- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Super Micro Computer (SMCI): Evaluating Valuation After Weak Earnings, Outlook, and Internal Controls Disclosure

If you own or are watching Super Micro Computer (SMCI), the past month may have put you on edge. The stock has tumbled nearly 30% following news of disappointing Fiscal Q4 earnings, a weaker outlook, and, most concerning to many, fresh disclosures of material weaknesses in SMCI’s internal financial controls as of June 30, 2025. While the company has launched efforts to shore up its procedures, investors remain uneasy as there is no clear assurance that these issues will be swiftly resolved.

Looking at the bigger picture, it is not just this quarter’s stumble attracting attention. Over the year, SMCI’s share price has slipped a touch below where it started, lagging broader markets and further dampened by the recent setbacks. However, put this next to its long-term returns alongside annual revenue and net income growth, and you have a company many once associated with strong performance. That momentum now seems to be at a crossroads: declining in the short run, yet still supported by a multi-year track record of robust expansion and buyback activity.

So with all this turbulence, is the market overreacting, or is it simply pricing in the risks and dialing back expectations for future growth?

Most Popular Narrative: 46% Undervalued

According to DavidWSC, the most widely followed narrative sees SMCI shares trading at a significant discount to what underlying fundamentals could justify.

Partnerships with NVDA, AMD, xAI and Intel make them one of the most attractive providers of GPU data center infrastructure. The company also continues to profit from growth in other related industries such as Cloud, 5G and Storage. Using the SWS Fair Value tool and management's guidance of $23bn for 2025 and $40bn for 2026, I decided to use a revenue growth rate of 50% to reach an estimated revenue of $50bn for 2028, which I view as conservative.

Want to know what bold bets lie behind this massive undervaluation claim? The story hinges on game-changing growth rates and a future profit multiple that could rival the tech giants. Which data points flip the narrative from caution to optimism? Discover the crucial numbers at the heart of this bullish fair value estimate.

Result: Fair Value of $74.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, lingering worries about audit scrutiny and slower data center adoption could easily dampen this optimistic outlook if conditions deteriorate further.

Find out about the key risks to this Super Micro Computer narrative.Another View: Discounted Cash Flow Sends a Different Signal

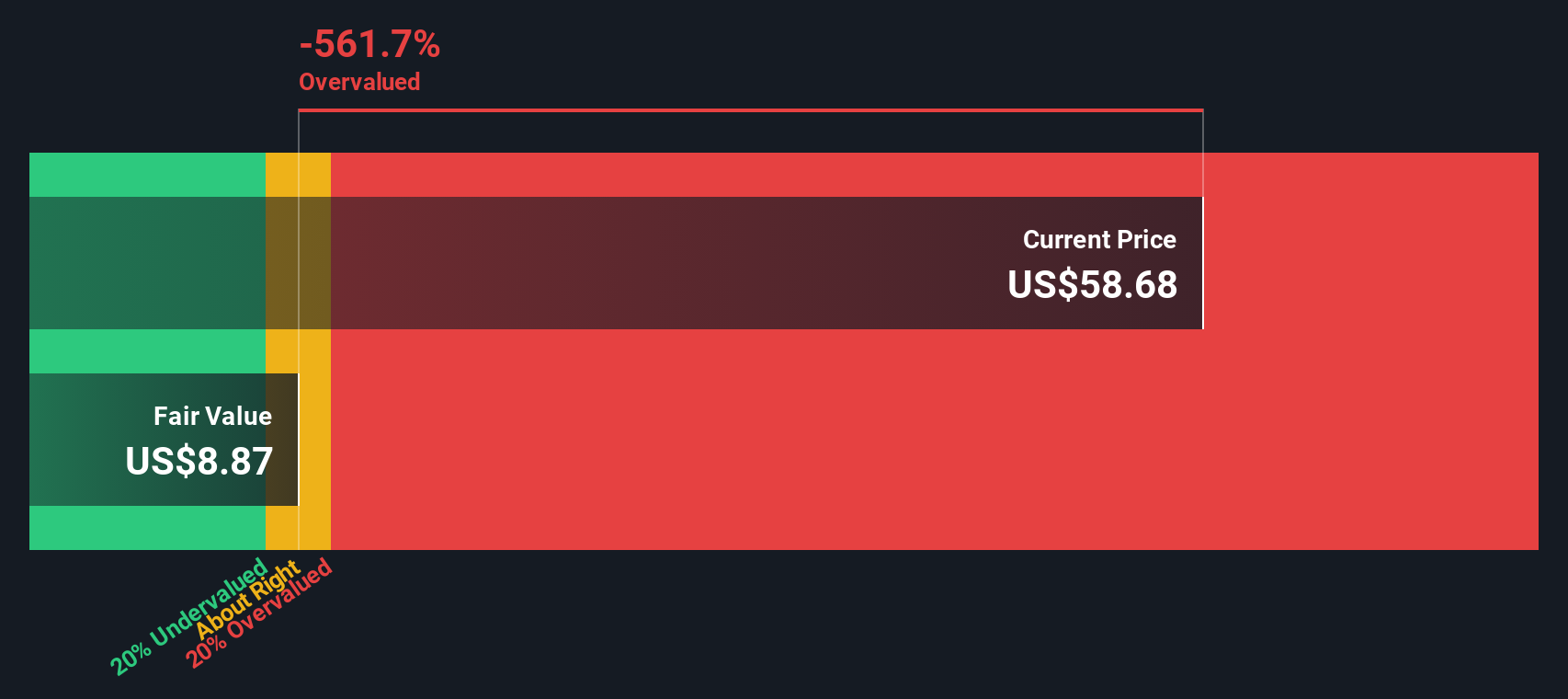

While the narrative points to undervaluation, our DCF model sees things quite differently. This method suggests the shares may be trading above their intrinsic value. Investors are prompted to weigh both stories carefully. Which approach better captures reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Super Micro Computer Narrative

If you see things differently or enjoy digging into the numbers yourself, take a few minutes to uncover your own perspective on SMCI. Do it your way

A great starting point for your Super Micro Computer research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't settle for what's trending. Tap into unique opportunities and set your strategy apart. Handpick stocks built to perform by using these powerful tools today:

- Unlock the potential of technology’s next wave by scanning for quantum computing stocks, where innovation meets exponential growth.

- Generate income you can count on by checking out companies offering dividend stocks with yields > 3% for reliable yields above the market average.

- Spot bargains the market is missing when you search for undervalued stocks based on cash flows. Boost your portfolio with stocks priced below their real worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.