- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

Why Investors Shouldn't Be Surprised By Seagate Technology Holdings plc's (NASDAQ:STX) 26% Share Price Surge

Despite an already strong run, Seagate Technology Holdings plc (NASDAQ:STX) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 27% in the last year.

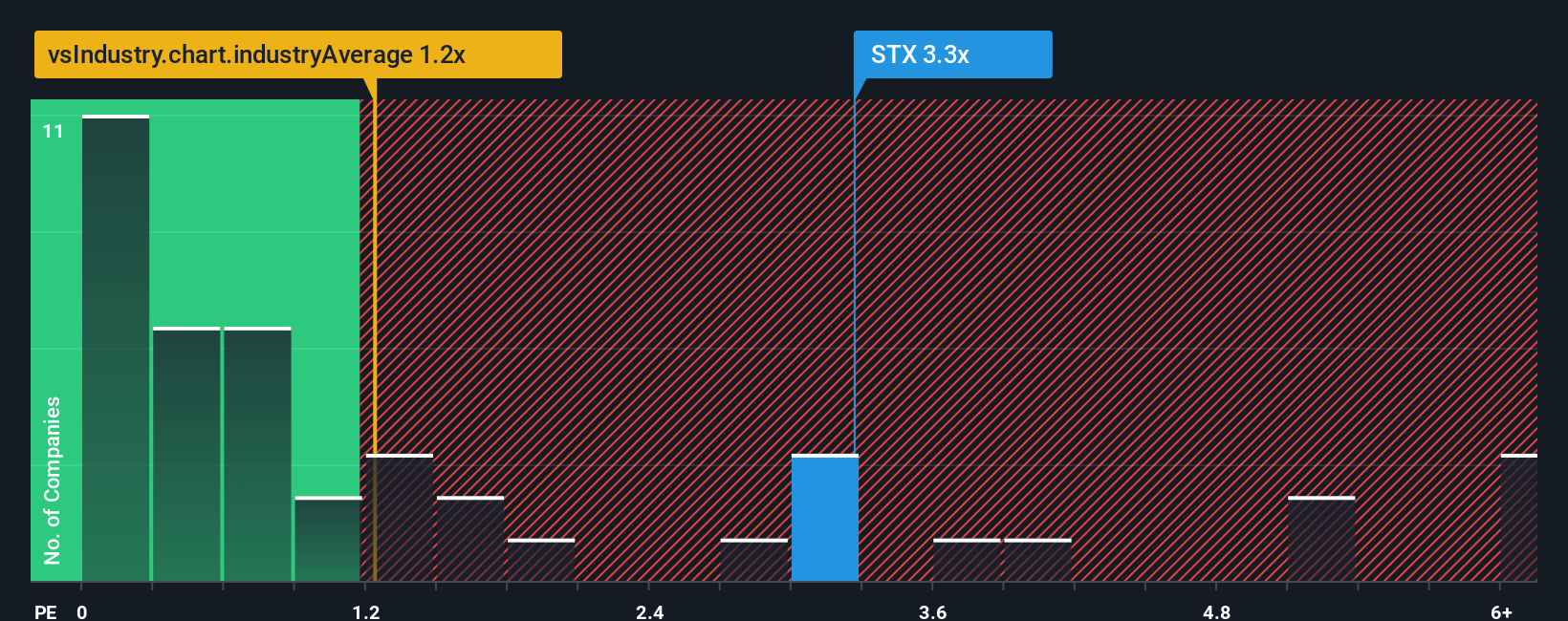

After such a large jump in price, you could be forgiven for thinking Seagate Technology Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.3x, considering almost half the companies in the United States' Tech industry have P/S ratios below 1.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Seagate Technology Holdings

What Does Seagate Technology Holdings' P/S Mean For Shareholders?

Seagate Technology Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Seagate Technology Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Seagate Technology Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Seagate Technology Holdings' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 36% last year. Still, revenue has fallen 29% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 11% each year over the next three years. That's shaping up to be materially higher than the 6.3% per year growth forecast for the broader industry.

In light of this, it's understandable that Seagate Technology Holdings' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Seagate Technology Holdings' P/S

The strong share price surge has lead to Seagate Technology Holdings' P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Seagate Technology Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 4 warning signs we've spotted with Seagate Technology Holdings (including 3 which are significant).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives