- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:SGMA

Shareholders Will Most Likely Find SigmaTron International, Inc.'s (NASDAQ:SGMA) CEO Compensation Acceptable

Key Insights

- SigmaTron International will host its Annual General Meeting on 22nd of September

- CEO Gary Fairhead's total compensation includes salary of US$347.7k

- The overall pay is comparable to the industry average

- SigmaTron International's total shareholder return over the past three years was 13% while its EPS grew by 29% over the past three years

Under the guidance of CEO Gary Fairhead, SigmaTron International, Inc. (NASDAQ:SGMA) has performed reasonably well recently. As shareholders go into the upcoming AGM on 22nd of September, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. We present our case of why we think CEO compensation looks fair.

See our latest analysis for SigmaTron International

How Does Total Compensation For Gary Fairhead Compare With Other Companies In The Industry?

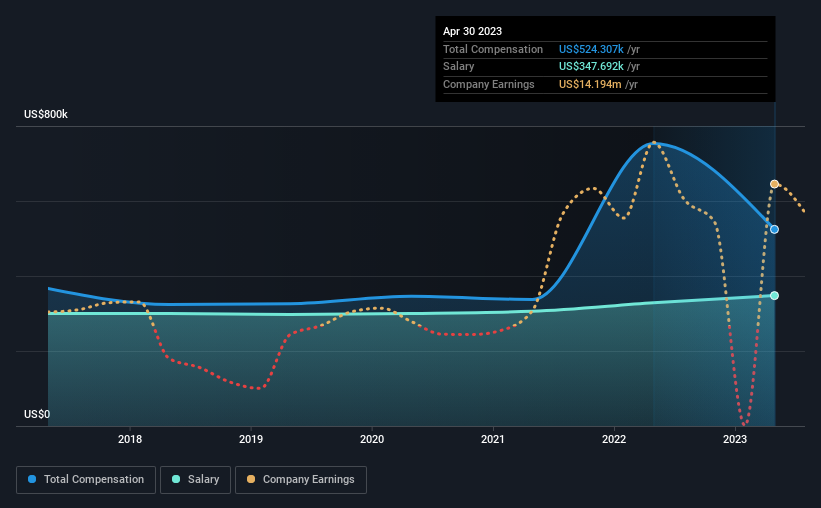

According to our data, SigmaTron International, Inc. has a market capitalization of US$21m, and paid its CEO total annual compensation worth US$524k over the year to April 2023. We note that's a decrease of 30% compared to last year. We note that the salary portion, which stands at US$347.7k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the American Electronic industry with market capitalizations below US$200m, reported a median total CEO compensation of US$441k. So it looks like SigmaTron International compensates Gary Fairhead in line with the median for the industry. Furthermore, Gary Fairhead directly owns US$326k worth of shares in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$348k | US$328k | 66% |

| Other | US$177k | US$425k | 34% |

| Total Compensation | US$524k | US$753k | 100% |

On an industry level, roughly 32% of total compensation represents salary and 68% is other remuneration. SigmaTron International pays out 66% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

SigmaTron International, Inc.'s Growth

SigmaTron International, Inc.'s earnings per share (EPS) grew 29% per year over the last three years. In the last year, its revenue is up 2.4%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has SigmaTron International, Inc. Been A Good Investment?

SigmaTron International, Inc. has generated a total shareholder return of 13% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 3 warning signs for SigmaTron International you should be aware of, and 2 of them are significant.

Switching gears from SigmaTron International, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SGMA

SigmaTron International

Operates as an independent provider of electronic manufacturing services in the United States, Mexico, China, Vietnam, and Taiwan.

Good value slight.

Similar Companies

Market Insights

Community Narratives