- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ZBRA

Zebra Technologies Second Quarter 2025 Earnings: EPS Misses Expectations

Zebra Technologies (NASDAQ:ZBRA) Second Quarter 2025 Results

Key Financial Results

- Revenue: US$1.29b (up 6.2% from 2Q 2024).

- Net income: US$112.0m (flat on 2Q 2024).

- Profit margin: 8.7% (down from 9.3% in 2Q 2024). The decrease in margin was driven by higher expenses.

- EPS: US$2.20.

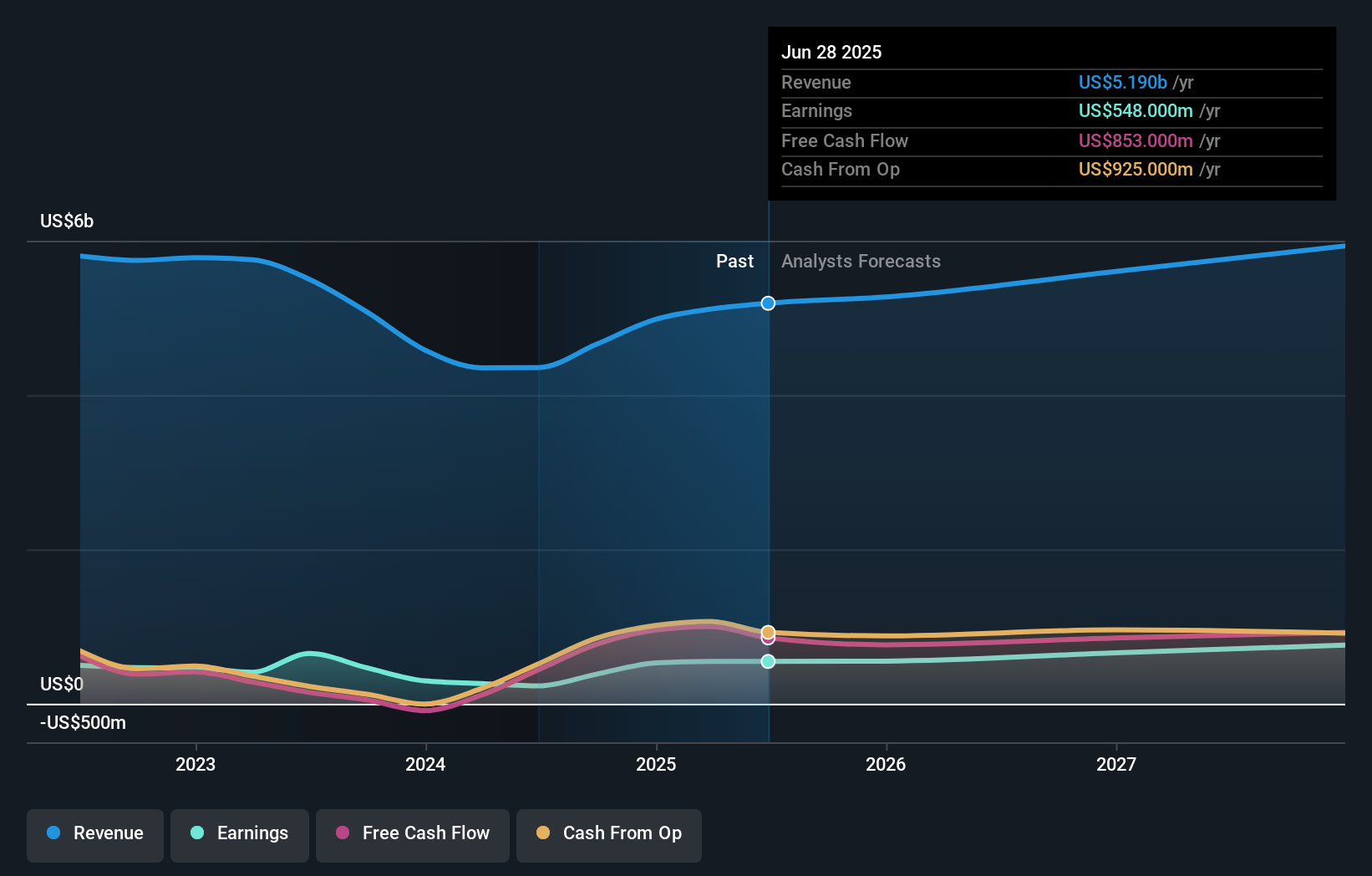

All figures shown in the chart above are for the trailing 12 month (TTM) period

Zebra Technologies EPS Misses Expectations

Revenue was in line with analyst estimates. Earnings per share (EPS) missed analyst estimates by 6.9%.

Looking ahead, revenue is forecast to grow 5.4% p.a. on average during the next 3 years, compared to a 8.2% growth forecast for the Electronic industry in the US.

Performance of the American Electronic industry.

The company's shares are down 8.7% from a week ago.

Balance Sheet Analysis

While it's very important to consider the profit and loss statement, you can also learn a lot about a company by looking at its balance sheet. We have a graphic representation of Zebra Technologies' balance sheet and an in-depth analysis of the company's financial position.

Valuation is complex, but we're here to simplify it.

Discover if Zebra Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ZBRA

Zebra Technologies

Operates in the automatic identification and data capture solutions industry worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

The Grid Modernizer: Leidos and the $2.4 Billion Bet on Sovereign AI and Energy

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.