- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Supermicro (SMCI): Valuation in Focus After Major AI System Launches and Expanding Strategic Partnerships

Reviewed by Kshitija Bhandaru

Super Micro Computer (SMCI) has grabbed investor attention lately, thanks to the launch of NVIDIA’s Blackwell Ultra AI systems and a push into advanced liquid cooling for big AI data centers. These moves also strengthen its collaborations with AMD, Intel, and NVIDIA.

See our latest analysis for Super Micro Computer.

Momentum has returned to Super Micro Computer’s stock lately, following a sharp bounce from its post-earnings dip and boosted by ambitious AI system launches, partnerships, and upbeat product unveilings. Investors who held for the long run have been rewarded. The 1-year total shareholder return lands at 0.26%, but those sticking around since late 2022 have seen a remarkable 7.54% three-year total return. With robust demand for AI infrastructure fueling growth, sentiment around SMCI appears to be building once again.

If Super Micro’s tech-driven climb has you looking for new opportunities, the entire high-growth tech and AI space is worth a closer look. Start exploring with See the full list for free.

The company’s rapid growth and product announcements have driven renewed enthusiasm. However, with shares recovering quickly from their recent dip, investors may wonder if there is still a buying opportunity left, or if future growth is already priced in.

Most Popular Narrative: 5% Overvalued

With Super Micro Computer’s consensus fair value sitting just above $50 and the last close at $52.50, the market is pricing in added optimism beyond analyst assumptions. This sets the stage for why the narrative valuation stands apart from current trading levels.

The accelerating global adoption of AI and analytics continues to drive demand for high-performance, scalable server and data center solutions. This positions Super Micro for strong multi-year revenue growth as enterprises and nations build out AI infrastructure, directly supporting projected revenue outperformance.

Curious which bold business drivers and ambitious forecasts power the most-watched valuation? The heart of this narrative is all about exponential market shifts, next-generation infrastructure, and the kinds of future numbers that could reshape SMCI’s destiny. Want the details behind the projection? Dive in for the full story and discover the exact growth assumptions setting this price target.

Result: Fair Value of $50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few big customers and ongoing hardware price competition could quickly challenge the bullish long-term case for Super Micro Computer.

Find out about the key risks to this Super Micro Computer narrative.

Another View: What Does the SWS DCF Model Say?

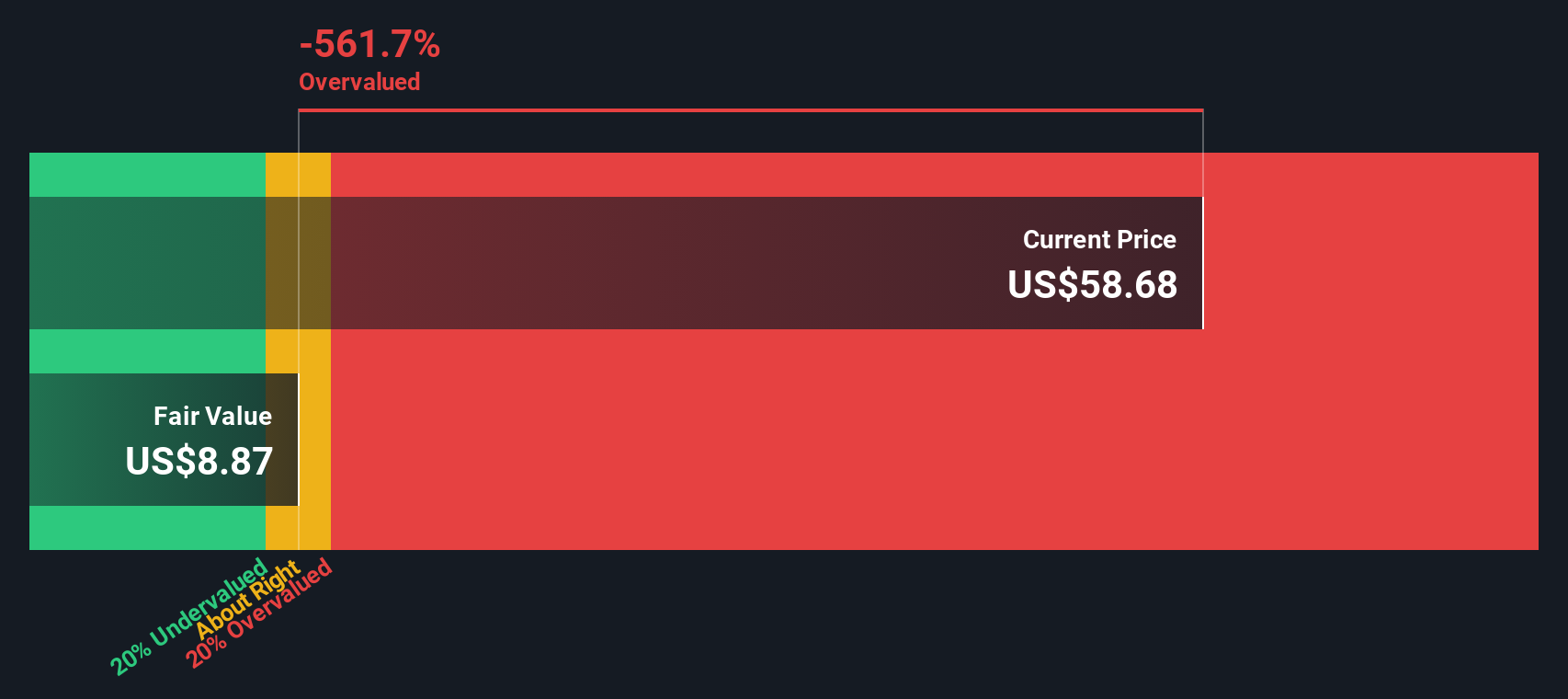

Looking from a different angle, our DCF model puts Super Micro Computer’s fair value much lower, at $8.84, compared to its $52.50 market price. This suggests shares could be significantly overvalued if the cash flow forecasts hold true. Can market momentum ignore fundamental value forever?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Super Micro Computer Narrative

If you want to dig deeper, question the assumptions, or take a fresh approach with your own research, you can always craft your perspective in just a few minutes, and Do it your way.

A great starting point for your Super Micro Computer research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities pass you by. Use the Simply Wall Street screener to target stocks matching your goals and stay ahead of the curve. Fresh ideas are just a click away.

- Uncover reliable income streams by tapping into these 19 dividend stocks with yields > 3% that consistently deliver attractive yields above 3%.

- Take advantage of industry shifts by backing innovation with these 24 AI penny stocks, where AI breakthroughs drive standout performance.

- Jump on game-changing technology trends by scanning these 26 quantum computing stocks at the forefront of computing’s next leap.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026