- United States

- /

- Communications

- /

- NasdaqGS:VSAT

Does Viasat’s Stock Rally Signal a Real Opportunity After Latest Global Partnership News?

Reviewed by Bailey Pemberton

- Wondering if Viasat is a bargain or just riding the latest market buzz? You are not alone, as many investors are asking the same question after seeing dramatic moves in the stock price.

- Viasat’s stock has seen a tremendous year, soaring 219.6% year-to-date and 265.7% over the last 12 months. This comes even after a recent dip of 14.9% in the past week and 17.0% in the last month.

- The recent volatility follows major headlines, including new global partnerships and expansion deals that are shifting perceptions about the company’s growth prospects. These announcements have investors closely watching how much of the optimism is already reflected in today’s price.

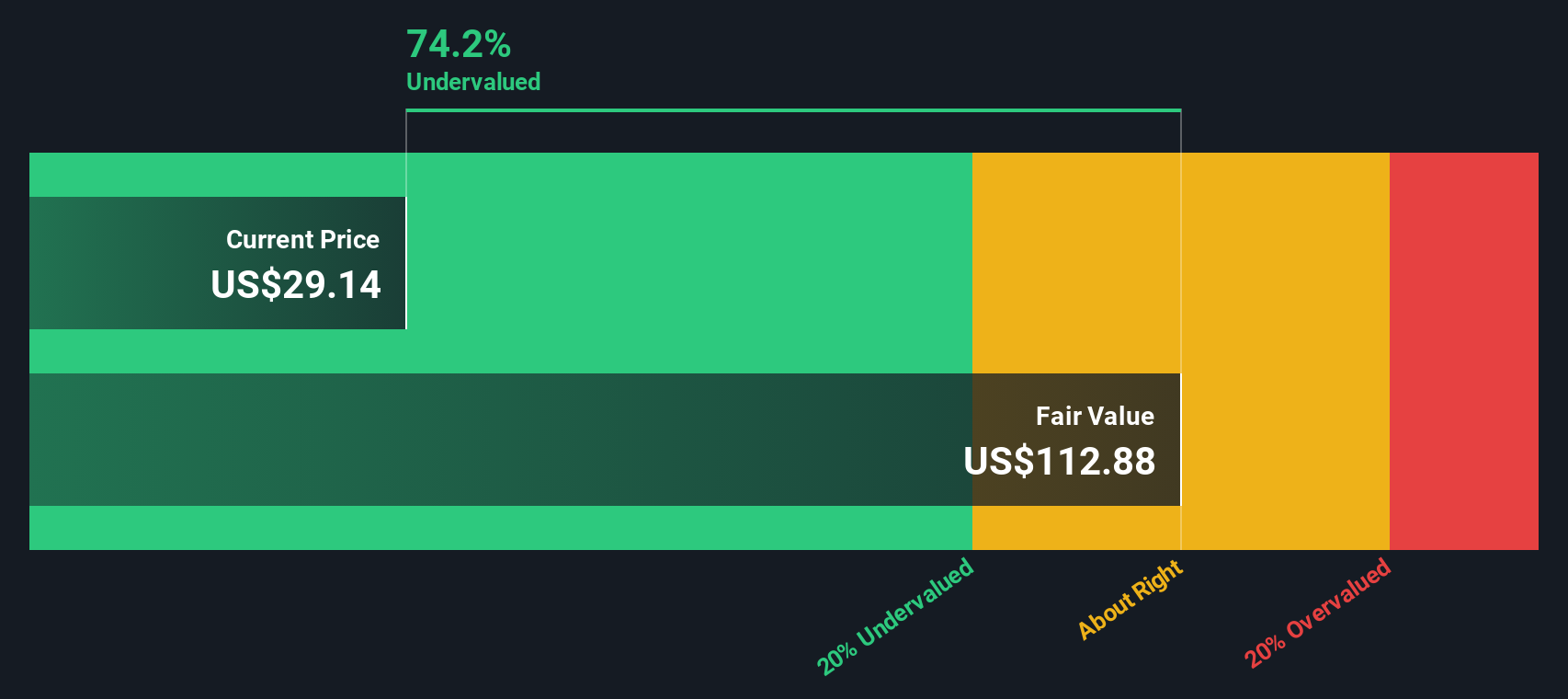

- According to Simply Wall St’s valuation checks, Viasat scores 5 out of 6 for being undervalued, suggesting there may still be significant value on the table. We will break down what goes into these valuation checks shortly, and provide a look at an additional way to judge if Viasat truly offers a compelling opportunity.

Approach 1: Viasat Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future cash flows and discounting them back to today’s dollars. For Viasat, this method uses expected free cash flow trends to help determine whether the stock is trading above or below its intrinsic value.

Currently, Viasat’s free cash flow stands at -$265 million, indicating negative cash generation over the last twelve months. However, analyst forecasts and long-term projections see a sharp turnaround, with free cash flow projected to reach over $2.14 billion by 2035. Over the next five to ten years, the company is expected to move from smaller positive cash flows, such as $51 million in 2026 and $283 million in 2027, to well over $1 billion annually as growth accelerates.

Applying the 2 Stage Free Cash Flow to Equity model, these projections yield an estimated intrinsic value of $103.28 per share. Given today’s share price, this suggests Viasat is currently undervalued by 70.5 percent using this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Viasat is undervalued by 70.5%. Track this in your watchlist or portfolio, or discover 923 more undervalued stocks based on cash flows.

