- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:SPCB

Further Upside For SuperCom Ltd. (NASDAQ:SPCB) Shares Could Introduce Price Risks After 63% Bounce

SuperCom Ltd. (NASDAQ:SPCB) shareholders would be excited to see that the share price has had a great month, posting a 63% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

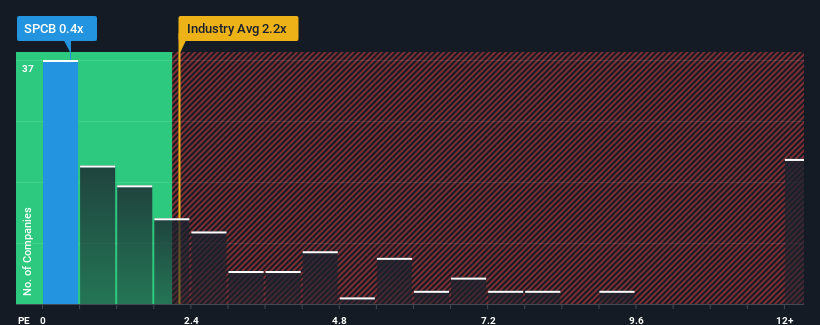

In spite of the firm bounce in price, SuperCom's price-to-sales (or "P/S") ratio of 0.4x might still make it look like a buy right now compared to the Electronic industry in the United States, where around half of the companies have P/S ratios above 2.2x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for SuperCom

How Has SuperCom Performed Recently?

SuperCom certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think SuperCom's future stacks up against the industry? In that case, our free report is a great place to start.How Is SuperCom's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like SuperCom's to be considered reasonable.

Retrospectively, the last year delivered a decent 5.2% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 142% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 12% as estimated by the sole analyst watching the company. That's shaping up to be similar to the 9.9% growth forecast for the broader industry.

In light of this, it's peculiar that SuperCom's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

Despite SuperCom's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for SuperCom remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Having said that, be aware SuperCom is showing 6 warning signs in our investment analysis, and 5 of those don't sit too well with us.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SPCB

SuperCom

Provides traditional and digital identity, Internet of Things (IoT) and connectivity, and cyber security products and solutions to governments, and private and public organizations worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Beacon Trade and Vertical Integration leading Growth. However, economic headwinds and store rollouts could continue to fuel OpEx

High-Tech Precision Play

Perion (PERI) Q4 Earnings: Real AI Turnaround… or Just Another Adtech Hype Cycle? 🤔📊

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.