- United States

- /

- Communications

- /

- NYSE:ANET

A Look at Arista Networks’s Valuation as AI Demand Fuels Anticipation for Strong Earnings

Reviewed by Simply Wall St

Arista Networks (ANET) is in the spotlight as investors look ahead to its next earnings report, with management and analysts expressing confidence about accelerating revenue linked to AI-focused projects. The company’s role in powering cloud operations for top tech firms keeps expectations high.

See our latest analysis for Arista Networks.

Arista Networks’ recent momentum shows no signs of slowing, with the share price advancing over 37% year-to-date and the 1-year total shareholder return reaching an impressive 56%. Positive sentiment around its role in powering AI growth for industry leaders, along with anticipation for another strong earnings update, has clearly fueled investor confidence and kept the rally going.

If Arista’s growth streak has you thinking bigger, see what’s happening across high-growth tech and AI stocks with See the full list for free.

The company’s impressive gains and persistent optimism about AI-driven growth have put Arista Networks at the center of investor debate. With shares trading near all-time highs, some are questioning whether there is still a real buying opportunity or if the market is already pricing in future growth.

Most Popular Narrative: 3.7% Undervalued

With the narrative fair value now set at $159.70 and the last close at $153.82, the latest valuation suggests Arista Networks trades at a discount. This positions the company for further attention as bullish and bearish outlooks diverge.

The migration of AI networking from proprietary standards (InfiniBand, NVLink) to open Ethernet solutions is expanding Arista's addressable market. This shift is expected to drive sustained multi-year revenue growth as hyperscalers and enterprises favor open, scalable architectures for both back-end and front-end AI clusters.

Curious what’s fueling this number? The secret sauce driving this fair value isn’t just about AI hype. See which ambitious revenue, margin, and profit projections power the market’s outlook and what could tip the scales even further. You won't believe how they stack up the numbers.

Result: Fair Value of $159.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Arista’s reliance on a handful of large customers and rising competition from industry heavyweights could quickly shift the current outlook.

Find out about the key risks to this Arista Networks narrative.

Another View: Are Shares Fairly Valued on Earnings?

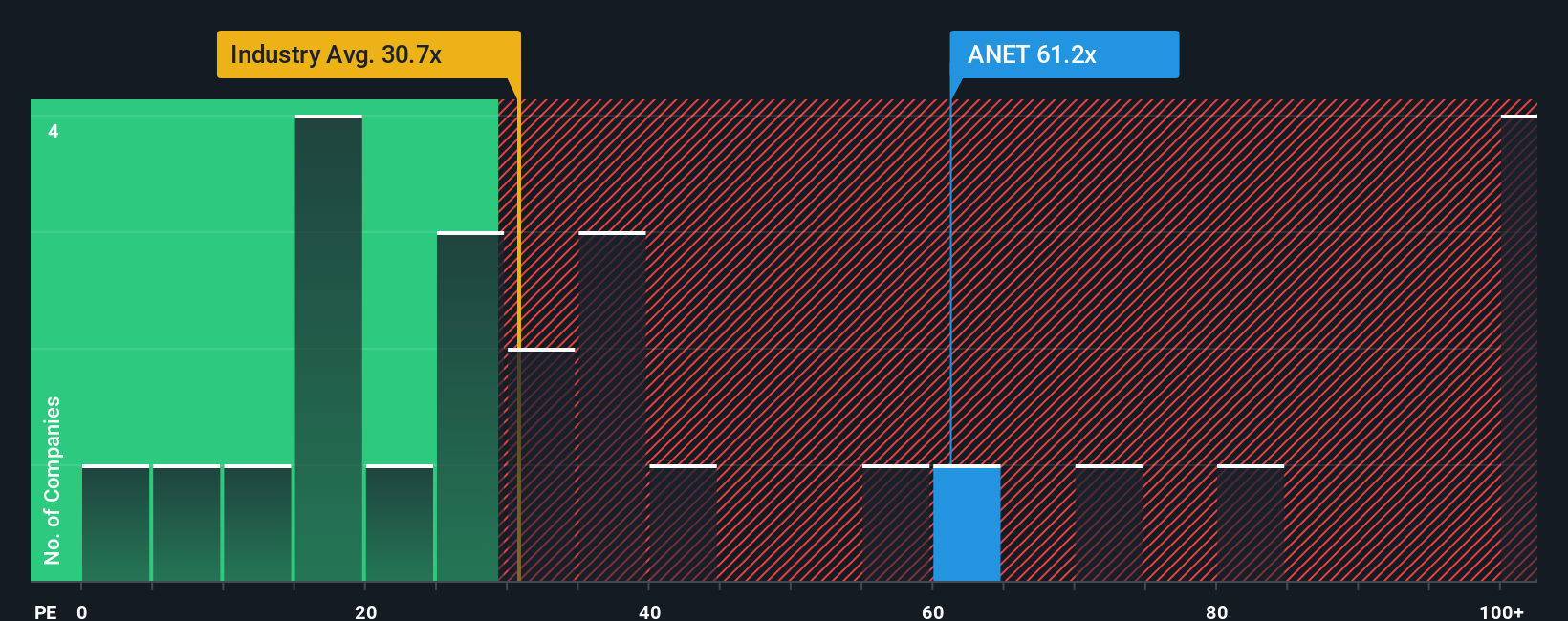

While the current narrative points to Arista Networks being undervalued, there is a different perspective when comparing its price-to-earnings ratio to industry benchmarks. At 59.5x, Arista’s ratio is much higher than the US Communications industry average of 30.6x and also exceeds the fair ratio of 43.6x. This signals potential valuation risk if the market’s optimism increases, rather than holds. Can the growth story keep up with the premium investors are paying?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arista Networks for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arista Networks Narrative

If you’re not convinced by the consensus or want to dive deeper into the numbers yourself, you can quickly build your own view from the data in just a few minutes. Do it your way

A great starting point for your Arista Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their edge by looking beyond the obvious. Head over to the Simply Wall St Screener and don’t let prime opportunities slip through your fingers. There are exciting finds waiting where you least expect them.

- Unlock powerful growth potential when you tap into these 27 AI penny stocks and see which companies are driving breakthroughs in artificial intelligence and automation.

- Capitalize on resilient cash flows and steady payouts by scanning these 17 dividend stocks with yields > 3%, where dependable dividend earners line up for your portfolio consideration.

- Break into the quantum investment wave with these 28 quantum computing stocks and follow innovators aiming to shape the next era of computing technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANET

Arista Networks

Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for AI, data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives