- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Why Super Micro Computer (SMCI) Is Down 6.3% After Delayed AI Project Revenues and Reaffirmed Guidance

Reviewed by Sasha Jovanovic

- Earlier this week, Super Micro Computer, Inc. reported preliminary first-quarter fiscal 2026 revenue of US$5 billion, significantly below expectations due to delayed deployments for large artificial intelligence projects, but reaffirmed its full-year revenue guidance of at least US$33 billion on the basis of over US$12 billion in newly secured business and continued AI infrastructure demand.

- An important insight is that while first-quarter sales were deferred rather than lost, Super Micro's outlook remains supported by strong customer engagement for its AI-oriented liquid-cooled solutions, highlighting continued momentum despite near-term volatility.

- We'll now explore how the delayed revenue recognition and sustained guidance may alter Super Micro Computer's investment narrative and risk profile.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Super Micro Computer Investment Narrative Recap

To own shares in Super Micro Computer today, investors need confidence in the multi-year growth of global AI infrastructure and the company's ability to capture it with fast, modular server solutions. The recent revenue shortfall, driven by delayed but not lost AI customer deployments, creates near-term uncertainty but does not materially alter the strongest short-term catalyst: robust, deferred AI-fueled demand for Super Micro’s high-performance platforms. The biggest present risk remains customer concentration, as the business depends on just a few very large buyers.

Among recent announcements, the launch of the Data Center Building Block Solutions (DCBBS) stands out. This integrated product line is well-timed, targeting the same organizations experiencing project delays, and could accelerate revenue recognition once deployments resume, making it central to Super Micro’s catalyst of expanding into turnkey, higher-margin offerings.

Yet, while the growth runway seems intact, investors should be aware that if a top customer ...

Read the full narrative on Super Micro Computer (it's free!)

Super Micro Computer's outlook projects $48.2 billion in revenue and $2.4 billion in earnings by 2028. This is based on an annual revenue growth rate of 29.9% and a $1.4 billion increase in earnings from the current level of $1.0 billion.

Uncover how Super Micro Computer's forecasts yield a $50.59 fair value, in line with its current price.

Exploring Other Perspectives

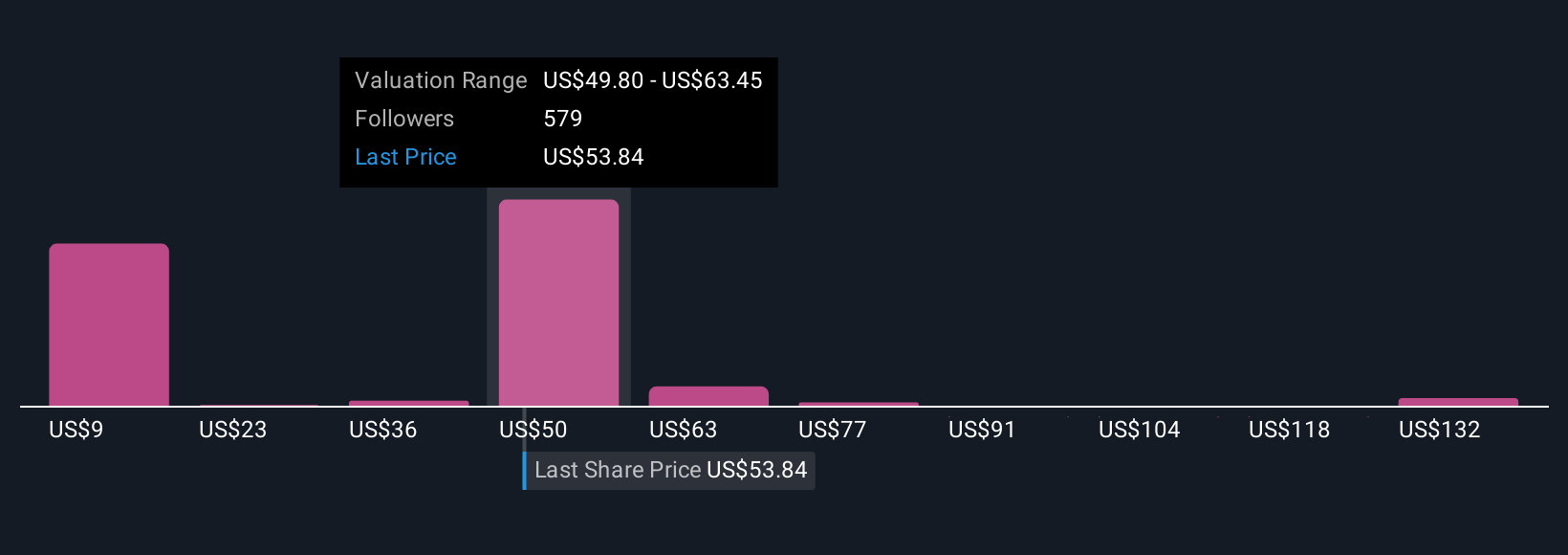

Fifty-two fair value estimates from the Simply Wall St Community span a wide US$3.63 to US$82.39 range, highlighting diverse investor views. Given recent revenue concentration risks, these differing insights show the importance of multiple perspectives on Super Micro’s future performance.

Explore 52 other fair value estimates on Super Micro Computer - why the stock might be worth as much as 60% more than the current price!

Build Your Own Super Micro Computer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Super Micro Computer research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Super Micro Computer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Super Micro Computer's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion