- United States

- /

- Communications

- /

- NasdaqGS:VIAV

Viavi Solutions (VIAV) Is Up 27.4% After Strong Q1 Results and Data Center Acquisition Announcement

Reviewed by Sasha Jovanovic

- Viavi Solutions recently reported first quarter fiscal 2026 results that exceeded expectations, with net revenue rising 25.6% year-over-year to US$299.10 million and adjusted earnings of US$0.15 per share, while also providing second quarter guidance for net revenue between US$360 million and US$370 million and non-GAAP EPS of US$0.18 to US$0.20.

- The company’s acquisition of Spirent’s high-speed Ethernet network security and channel emulation business lines is anticipated to add about US$200 million in annual revenue run rate and significantly bolster Viavi’s position in the rapidly expanding data center market.

- We'll examine how Viavi's stronger margins and data center-driven outlook influence the company's investment narrative amid emerging growth catalysts.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Viavi Solutions Investment Narrative Recap

For Viavi Solutions, the investment case hinges on confidence in the company’s ability to leverage surging demand for data center connectivity and capitalize on multi-year upgrade cycles in fiber and optical networks. The latest results, with a strong uptick in margins and the Spirent acquisition, reinforce the near-term growth catalyst in the data center segment, while ongoing cyclicality in service provider spending remains the most important risk; so far, the news does not materially reduce this unpredictability for wireless and service provider markets.

Among recent announcements, the completion of Viavi’s acquisition of Spirent’s high-speed Ethernet and network security business lines stands out. This move is expected to directly support Viavi’s recent upward guidance, creating additional revenue streams and strengthening its presence in high-growth data center infrastructure, which remains a central pillar to its investment appeal as new catalysts emerge in networking technology.

However, investors should also weigh that, in contrast to revenue and margin gains, persistent unpredictability in wireless infrastructure and cyclical service provider capital spending still means...

Read the full narrative on Viavi Solutions (it's free!)

Viavi Solutions' narrative projects $1.3 billion revenue and $227.3 million earnings by 2028. This requires 5.8% yearly revenue growth and a $192.5 million earnings increase from $34.8 million currently.

Uncover how Viavi Solutions' forecasts yield a $14.57 fair value, a 15% downside to its current price.

Exploring Other Perspectives

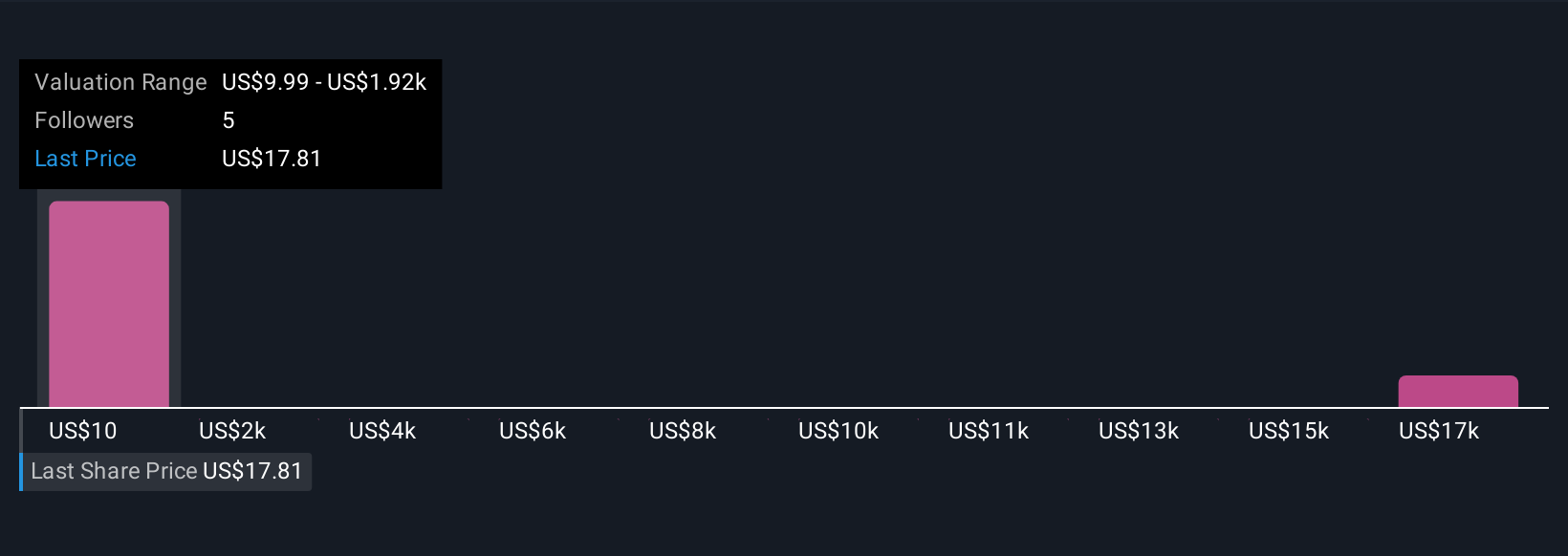

Fair value estimates sourced from three individuals in the Simply Wall St Community range broadly from US$10.38 to over US$19,100 per share. As you weigh these outlooks, keep in mind the recurring risk that service provider and wireless customer cyclicality continues to cloud the company’s path to stable revenue growth.

Explore 3 other fair value estimates on Viavi Solutions - why the stock might be a potential multi-bagger!

Build Your Own Viavi Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viavi Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Viavi Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viavi Solutions' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VIAV

Viavi Solutions

Provides network test, monitoring, and assurance solutions for telecommunications, cloud, enterprises, first responders, military, aerospace, and critical infrastructures in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives