- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:SNT

Subdued Growth No Barrier To Senstar Technologies Corporation (NASDAQ:SNT) With Shares Advancing 26%

Senstar Technologies Corporation (NASDAQ:SNT) shares have continued their recent momentum with a 26% gain in the last month alone. The annual gain comes to 152% following the latest surge, making investors sit up and take notice.

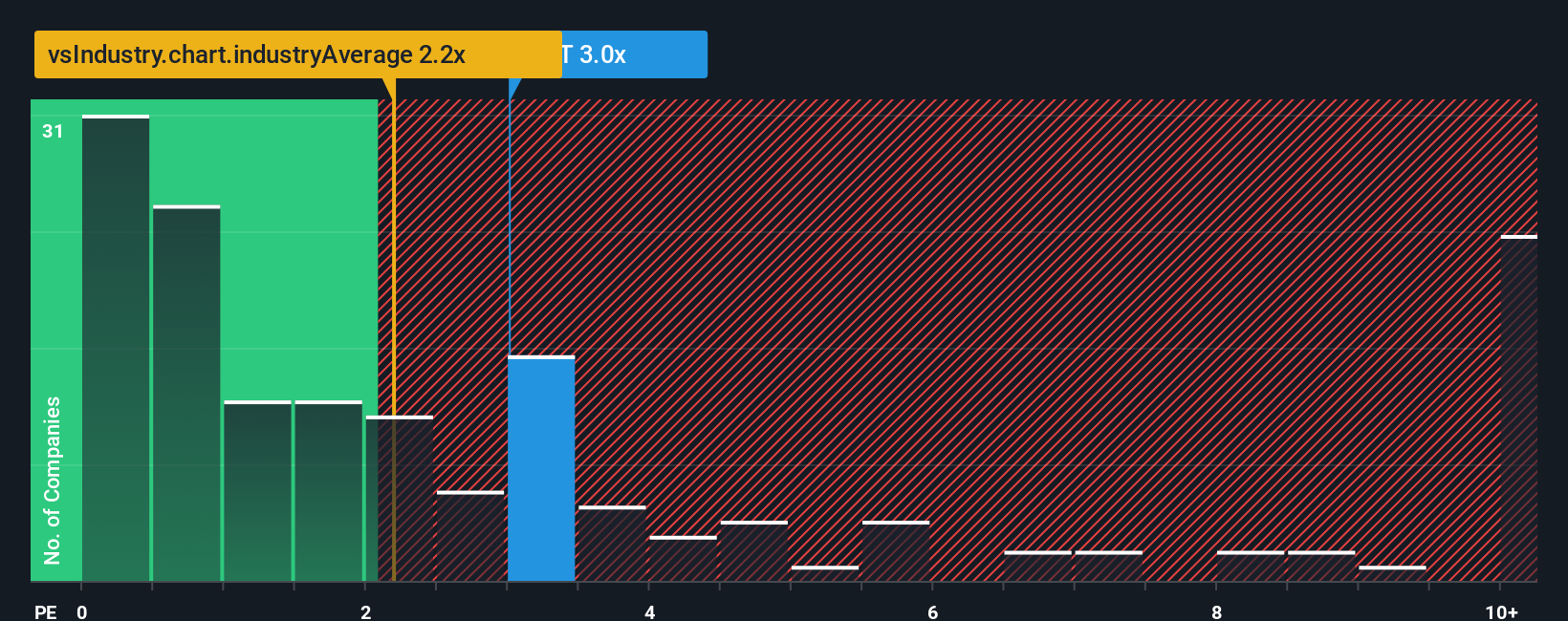

Since its price has surged higher, given close to half the companies operating in the United States' Electronic industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Senstar Technologies as a stock to potentially avoid with its 3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Senstar Technologies

How Senstar Technologies Has Been Performing

The revenue growth achieved at Senstar Technologies over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Senstar Technologies, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

Senstar Technologies' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.4% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 17% shows it's noticeably less attractive.

In light of this, it's alarming that Senstar Technologies' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Senstar Technologies' P/S

The large bounce in Senstar Technologies' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Senstar Technologies currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Senstar Technologies with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:SNT

Senstar Technologies

Provides physical, video, and access control security products and solutions worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives