- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 1.2%, yet it remains up by 30% over the past year, with earnings expected to grow by 15% per annum in the coming years. In this context of robust annual growth and recent volatility, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on future earnings potential.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Sarepta Therapeutics | 23.90% | 42.65% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Clene | 78.50% | 60.70% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 250 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

ImmunityBio (NasdaqGS:IBRX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ImmunityBio, Inc. is a clinical-stage biotechnology company focused on developing therapies and vaccines to enhance the natural immune system against cancers and infectious diseases, with a market cap of approximately $3.73 billion.

Operations: ImmunityBio focuses on developing immune-enhancing therapies and vaccines for cancer and infectious diseases, generating revenue primarily from its biotechnology segment, which reported $7.33 million.

ImmunityBio's rapid revenue growth, forecasted at 72.9% annually, significantly outpaces the U.S. market average of 8.9%, indicating robust expansion within its sector. Despite current unprofitability, the company is expected to pivot to profitability with an impressive projected annual profit growth of 68.1%. This potential turnaround is underscored by recent clinical successes, notably the QUILT 3.032 study where ANKTIVA combined with BCG showed a 71% complete response rate in treating bladder cancer—data that could enhance regulatory submissions and market presence in Europe soon. ImmunityBio's commitment to R&D is evident as it continues to innovate in immunotherapy, leveraging cutting-edge science to improve patient outcomes which may well set a new standard within oncology treatment protocols.

- Navigate through the intricacies of ImmunityBio with our comprehensive health report here.

Explore historical data to track ImmunityBio's performance over time in our Past section.

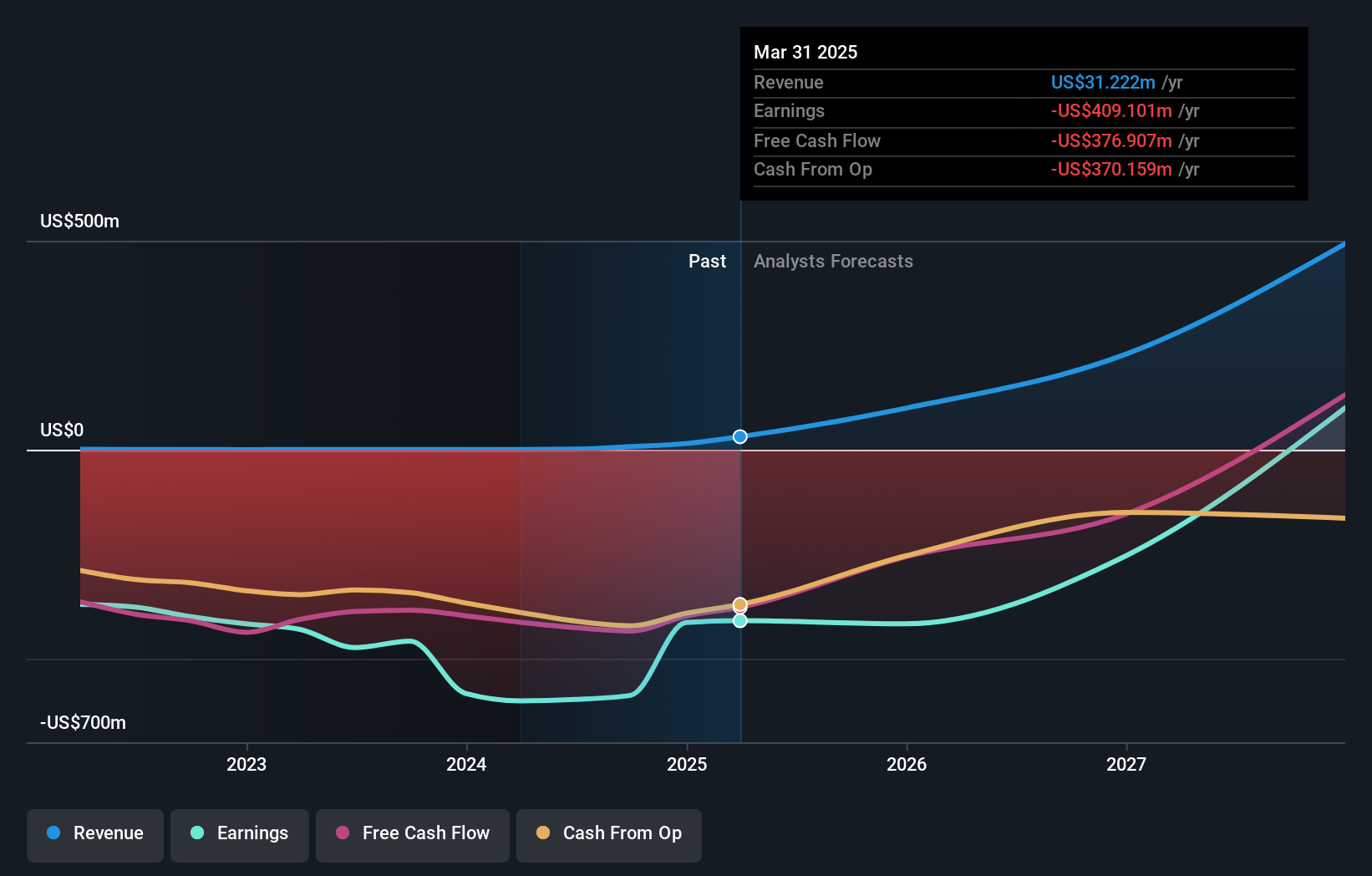

Western Digital (NasdaqGS:WDC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Western Digital Corporation is a global company that develops, manufactures, and sells data storage devices and solutions across various regions including the United States, China, Europe, and more, with a market cap of approximately $22.57 billion.

Operations: Western Digital generates revenue primarily from its Hard Disk Drives (HDD) and Flash-Based Products segments, contributing $7.33 billion and $7.02 billion respectively.

Western Digital's recent pivot from a net loss to a substantial net income of $493 million highlights its recovery and strategic realignment. This turnaround is reflected in a significant sales increase to $4.095 billion, up from $2.75 billion year-over-year, driven by innovative product launches like the 32TB UltraSMR HDD, which caters to the burgeoning demands of data-intensive AI applications. The firm's R&D commitment is evident with expenses aligning closely with revenue growth trends, ensuring continuous innovation in storage solutions critical for AI and cloud computing landscapes. This focus on high-capacity storage solutions positions Western Digital favorably as enterprises increasingly depend on robust data management systems to harness the potential of AI technologies, underpinning future growth prospects in an ever-evolving tech sphere.

- Unlock comprehensive insights into our analysis of Western Digital stock in this health report.

Review our historical performance report to gain insights into Western Digital's's past performance.

Coherent (NYSE:COHR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Coherent Corp. specializes in the development, manufacturing, and marketing of engineered materials, optoelectronic components and devices, as well as optical and laser systems for industrial, communications, electronics, and instrumentation sectors globally; it has a market cap of approximately $16.12 billion.

Operations: Coherent Corp. generates revenue through three primary segments: Lasers ($1.41 billion), Materials ($1.51 billion), and Networking ($2.63 billion). The company's focus on diverse sectors allows it to cater to a wide range of industrial, communications, electronics, and instrumentation markets globally.

Coherent's recent strategic maneuvers and innovative product launches, such as the high-speed indium phosphide photodiodes, underscore its commitment to maintaining a competitive edge in the tech sector. These developments are crucial as they align with the growing demands for faster and more efficient data transmission technologies. Notably, Coherent's transition from a net loss to reporting a net income of $25.89 million highlights significant operational improvements and financial health stabilization. Furthermore, R&D expenses have been pivotal in supporting these innovations; for instance, R&D spending has surged by 10.9%, reflecting its dedication to advancing technological frontiers and securing future growth avenues in an industry driven by rapid evolution and intense competition.

- Take a closer look at Coherent's potential here in our health report.

Examine Coherent's past performance report to understand how it has performed in the past.

Taking Advantage

- Gain an insight into the universe of 250 US High Growth Tech and AI Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions in the United States, China, Hong Kong, Europe, the Middle East, Africa, rest of Asia, and internationally.

Reasonable growth potential with adequate balance sheet.