- United States

- /

- Tech Hardware

- /

- NasdaqGS:SNDK

Can Sandisk (SNDK) Leverage Ultra-Compact Storage to Strengthen Its Competitive Edge?

Reviewed by Sasha Jovanovic

- Sandisk recently launched the world’s smallest USB-C flash drive, offering up to 1 terabyte of storage and designed for users needing fast, compact solutions for slim laptops and tablets.

- This innovation generated significant user buzz but arrived during a period of mixed investor sentiment tied to fluctuating fabrication costs and increased options activity by large investors.

- We'll explore how Sandisk's push into high-capacity, ultra-compact storage products shapes its investment narrative amid ongoing market volatility.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Sandisk's Investment Narrative?

For Sandisk shareholders, the big picture rests on the company's ability to capitalize on strong demand for advanced storage solutions like AI data infrastructure and ultra-compact, high-capacity consumer devices. The recent launch of the world’s smallest 1TB USB-C flash drive certainly boosted brand buzz and lifted the stock temporarily, but its impact on core business drivers may be limited as bigger short-term catalysts and risks remain. The ongoing ramp-up of Fab2 with Kioxia and new partnerships targeting AI workloads keep the growth story intact, yet elevated fabrication costs and margin compression have weighed on earnings and shaken investor confidence, as seen with the sharp 21% price drop. Meanwhile, board and management turnover add uncertainty, and unusual bearish options activity signals persistent caution in the market. Ultimately, while innovation is a clear strength, investors must weigh it against the real risks of execution, cost volatility, and leadership stability that define Sandisk’s evolving narrative right now.

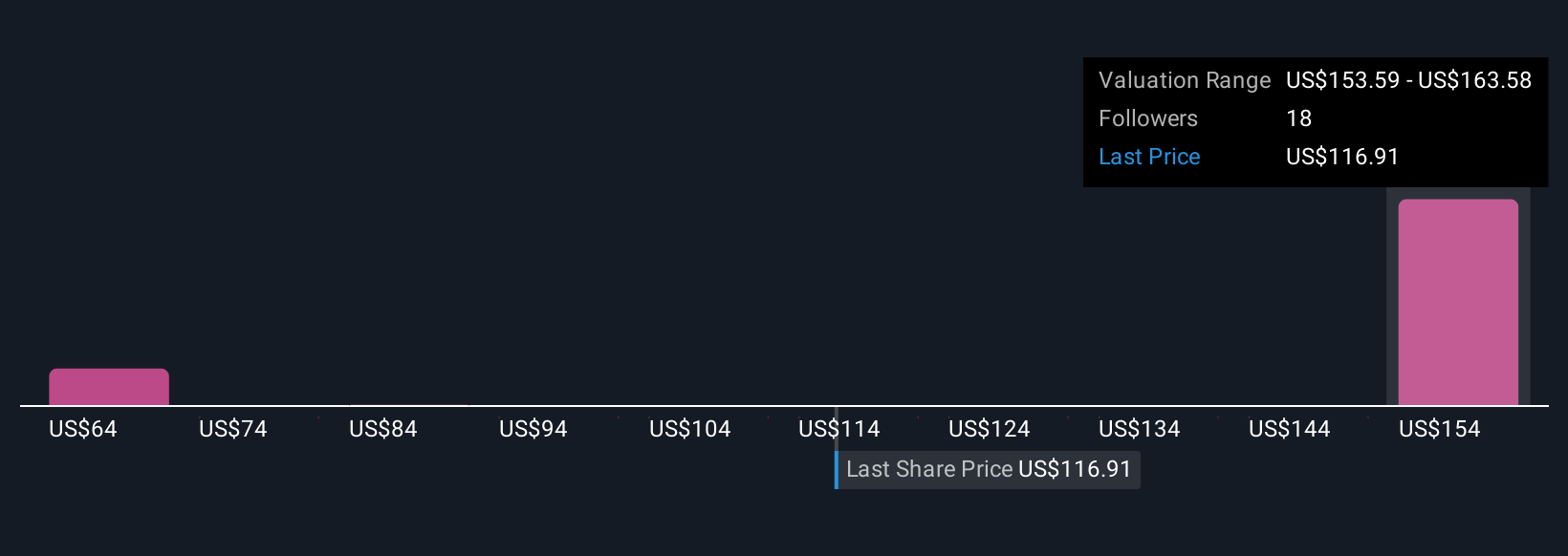

But with margin pressure still unresolved, there’s a risk some investors may be overlooking. Despite retreating, Sandisk's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 4 other fair value estimates on Sandisk - why the stock might be worth over 3x more than the current price!

Build Your Own Sandisk Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sandisk research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sandisk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sandisk's overall financial health at a glance.

No Opportunity In Sandisk?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDK

Sandisk

Develops, manufactures, and sells data storage devices and solutions using NAND flash technology in the United States, Europe, the Middle East, Africa, Asia, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives