- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

Will Western Digital's (WDC) AI Storage Push Redefine Its Long-Term Competitive Edge?

Reviewed by Sasha Jovanovic

- In November 2025, Western Digital unveiled a suite of next-generation storage solutions and expanded partnerships at Supercomputing 2025, aimed at transforming performance, capacity, and scalability for AI and high-performance computing (HPC) customers.

- These innovations bring advanced UltraSMR storage technology and an expanded partner ecosystem to organizations of all sizes, supporting reduced costs, greater flexibility, and faster deployment for AI and HPC workloads beyond just the largest hyperscalers.

- Let's examine how Western Digital's new UltraSMR solutions and broader partner network could influence its longer-term growth prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Western Digital Investment Narrative Recap

To be a Western Digital shareholder, you need to believe that rising demand for advanced storage, driven by AI and HPC, will create sustained revenue streams, and that Western Digital’s ongoing innovation and partnerships can extend its role beyond hyperscale customers. The November 2025 product launch strengthens the company’s short-term growth catalysts but does not fundamentally alter the biggest risk: heavy revenue reliance on a small number of cloud customers, whose technology changes could impact future earnings.

The November unveiling of UltraSMR storage and expansion of the Composable Compatibility Lab stands out, as it directly supports Western Digital’s ability to win new customers outside of its traditional hyperscaler base. By fostering ecosystem growth with validated partners, the company underscores efforts to diversify its customer mix, a factor that matters when evaluating both risk and growth prospects.

But while new platforms target a wider market, investors need to be aware that customer concentration remains a real risk if...

Read the full narrative on Western Digital (it's free!)

Western Digital's narrative projects $11.9 billion revenue and $2.2 billion earnings by 2028. This requires 7.6% yearly revenue growth and a $0.6 billion earnings increase from $1.6 billion today.

Uncover how Western Digital's forecasts yield a $167.48 fair value, a 19% upside to its current price.

Exploring Other Perspectives

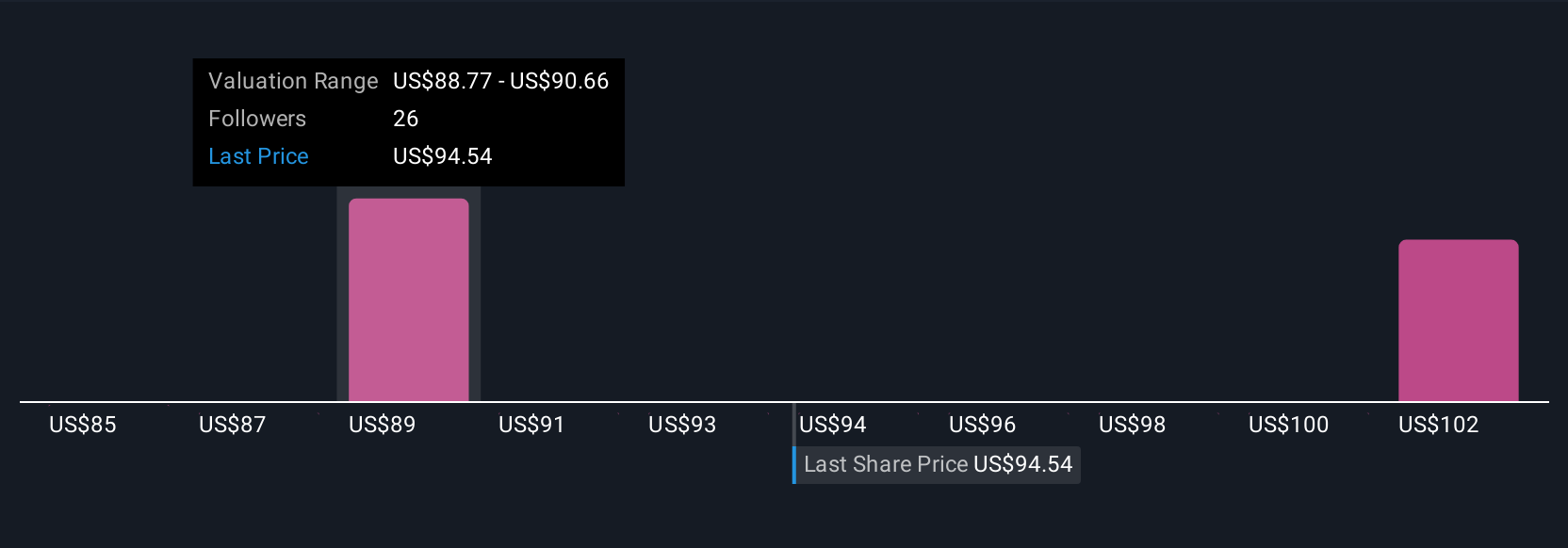

Simply Wall St Community members estimate Western Digital’s fair value from US$85 up to US$230, with four perspectives contributing. While views differ, expanding partnerships and storage solutions connect closely to how product adoption could shape long-term performance.

Explore 4 other fair value estimates on Western Digital - why the stock might be worth as much as 64% more than the current price!

Build Your Own Western Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Digital research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Western Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Digital's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the United States, Asia, Europe, the Middle East, and Africa.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives