- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

A Fresh Look at Western Digital (WDC) Valuation After Strong Q1 Earnings and Dividend Hike

Reviewed by Simply Wall St

Western Digital (WDC) delivered a noteworthy start to fiscal 2026 with first quarter earnings that exceeded expectations. Sales increased year-over-year, and the company announced a 25% dividend increase, signaling management’s growing confidence.

See our latest analysis for Western Digital.

Western Digital’s momentum is impossible to ignore right now. After reporting impressive quarterly results and increasing its dividend, the stock soared to new all-time highs, delivering a 1-day share price return of 5.2% and a staggering year-to-date gain of 155.4%. With a one-year total shareholder return of 221.6%, both short- and long-term investors have plenty to celebrate as confidence in the company’s growth outlook continues to build.

If you want to see what other tech names are gaining traction, check out our curated list of innovation leaders in See the full list for free.

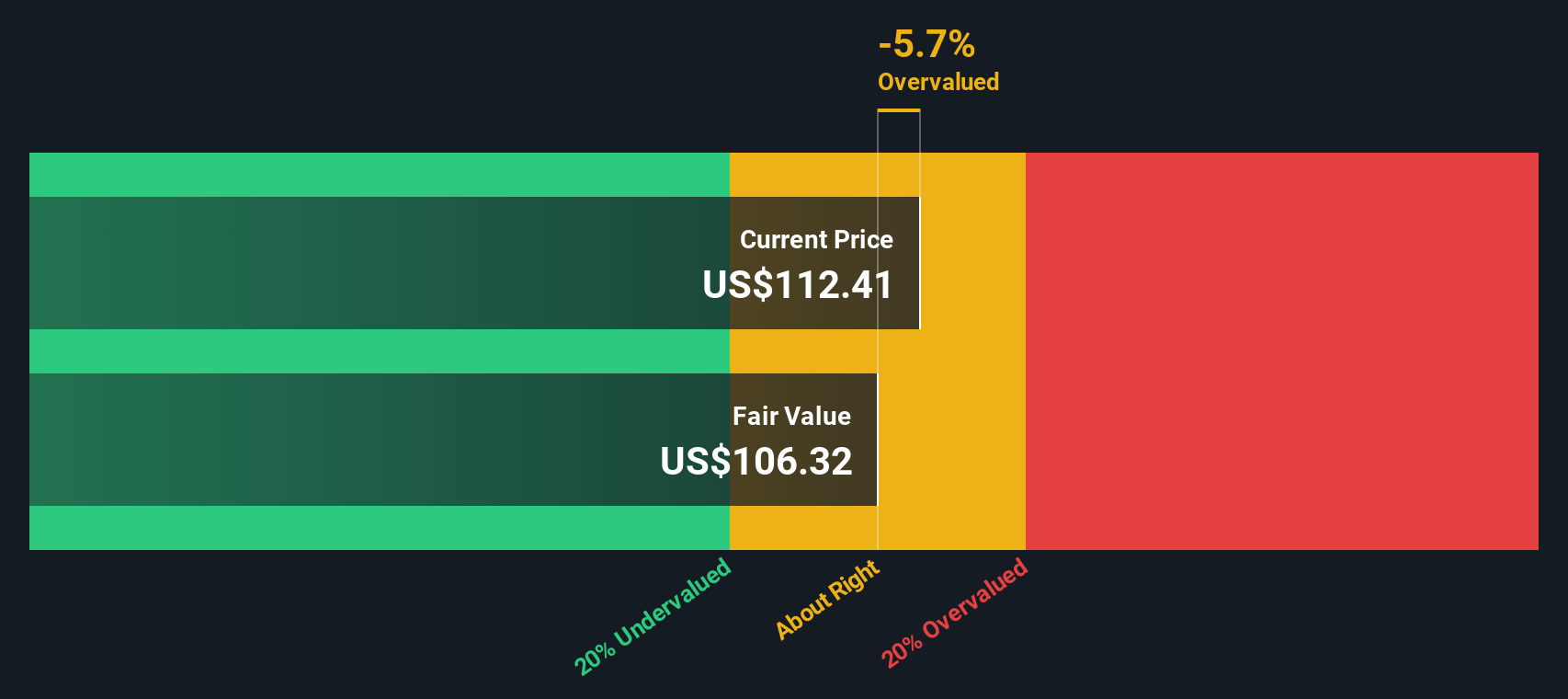

But after such a dramatic run-up, is Western Digital’s stock still trading at an attractive value? Or have recent gains fully priced in the company’s ambitious growth prospects? Is there still a buying opportunity, or is the market already anticipating future upside?

Most Popular Narrative: 25.5% Overvalued

Western Digital’s last close of $158.02 is far above the most popular narrative’s fair value estimate of $125.95 per share. This suggests optimism in the market is running even hotter than consensus fair value projections. This scenario sets the stage for bold assumptions driving the narrative’s price target.

Ongoing demand from cloud infrastructure, the rise of artificial intelligence, and increasing requirements for high-capacity storage have created long-term tailwinds. This has led analysts to revise shipment forecasts and margin expectations upward.

Curious what bold projections fuel this gap between the narrative fair value and the sizzling share price? There’s one surprising metric at the heart of the narrative’s math—hint, it’s not just old-school earnings. See which forward-looking growth and profit forecasts are behind this crowd favorite’s high-stakes valuation.

Result: Fair Value of $125.95 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, an unexpected shift in cloud customer demand or delays in technology ramp-up could quickly unsettle Western Digital’s bullish projections.

Find out about the key risks to this Western Digital narrative.

Another View: The SWS DCF Model Says Undervalued

While the popular narrative and fair value approaches suggest Western Digital is overvalued, the SWS DCF model presents a sharply different view. According to our DCF calculation, Western Digital is actually trading nearly 32% below its estimated fair value of $231.69 per share. Does this deep discount reveal an overlooked opportunity, or is there a catch hidden in the growth assumptions?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Western Digital Narrative

Feeling inspired to dig into the numbers yourself? If you want your own take or a different angle, you can craft a personalized Western Digital narrative in under three minutes. Do it your way

A great starting point for your Western Digital research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't just stop with Western Digital. The market is packed with dynamic opportunities waiting for your attention, so find your next winner before others do.

- Capitalize on emerging technology by jumping into these 27 AI penny stocks and spotting companies positioned to lead the AI revolution.

- Lock in potential high yields when you use these 18 dividend stocks with yields > 3% to uncover stocks delivering strong, consistent dividend payouts.

- Catch tomorrow’s market movers early by browsing these 3590 penny stocks with strong financials with robust growth and financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the United States, Asia, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives