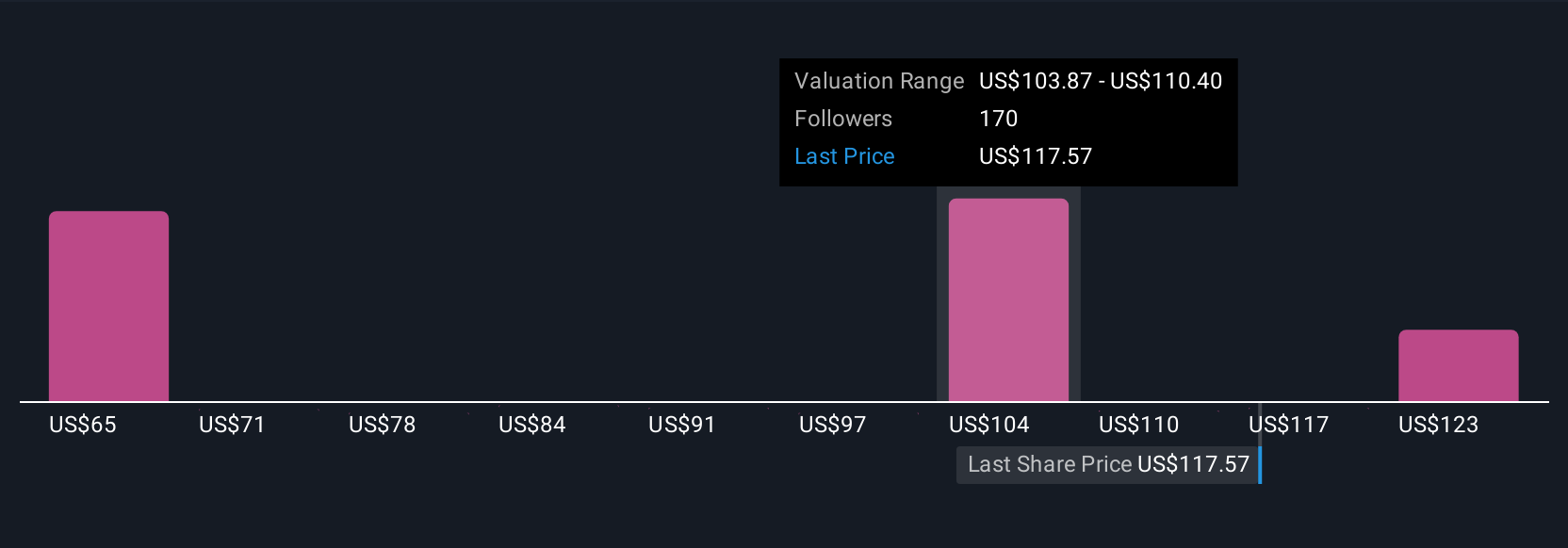

For example, some investors see Arista racing ahead thanks to AI and expect a Fair Value of $159.70, while others are more cautious, anchoring their view around $127.06. This makes it clear that you can tailor your Narrative, and your strategy, to what you believe matters most.

For Arista Networks, we’ll make it easy for you with previews of two leading Arista Networks Narratives:

Fair value: $159.70

Current price is 3.7% below this fair value

Expected revenue growth rate: 20.69%

- Arista’s leadership in high-bandwidth, AI-driven open networking positions it for sustained growth and market share gains as the industry shifts from proprietary to open Ethernet solutions.

- Strong emphasis on software platforms, network automation, and expansion into enterprise markets broadens the recurring revenue base and supports long-term earnings stability.

- Risks include dependence on large customers, rapid tech shifts, and rising competition. Analyst consensus sees the current share price as close to fair value given robust future growth expectations.

Fair value: $127.06

Current price is 21.1% above this fair value

Expected revenue growth rate: 15.0%

- Arista Networks is seen as an agile disruptor, winning market share from legacy leaders like Cisco with an integrated hardware and software approach likened to Apple’s ecosystem.

- The company maintains strong financial health, being debt-free with a high and sustained return on equity above 20%.

- However, the current market valuation is judged as stretched relative to underlying free cash flow. Future growth must remain strong just to justify the premium price.

Do you think there's more to the story for Arista Networks? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANET

Arista Networks

Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for AI, data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives