- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Does the Recent 82% Rally in Super Micro Signal an Opportunity or Premium in 2025?

Reviewed by Bailey Pemberton

If you’re on the fence about what to do with Super Micro Computer’s stock, you’re not alone. The last few years have been a wild ride for SMCI shareholders. If you got in early, you’ve seen the stock soar by a jaw-dropping 2209.2% over five years. Even in just the last three years, the company’s share price has surged 717.7%. While the big headlines tend to focus on these long-term numbers, recent momentum shouldn’t be ignored as shares have climbed 19.7% in the past month and are already up 82.4% year-to-date, putting SMCI firmly on investors’ radar.

One of the key narratives fueling this optimism has been Super Micro’s growing presence in AI-optimized server manufacturing. The company has announced new partnerships and ongoing integration with major cloud and semiconductor leaders, confirming its spot at the heart of the data infrastructure build-out. This context explains the current hype, but it has also shifted how the market views risk and future growth, which are both critical factors in how the company’s valuation is assessed.

Of course, no glowing share chart tells the whole story. When we run the numbers using several traditional valuation checks, Super Micro Computer scores just 1 out of 6 for being undervalued. That suggests there are some areas where the stock looks expensive compared to peers, even factoring in recent operational wins. But are these metrics enough, or is there a smarter way to understand SMCI’s worth? Let’s take a look at the different valuation approaches, and I’ll share a more insightful angle as we go.

Super Micro Computer scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Super Micro Computer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a key valuation approach that estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to present-day dollars. This gives investors a sense of what the company could be worth today, based on the money it is expected to generate in the years ahead.

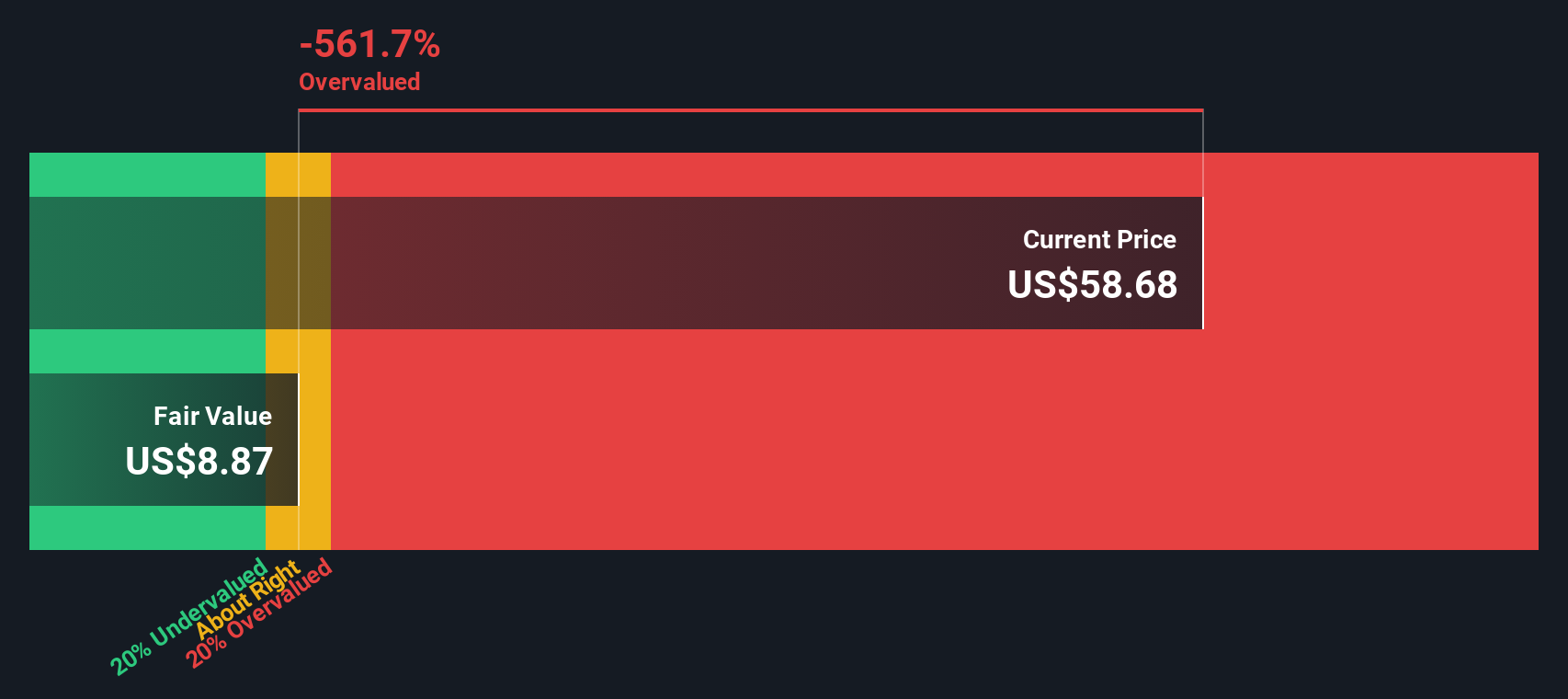

For Super Micro Computer, the current Free Cash Flow stands at $1.52 billion. While analysts provide cash flow estimates for the next five years, projections for years six through ten are extrapolated for this model. According to these projections, Super Micro’s free cash flow is expected to decline sharply in 2026, then recover, reaching roughly $378.86 million by 2035. These numbers reflect expectations of increased volatility and much slower growth after the current surge.

After crunching these numbers using a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for SMCI works out to just $8.87 per share. This is significantly lower than the current share price, implying the stock is trading at a 517.8% premium and is therefore considered overvalued according to this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Super Micro Computer may be overvalued by 517.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Super Micro Computer Price vs Earnings

The Price-to-Earnings (PE) ratio is a commonly used valuation metric for profitable companies like Super Micro Computer because it relates the company’s market price directly to its actual earnings. This makes it especially relevant for investors who want to understand if current share prices are justified by the company’s profit generation capabilities.

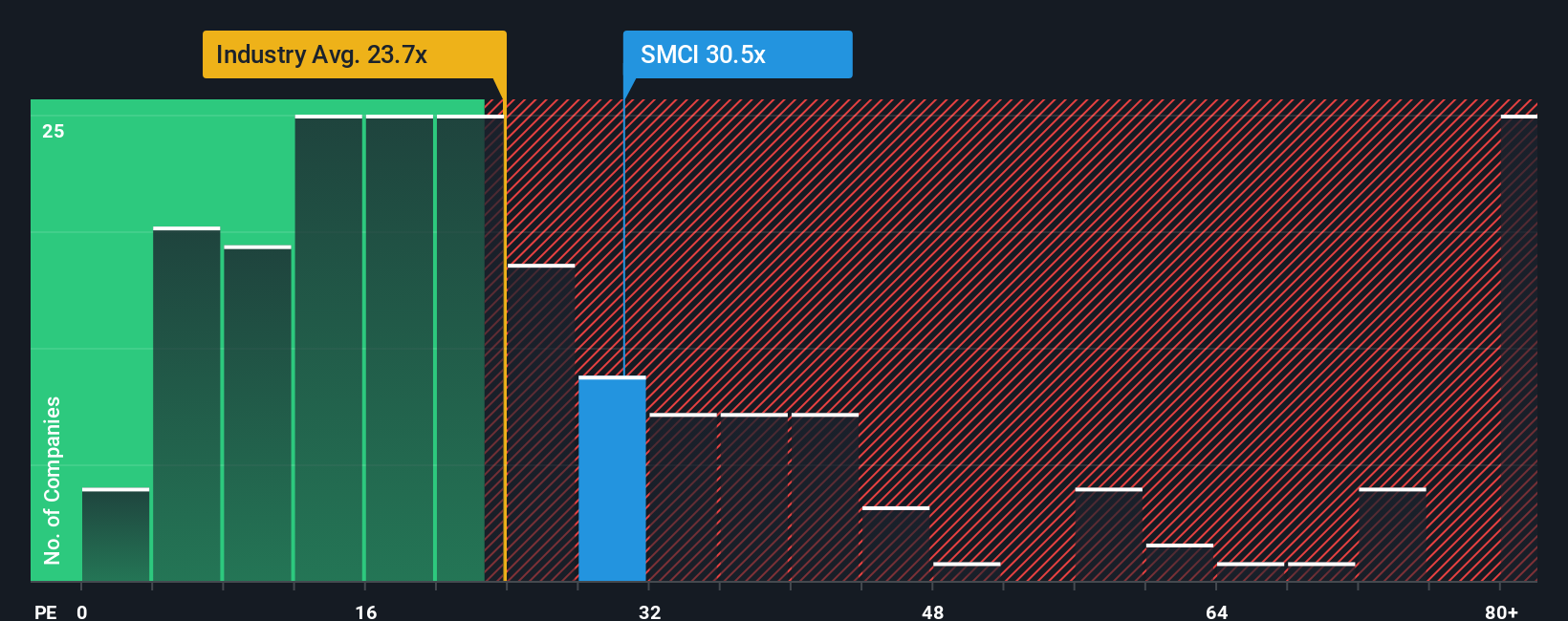

However, it's important to remember that what constitutes a "normal" or “fair” PE ratio is not universal. Companies expected to grow faster or with lower risk often justify higher multiples compared to slower-growing or riskier competitors. So, context is key. Not all 30x PE ratios are created equally.

Super Micro Computer’s current PE ratio stands at 31.1x. In comparison, the average PE for its industry is 23.8x and the average among peers is 20.8x. At first glance, this suggests that SMCI is trading at a premium to both benchmarks.

To address the limitations of simple comparisons, Simply Wall St uses a “Fair Ratio”, which calculates the PE you’d expect for a business with Super Micro’s specific growth prospects, industry, risks, and margins. Unlike basic benchmarks, this proprietary figure accounts for the company’s unique fundamentals and market position, offering a more nuanced valuation perspective.

For Super Micro Computer, the Fair Ratio is 62.2x. With a current PE of 31.1x, the stock actually appears undervalued against this customized benchmark, signaling that, despite its high multiple, the price may not fully reflect its strengths or growth potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Super Micro Computer Narrative

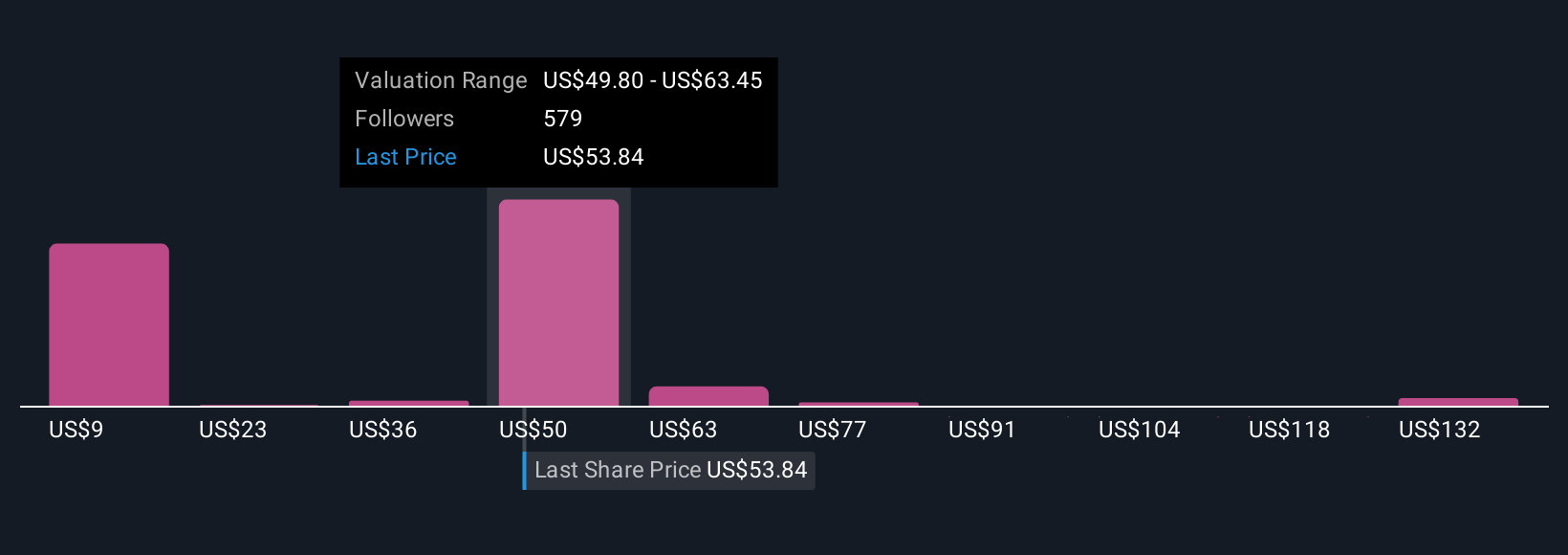

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Simply put, a Narrative is your personalized story or perspective about a company. It is where you connect your views about Super Micro Computer's business (like future revenue, growth rates, and profit margins) directly to a forecast and a fair value, going beyond what traditional ratios can tell you.

Narratives let you set your own assumptions about SMCI’s future, linking the company’s story to a financial forecast and estimating what you believe the stock is actually worth. This hands-on approach is now available to everyone within the Simply Wall St Community page, making professional-level valuation accessible to millions of investors.

With Narratives, you can decide when to buy or sell by comparing your custom Fair Value estimate to the current share price. Because these forecasts update dynamically whenever new information emerges, your view always keeps pace with the latest news or earnings releases.

For example, some investors see SMCI’s robust growth in AI infrastructure and forecast a fair value above $74.50 per share. Others, factoring in governance risks and competition, arrive at a more cautious estimate closer to $26.00. This shows how different narratives can guide very different decisions, even for the same stock.

For Super Micro Computer, here is an easy overview with previews of two leading Super Micro Computer Narratives:

🐂 Super Micro Computer Bull Case

Fair Value Estimate: $74.53

Undervalued by 26.4% compared to the latest close

Revenue Growth Assumption: 50%

- Sees Super Micro Computer regaining momentum and capturing a dominant share of customized data center solutions, driven by strong management guidance and next-generation DLC (Direct Liquid Cooling) technology adoption.

- Thesis rests on new partnerships with leaders like NVIDIA, AMD, xAI, and Intel, plus expectations for recovery and transparency following recent accounting scrutiny and special committee interventions.

- Applies a 50% revenue growth rate and conservative profit margin, arriving at a fair value well above current prices due to confidence in SMCI’s position as a leading AI infrastructure provider.

🐻 Super Micro Computer Bear Case

Fair Value Estimate: $50.06

Overvalued by 9.5% compared to the latest close

Revenue Growth Assumption: 29.9%

- Highlights Super Micro Computer’s potential from global AI and analytics adoption, but stresses risks including heavy reliance on a few large customers, hardware commoditization, and intense competition putting pressure on profit margins.

- Assumes stable, but moderate improvements in future profit margin and a lower valuation multiple by 2028, with consensus analyst price targets offering only modest upside from current prices.

- Warns of risks around elongated customer buying cycles, elevated execution risks for new solutions, and exposure to global supply chain and compliance costs, suggesting that current optimism could be overextended.

Do you think there's more to the story for Super Micro Computer? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives