- United States

- /

- Communications

- /

- NasdaqGS:VSAT

Can Viasat’s (VSAT) Latest Connectivity Wins Reshape Its Competitive Edge in Global Communications?

Reviewed by Sasha Jovanovic

- In the past week, Viasat announced a series of significant developments, including the successful launch of its ViaSat-3 Flight 2 satellite, a fleetwide connectivity agreement with Etihad Airways for Viasat Amara, and a contract extension to provide managed connectivity services for U.S. Navy bases worldwide. These achievements also featured advancements in aviation and space communications technology, further expanding Viasat's presence in commercial and government sectors.

- An important insight is that Viasat's recent customer wins and technology milestones not only enhance its satellite network capacity but also demonstrate the company's appeal across diverse global markets, reinforcing its position as an integrated connectivity solutions provider.

- We'll examine how the successful ViaSat-3 Flight 2 satellite launch signals a new phase of network capacity and contract momentum for Viasat's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Viasat Investment Narrative Recap

For anyone considering Viasat, the central investment thesis centers on the successful execution and monetization of its ViaSat-3 satellite constellation, which aims to drive future bandwidth, expand global aviation and government contracts, and unlock new service revenues. The recent milestone of ViaSat-3 Flight 2's successful launch and strong contract momentum, especially in aviation and defense connectivity, strengthens the core catalyst but does not materially reduce the risks tied to large CapEx, ongoing losses, and heavy competition in terrestrial broadband and satellite communications.

Among recent announcements, Etihad Airways' fleetwide adoption of Viasat Amara stands out as especially relevant, providing tangible proof of increasing airline demand for high-speed in-flight connectivity. This client win directly highlights the potential for ViaSat-3 capacity to address commercial mobility contracts and reinforces the narrative around contract wins translating to service revenue growth.

However, investors should also keep in mind that, despite these wins, competitive and regulatory risks remain critical, particularly as ...

Read the full narrative on Viasat (it's free!)

Viasat's narrative projects $5.0 billion revenue and $534.2 million earnings by 2028. This requires 2.9% yearly revenue growth and a $1,132.7 million increase in earnings from the current -$598.5 million.

Uncover how Viasat's forecasts yield a $36.25 fair value, a 3% upside to its current price.

Exploring Other Perspectives

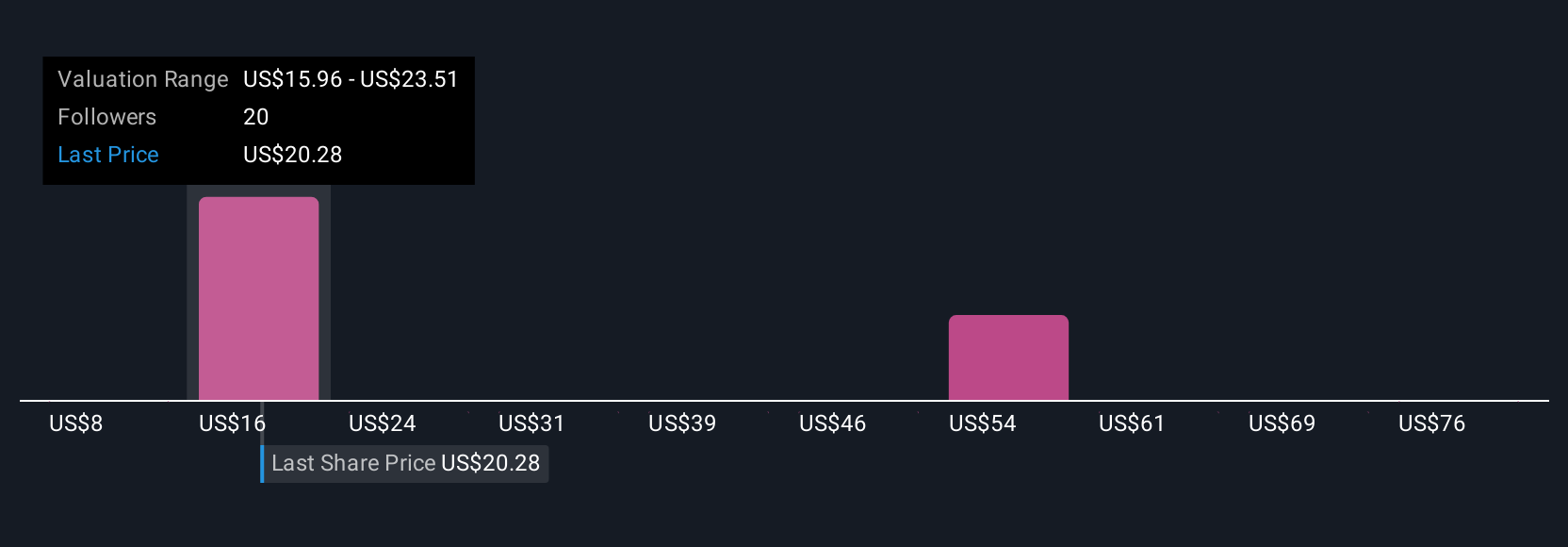

Eight estimates from the Simply Wall St Community place Viasat's fair value between US$10 and US$122.84, with several views far above current pricing. Against this range, ongoing losses and pressure on cash flow continue to weigh on the company's outlook, underscoring why it pays to explore alternative views when evaluating opportunities.

Explore 8 other fair value estimates on Viasat - why the stock might be worth over 3x more than the current price!

Build Your Own Viasat Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viasat research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Viasat research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viasat's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VSAT

Viasat

Provides broadband and communications products and services in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives