- United States

- /

- Tech Hardware

- /

- NasdaqGS:SNDK

Is Sandisk’s Soaring 512% Rally in 2025 Backed by Real Value?

Reviewed by Bailey Pemberton

- Wondering if Sandisk's red-hot rise is justified or if the stock is getting ahead of itself? You're not alone, especially with the buzz swirling around its valuation.

- After rocketing up 18.4% in the past 30 days, but sliding 10.0% over the last week, Sandisk has clearly caught investor attention and some nerves along the way. Its year-to-date gain is a staggering 512.5%.

- The stock’s wild ride lately comes amidst renewed market optimism for tech hardware, reportedly spurred by strong industry data and speculation about Sandisk's strategic moves in the flash memory market. Recent headlines highlight surging demand in data centers and whispers of a potential supply expansion that could shift the industry landscape.

- Despite all this momentum, Sandisk currently scores just 2 out of 6 on our undervaluation checks, putting its real value under the microscope. In this article, we’ll break down what goes into that score, explore classic valuation measures, and hint at a smarter approach savvy investors can turn to at the end.

Sandisk scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sandisk Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps investors approximate what the company is actually worth compared to its current market price.

For Sandisk, the latest reported Free Cash Flow (FCF) is $481.4 Million. Analysts expect the company’s FCF to grow considerably, with projections reaching over $3.4 Billion by 2028. Ten-year projections, which combine analyst estimates and extrapolation, anticipate annual FCFs exceeding $7.1 Billion by 2035. All cash flows are shown in US dollars.

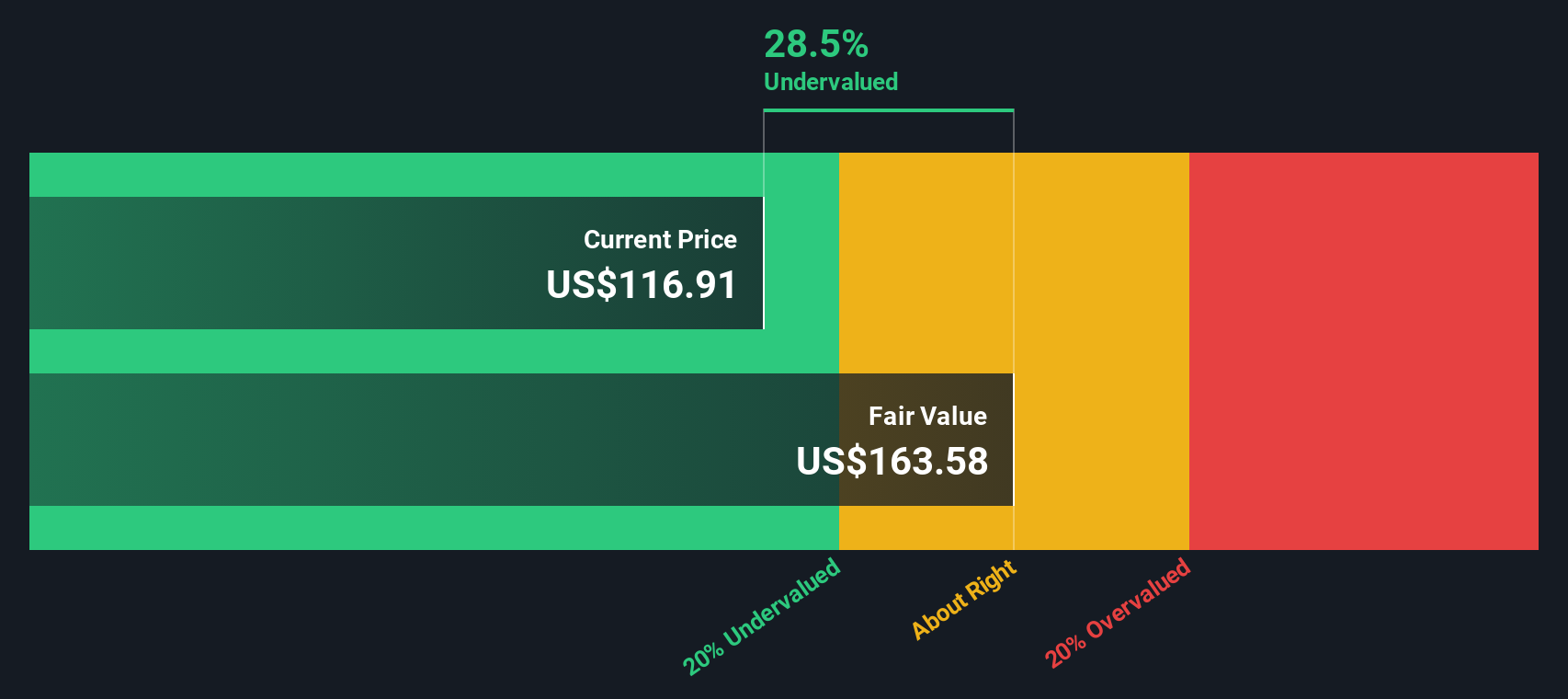

Using a 2 Stage Free Cash Flow to Equity model, this cash flow growth results in an estimated intrinsic value of $647.78 per share. Based on this calculation, Sandisk stock is trading at a significant 66.0% discount to its estimated fair value, suggesting the stock is deeply undervalued when considering its future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sandisk is undervalued by 66.0%. Track this in your watchlist or portfolio, or discover 933 more undervalued stocks based on cash flows.

Approach 2: Sandisk Price vs Sales

For profitable companies, the Price-to-Sales (P/S) ratio is a widely recognized way to assess valuation. It offers a clear view of how much investors are currently paying for every dollar of sales, making it especially useful for tech and hardware companies like Sandisk where earnings can swing due to industry cycles.

What makes a “normal” or “fair” P/S ratio depends on expectations for future growth and the risks involved. Fast-growing and profitable companies often trade at higher multiples because investors are willing to pay more for those future returns. Conversely, riskier companies or those in mature industries are typically assigned lower multiples.

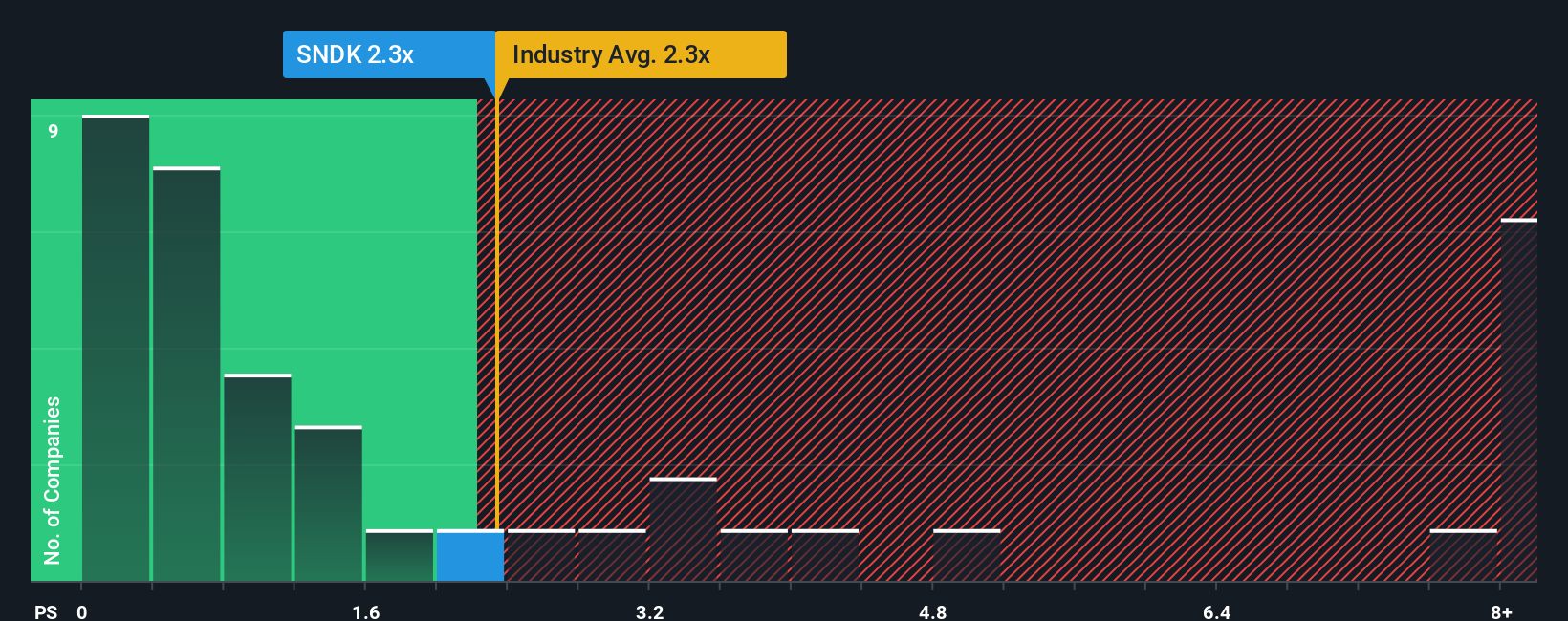

Currently, Sandisk trades at a P/S ratio of 4.15x. For comparison, the average P/S ratio among its industry peers is 3.20x, and the tech sector average is even lower at 1.75x. This could at first glance imply Sandisk is trading at a premium to its competitors.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, calculated as 3.88x, considers Sandisk’s unique mix of earnings growth, profit margins, size, sector, and risk profile. Unlike blunt peer or industry averages, the Fair Ratio reflects what investors should actually expect for a company like Sandisk right now.

Since Sandisk’s P/S multiple (4.15x) is very close to its Fair Ratio (3.88x), the stock appears to be valued about where it should be according to underlying fundamentals and expected growth.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sandisk Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your investment story: your specific perspective on a company that connects what you believe about its future to real numbers like fair value, expected revenue, earnings growth, and profit margins.

Narratives let you turn your outlook for Sandisk into a clear financial forecast and then a fair value estimate, linking your story directly to the numbers. This feature, available for free to all users on Simply Wall St’s Community page, lets millions of investors create, share, and update their own Narratives with just a few clicks.

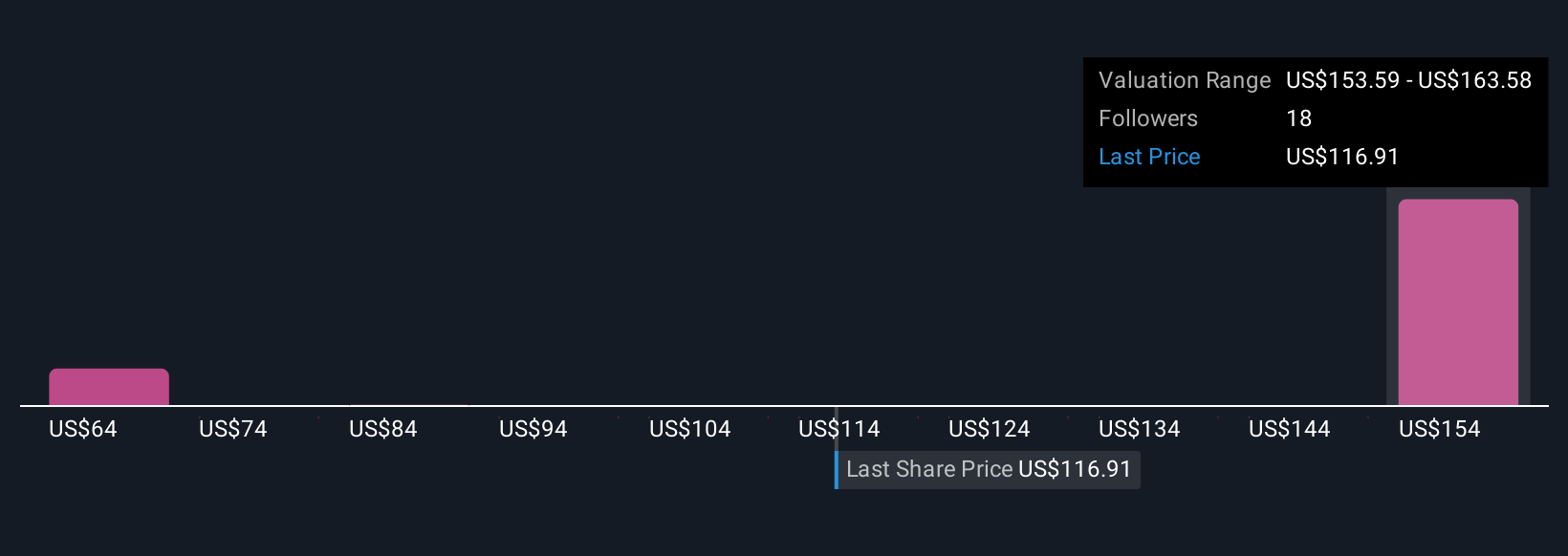

By comparing your Narrative’s Fair Value to Sandisk’s actual price, you can see at a glance whether it’s time to buy, hold, or sell. Because Narratives are dynamic, they update automatically when new news or results hit the market. For example, some investors currently see Sandisk's fair value above $650, while others estimate it closer to $440, reflecting different stories about its growth and risk.

Do you think there's more to the story for Sandisk? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDK

Sandisk

Develops, manufactures, and sells data storage devices and solutions using NAND flash technology in the United States, Europe, the Middle East, Africa, Asia, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success