Approach 2: Viasat Price vs Sales

The price-to-sales (P/S) ratio is often favored when evaluating companies like Viasat, especially in periods where profitability may be volatile or negative, but there is meaningful revenue and growth potential. This metric helps investors assess how much they are paying for every dollar of company sales, making it particularly useful for technology and communications firms that may not yet show consistent earnings on the bottom line.

Typically, expectations for future growth and the risks associated with a company will influence what is considered a “normal” or “fair” P/S ratio. Higher growth and lower perceived risk can support a higher multiple, while slower growth or greater risk will lower it.

Viasat’s current P/S ratio is 0.90x, which is significantly below both the industry average of 1.84x and its peer group, which trades at an average of 2.68x. By comparison, Simply Wall St’s proprietary “Fair Ratio” for Viasat is 2.15x. The Fair Ratio reflects a more tailored assessment, factoring in the company’s unique growth prospects, profit margin potential, industry trends, and company-specific risks and scale. This gives investors a more accurate benchmark than simply looking at peer or industry averages.

Given Viasat’s current P/S ratio of 0.90x versus a Fair Ratio of 2.15x, the stock appears undervalued by this metric and may offer substantial upside if it closes the gap to its fair value multiple.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1424 companies where insiders are betting big on explosive growth.

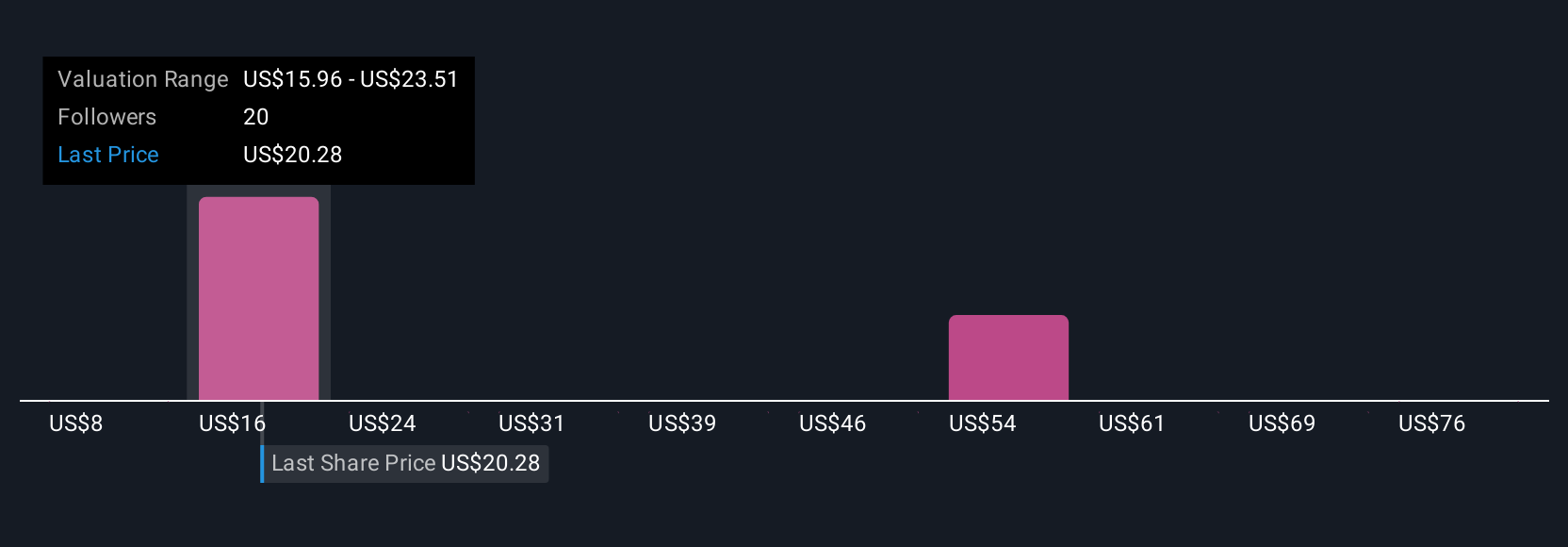

Upgrade Your Decision Making: Choose your Viasat Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story and investment thesis about a company, connecting your beliefs and expectations for Viasat’s future, from how much revenue and earnings it will generate to what profit margins it can sustain, directly to a fair value estimate. Narratives bridge the gap between qualitative insights and hard financial forecasts, letting you turn your opinions about key drivers or risks into a transparent, calculated fair value. On Simply Wall St, Narratives are available and easy to use on the Community page, empowering millions of investors to explain not just what they think Viasat is worth, but why.

Narratives help you decide when to buy or sell by comparing your estimated Fair Value to the current price, and they dynamically update as new information, like news or earnings, arrives. For example, one investor might set a bullish Narrative based on international spectrum deals and project a Fair Value for Viasat as high as $52 per share, while another, more cautious user might focus on rising competition and assign a lower value around $10. This makes Narratives a powerful, accessible tool for shaping your investment decisions around what truly matters to you.

Do you think there's more to the story for Viasat? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VSAT

Viasat

Provides broadband and communications products and services in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives