- United States

- /

- Communications

- /

- NasdaqGS:VIAV

Viavi Solutions Inc.'s (NASDAQ:VIAV) Shares Climb 26% But Its Business Is Yet to Catch Up

Viavi Solutions Inc. (NASDAQ:VIAV) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 34%.

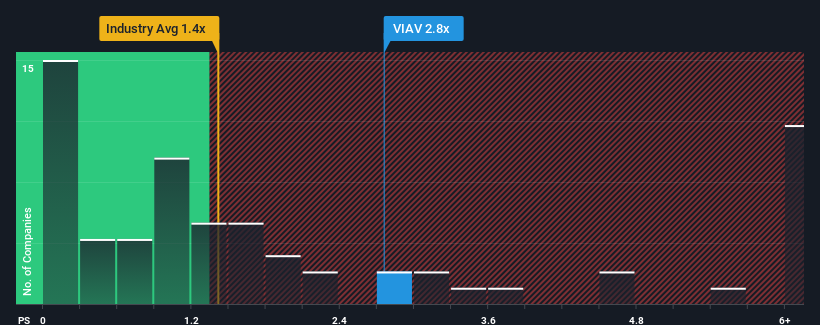

Since its price has surged higher, when almost half of the companies in the United States' Communications industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Viavi Solutions as a stock probably not worth researching with its 2.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Viavi Solutions

How Has Viavi Solutions Performed Recently?

Viavi Solutions hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Viavi Solutions.Is There Enough Revenue Growth Forecasted For Viavi Solutions?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Viavi Solutions' to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 20% drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 12% as estimated by the eight analysts watching the company. That's shaping up to be similar to the 11% growth forecast for the broader industry.

With this information, we find it interesting that Viavi Solutions is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Viavi Solutions' P/S

Viavi Solutions' P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Viavi Solutions currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

You always need to take note of risks, for example - Viavi Solutions has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Viavi Solutions, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VIAV

Viavi Solutions

Provides network test, monitoring, and assurance solutions for telecommunications, cloud, enterprises, first responders, military, aerospace, and critical infrastructures in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success