- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:SANM

Assessing Sanmina’s Valuation After Its 86% Stock Surge and New Supply Agreements

Reviewed by Bailey Pemberton

- Wondering if Sanmina's incredible run-up has left the stock undervalued, fairly priced, or even a bit too hot? Let's take a closer look together.

- Sanmina shares have surged this year, climbing an impressive 86.0% year-to-date and rocketing over 92.8% in the past 12 months.

- The jump in the stock price follows news that Sanmina has landed several high-profile supply agreements, fueling optimism about its demand pipeline and growth capabilities. Investors are watching closely as the company’s new contracts and industry partnerships put it firmly in the spotlight.

- Despite such momentum, Sanmina earns a valuation score of 2 out of 6. Is there more to the story than the headline numbers? We’ll break down the key valuation approaches and, at the end, introduce a better way you can judge value for yourself.

Sanmina scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sanmina Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This helps investors gauge whether a stock's current price appropriately reflects its long-term earning potential.

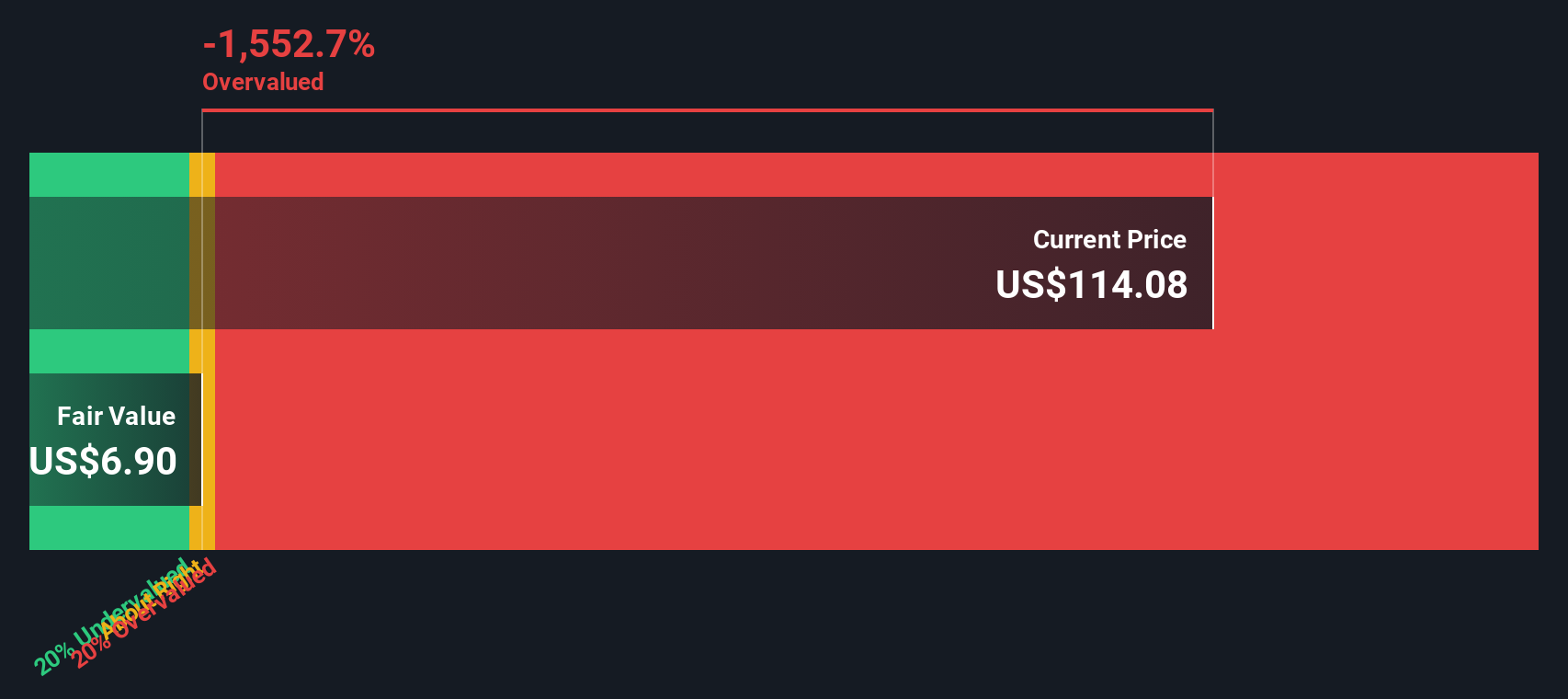

Sanmina's latest reported Free Cash Flow (FCF) stands at $331.8 million. Analysts have offered cash flow projections for the next five years. Beyond that, Simply Wall St extrapolates further to build a 10-year runway. By 2027, Sanmina's FCF is expected to reach $205.6 million, before gradually declining according to these longer-term estimates.

In total, the DCF model calculates Sanmina's fair value at $38.69 per share. With the stock currently trading 262.8% higher than this estimate, the DCF signals that Sanmina is significantly overvalued by this methodology.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sanmina may be overvalued by 262.8%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Sanmina Price vs Earnings

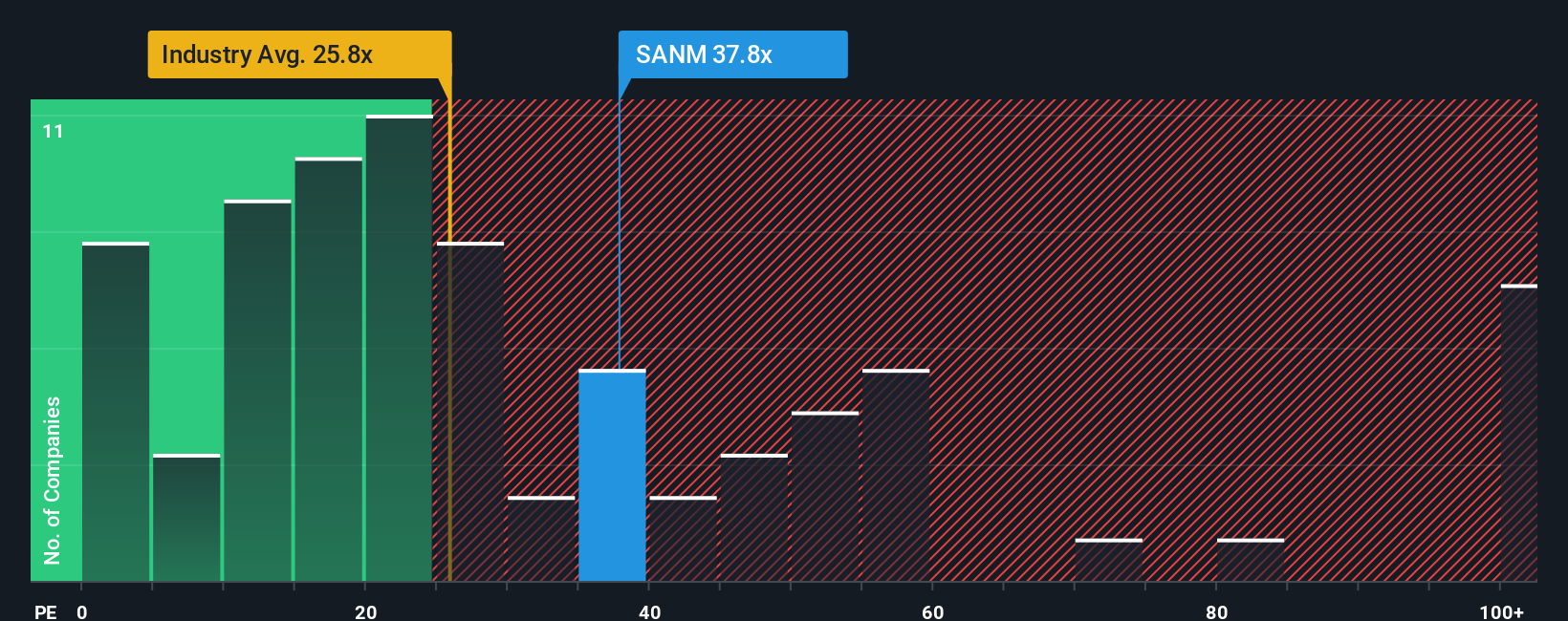

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies like Sanmina, as it directly relates a company's stock price to its earnings. This offers a straightforward way for investors to gauge how much they are paying for each dollar of profit.

Growth expectations and risk factors both play a major role in what counts as a “normal” PE ratio. Fast-growing companies or those with strong market positions often trade at higher multiples. In contrast, slower growers or those facing significant risks are typically assigned lower ratios.

Currently, Sanmina trades at a PE ratio of 28.8x. For context, the average PE ratio of industry peers stands at 38.0x, while the broader electronics industry’s average is about 24.3x. By comparison, Simply Wall St’s proprietary Fair Ratio for Sanmina is 30.1x, adjusting for its earnings growth, profit margins, market cap, and industry factors.

The “Fair Ratio” by Simply Wall St is more comprehensive than a simple comparison against peers or industry averages. It tailors the valuation to Sanmina’s unique growth prospects, profitability, and risk profile, providing a clearer picture of the stock’s relative value.

With Sanmina’s current PE ratio almost exactly aligned with its Fair Ratio, the stock looks appropriately valued by this measure.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sanmina Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple but powerful idea: it is your own story or perspective for Sanmina, connecting what you believe about the company’s future to numbers like expected revenue, margins, and fair value.

Unlike traditional metrics, Narratives seamlessly link what you think will drive the business to a financial forecast and from there to an estimate of fair value. This makes it easier to visualize how changing assumptions, such as stronger growth in AI datacenters or margin pressures, can impact what Sanmina might really be worth.

On Simply Wall St's Community page, you can build and track your own Narrative or see those created by millions of other investors. When you create a Narrative, you can instantly compare its fair value with the current share price, helping you decide whether to buy, hold, or sell, based on your own expectations.

What makes Narratives so dynamic is that they update as new news breaks or earnings are released, letting your thesis evolve alongside real-world events. For example, one bullish investor may see Sanmina's future potential worth $158.5 per share based on surging AI demand and analyst optimism, while a more cautious perspective might set fair value much lower, highlighting risks around customer concentration and margin pressures.

Do you think there's more to the story for Sanmina? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SANM

Sanmina

Provides integrated manufacturing solutions, components, products and repair, logistics, and after-market services in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives